Market Analysis – February 5

The USD/JPY pair remains firmly bid, extending its bullish recovery toward the 156.20 level as the US Dollar continues to outperform its major peers. The ongoing strength in the Greenback is underpinned by growing market expectations that the Federal Reserve will keep interest rates unchanged in the March and April policy meetings, delaying any near-term rate cuts. This hawkish repricing has supported US Treasury yields, weighing on the low-yielding Japanese Yen. Meanwhile, investors are closely watching upcoming US labor market data, with December JOLTS Job Openings expected at around 7.2 million, which could further shape near-term USD momentum.

USD/JPY Key Levels

- Supply Levels: 158, 159, 160

- Demand Levels: 152, 151, 150

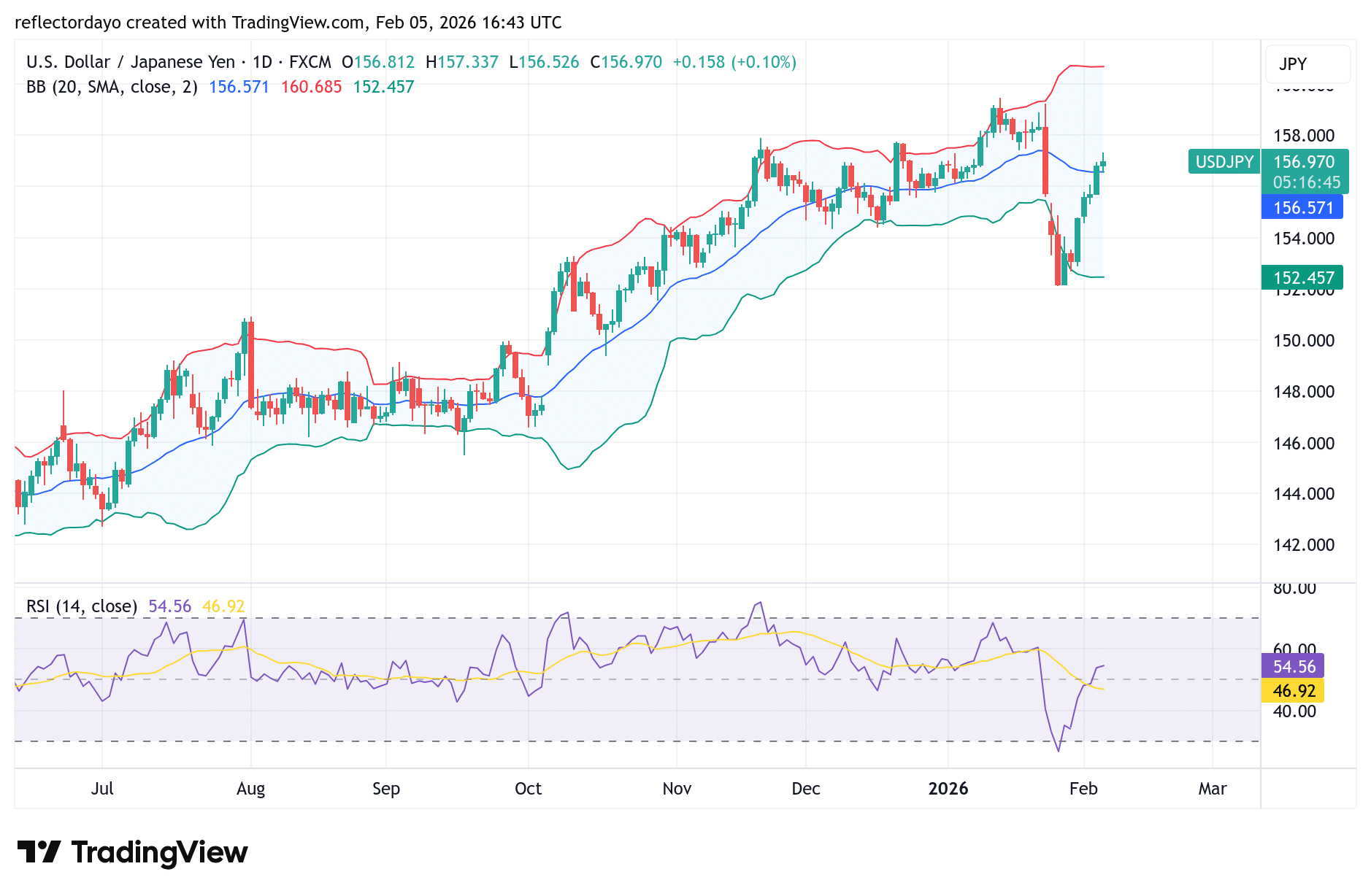

USD/JPY Daily Chart Outlook:

Following a sharp decline in USD/JPY, the pair has staged a strong and nearly symmetrical bullish recovery as the US Dollar regained notable strength against the Japanese Yen. The initial bearish pressure eased significantly after price fell from above the key 156.00 level and found a pivotal support zone around 152.00.

