USD/JPY Market Analysis—February 12

The USD/JPY extended its slide for a fourth consecutive day as the Japanese Yen found renewed support following the decisive general election victory of Prime Minister Sanae Takaichi. While the pair initially faced upward pressure, the market has pivoted toward a “sell the fact” reaction, with investors betting that Takaichi’s massive mandate will allow for more fiscally responsible policies than previously feared. This downside momentum is further reinforced by persistent intervention risks, as Japanese authorities maintain a “high alert” status and issue repeated verbal warnings to curb excessive volatility. Meanwhile, a softer US Dollar has capped potential rebounds as traders turn their focus to Friday’s crucial US CPI release, which is expected to dictate the next leg of the Federal Reserve’s policy path.

USD/JPY Key Levels

Supply Levels: 158, 159, 160

Demand Levels: 152, 151, 150

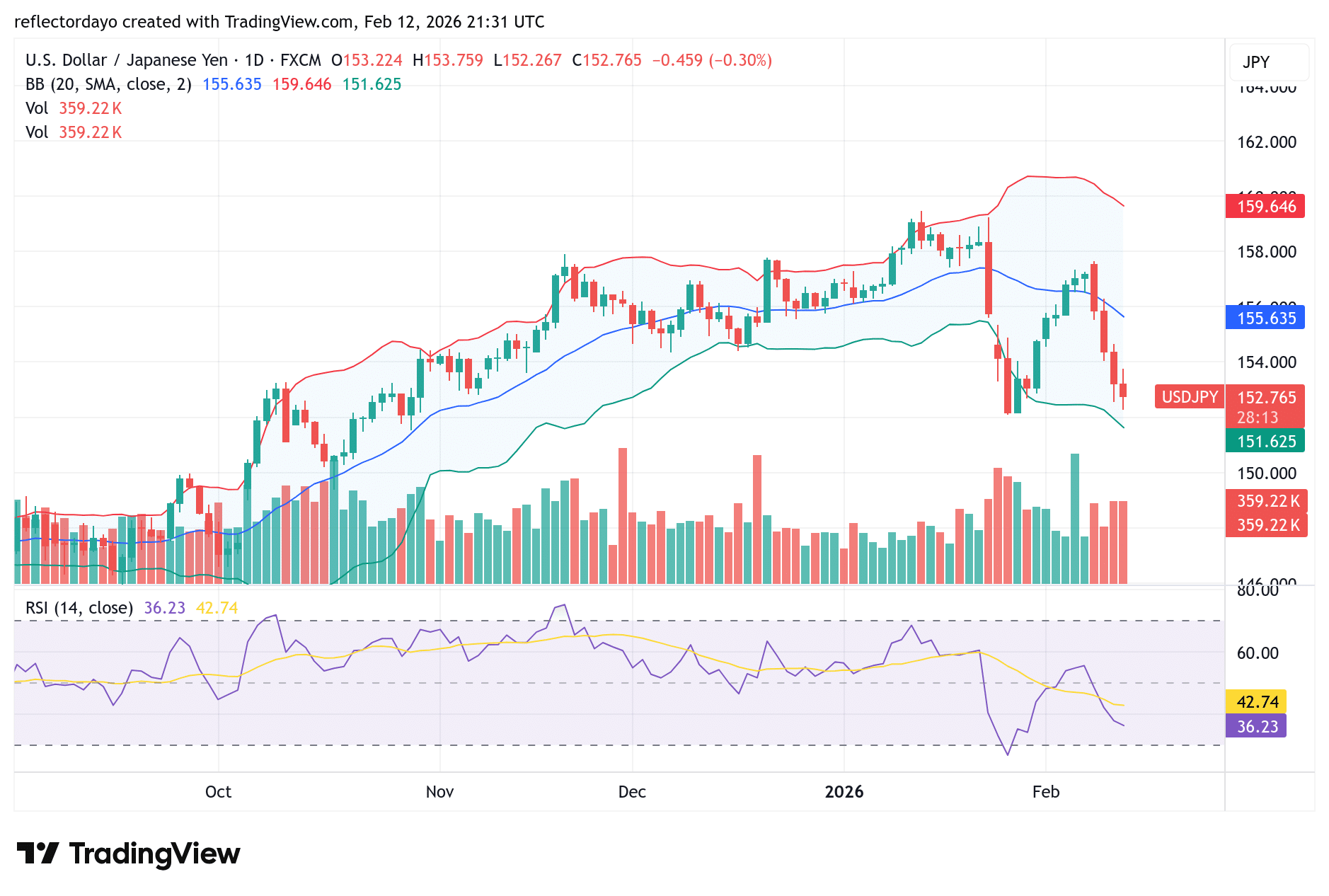

USD/JPY Daily Chart Outlook:

Last week, the USD/JPY narrative centered on a strong bullish recovery. The pair climbed from the 152.00 handle, surging to a peak near 157.00. However, momentum shifted abruptly as a bearish trend took hold. Since the start of this week, the price action has plummeted significantly, maintaining a consistent downward trajectory.

