USDCHF Price Analysis – February 25

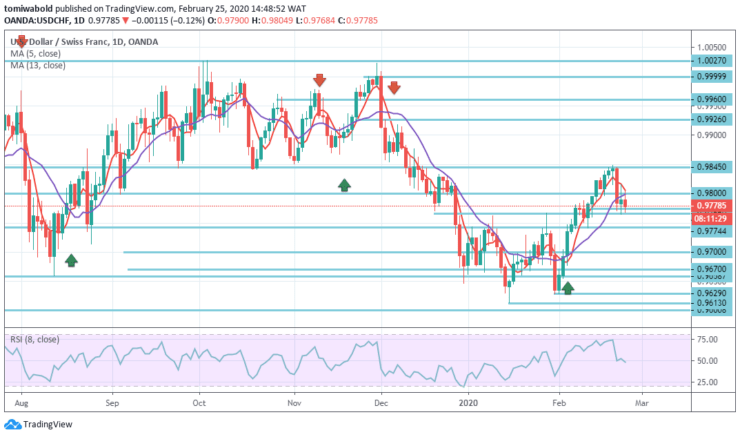

The USDCHF closed with small gains beneath 0.9800 level on the first day of the week and struggled Tuesday to climb past that point. During the decline of the Fx pair beneath the 0.9700 level, the start of the month around 0.9670 level and the bottom of the January month around 0.9613 level provided intermediate stops to 0.9600 level attempt.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9845

Support Levels: 0.9743, 0.9613, 0.9541

USDCHF Long term Trend: Ranging

During the pre-European session on Tuesday, USDCHF registers fewer movements when trading at about 0.9790 level. The daily chart forms a bearish candlestick pattern but may contain further declines with ranging from RSI to 13 moving average.

In the long term, the trend stays neutral as USDCHF is moving in a sideway trading started from 1.0231 (high). A plunge from the level at 1.0231 is a leg within the trend and could aim 0.9541 (low) level. In case of another advance, the break of 1.0231 level is required to indicate uptrend resumption.

USDCHF Short term Trend: Bullish

USDCHF intraday bias remains neutral, as range trading remains beneath the temporary high of 0.9845 level. A continuous increase is favorable, while the support level of 0.9743 stays unchanged, with attention at the levels of 0.9845 on the recovery of the price from 1.0231 to 0.9613 levels.

On the other hand, a steady breakthrough of the 0.9851 level, which is part of the short-term bullish reversal scenario, may lead to a partial pullback at the next level of 0.9999. On the other hand, a break of 0.9743 may indicate a deviation of 0.9845 level and support short-term bearish dynamics.

Instrument: USDCHF

Order: Buy

Entry price: 0.9774

Stop: 0.9743

Target: 0.9845

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.