The subsequent rebound has pushed the market back above the 156.00 level, an area where price previously consolidated. However, bullish momentum has started to flatten near the 156.60 region as traders turn more cautious ahead of the 157.00 psychological resistance. Selling interest has emerged around this zone, creating a temporary balance between demand and supply. As a result, USD/JPY is currently locked in a short-term consolidation phase around 156.80, with 156.00 remaining a critical support level to watch.

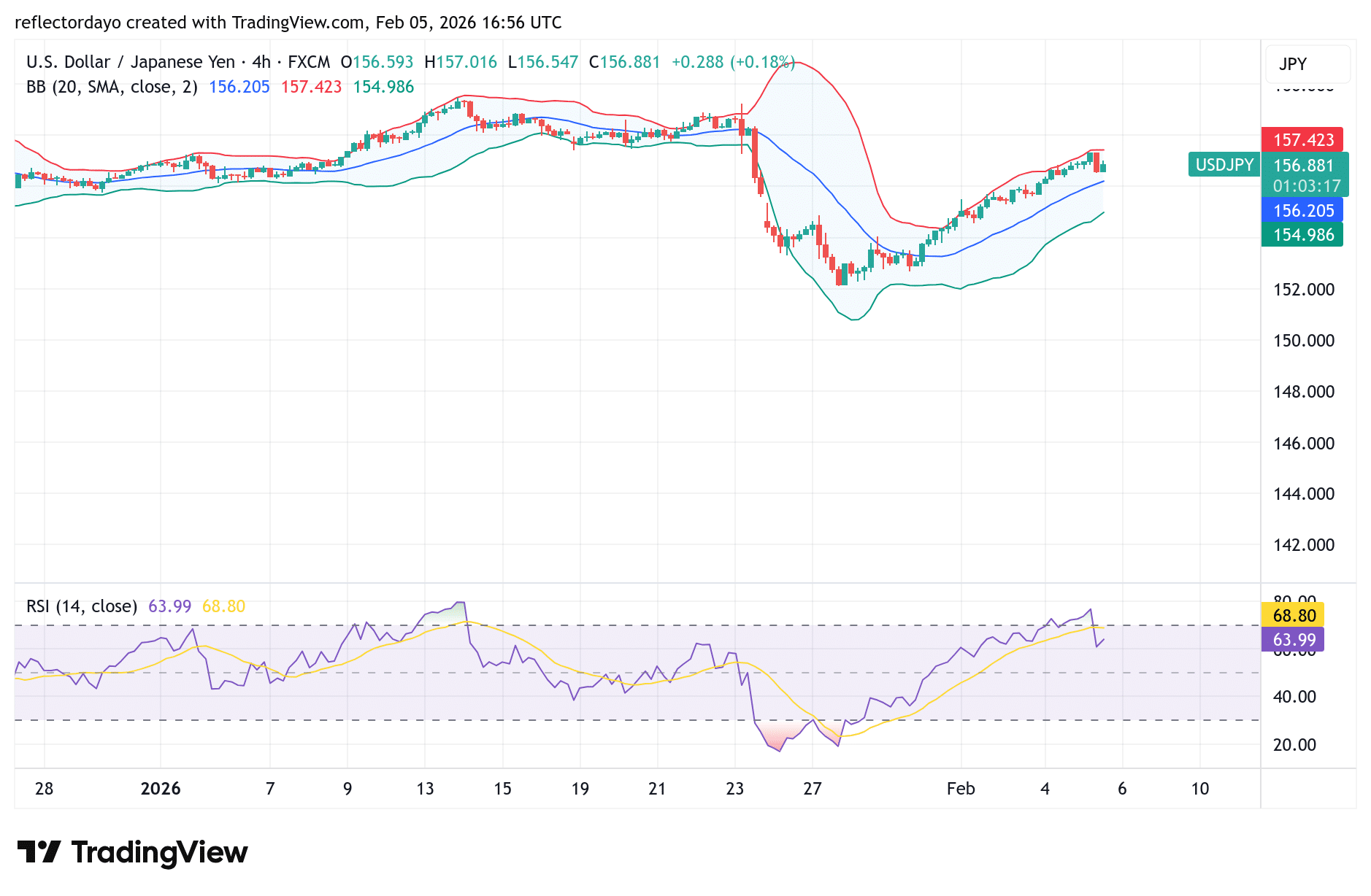

USD/JPY Short-Term Outlook (4-Hour Chart)

Apart from 156.00, the market has recently identified a higher support level at 156.556, which appears likely to hold. If this level sustains through the upcoming trading sessions, it could pave the way for a break above the 157.00 resistance. Such a move would signal that the bullish recovery may continue, potentially targeting the 158.00 level next.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.