As the pair approaches the critical 152.00 zone, the bearish momentum appears to be waning. Traders are identifying this level as a pivotal support zone, largely because it served as the launchpad for the previous bullish rally. Consequently, a temporary pause or consolidation is expected as the market tests this historical floor.

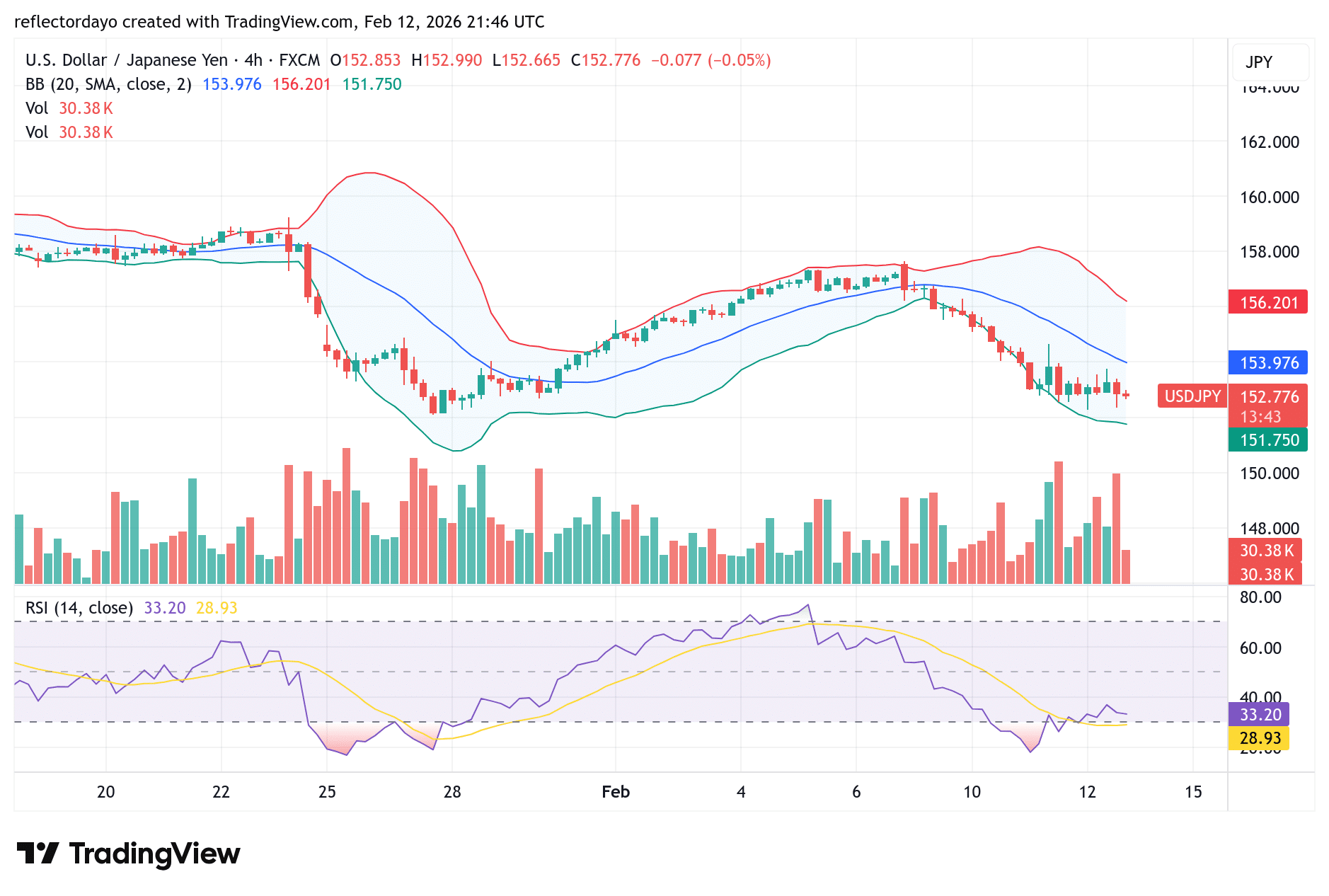

Short-Term Outlook (4-Hour Chart)

A closer look at the 4-hour chart reveals the formation of a higher support level situated just above the critical 152.00 handle. This emerging floor suggests a degree of bullish resilience within these lower price zones. However, in recent trading sessions, bearish pressure has begun to weigh more heavily on optimistic traders, resulting in a slight downward tilt in market sentiment.

This new secondary support level is established at 152.80. Should the bulls fail to defend this position, the market is likely to see a further decline toward the primary 152.00 support zone.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.