S&P 500 Price Analysis – February 25

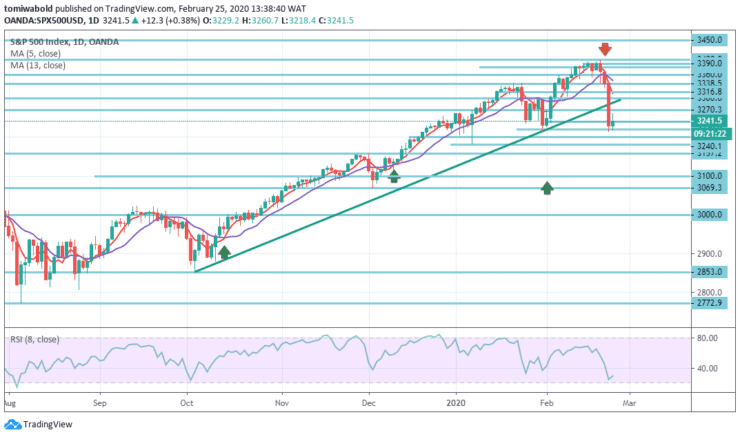

On Monday, the S & P 500 had a huge rally, breaking the main uptrend line downwards quite significantly during the trading session, testing the lows at 3215 levels. Finally, the impact of COVID-19, better known as coronavirus, began to strongly affect financial markets.

Key levels

Resistance Levels: 3400, 3360, 3300

Support Levels: 3200, 3100, 3000

S&P 500 long term Trend: Bullish

The S&P 500 Index trend is retracing significantly beneath the moving averages of 5 and 13 as the bulls are keen to keep the uptrend going and to protect low of 2020 and vital figure at 3200 levels.

Failure to do so, however, could see the bears extend the downward movement towards 3100 and the 3000 levels. On the flip side, a bullish recovery can uncover a resistance near the levels of 3300 and 3360.

S&P 500 Short term Trend: Bearish

The 3200 levels underneath break would result in a major breach of support on the 4-hour time frame, and if the market breaks down beneath here, the S&P 500 will likely go down in the future.

It’s not a market at this stage that can be followed through with the bearish bias and start selling, but the downside risk may increase on the off chance it breaks down beneath the 3200 levels.

Instrument: S&P 500

Order: Buy

Entry price: 3220

Stop: 3200

Target: 3270

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.