Market Analysis—January 29

The US Dollar is regaining momentum against the Japanese Yen, with both currencies lagging behind their G8 peers this week. USD/JPY is currently trading around the 153.50 region, where price action is stabilizing after rebounding from a three-month low near 152.00. This recovery phase is unfolding as traders shift their attention to Japan’s upcoming Tokyo CPI data, which could provide fresh direction for the pair.

The Yen’s recent weakness intensified after remarks from US Treasury Secretary Scott Bessent reaffirmed Washington’s commitment to maintaining a strong Dollar stance. His comments also cooled market speculation about potential coordinated intervention between the US and Japan to prop up the Yen—rumors that previously triggered a sharp sell-off in USD/JPY. As a result, the pair has found room to recover, with sentiment now favoring the Dollar ahead of key inflation data from Japan.

USD/JPY Key Levels

Supply Levels: 159, 160, 161

Demand Levels: 150, 145, 140

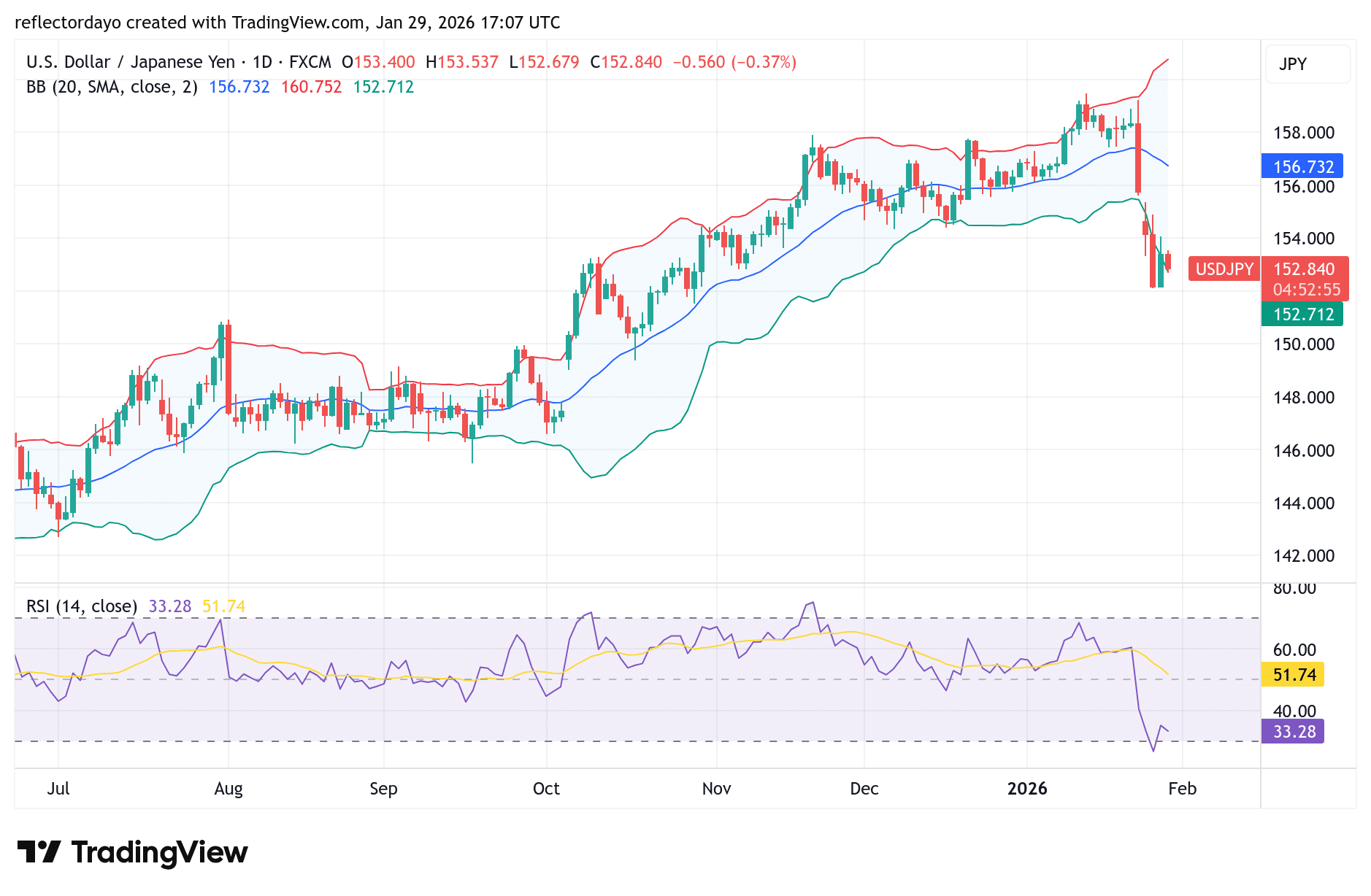

USD/JPY Daily Chart Outlook: Bears Maintain Control Despite Oversold Signals

From a daily chart perspective, the USD/JPY pair continues to extend its downward move, reflecting sustained bearish pressure. Last week, sellers drove the pair down to the 156.00 level, marking a notable decline of about 1.4%. This week, the bearish momentum intensified further, with price slipping toward the 152.00 zone.

At current levels, technical indicators suggest the market is approaching oversold conditions, with the Relative Strength Index (RSI) hovering near 33. This may attract short-term traders looking for a technical rebound. However, with price now facing nearby resistance around 153.00, bearish sentiment remains dominant. Unless USD/JPY reclaims this resistance zone convincingly, the broader bias is likely to stay tilted to the downside.

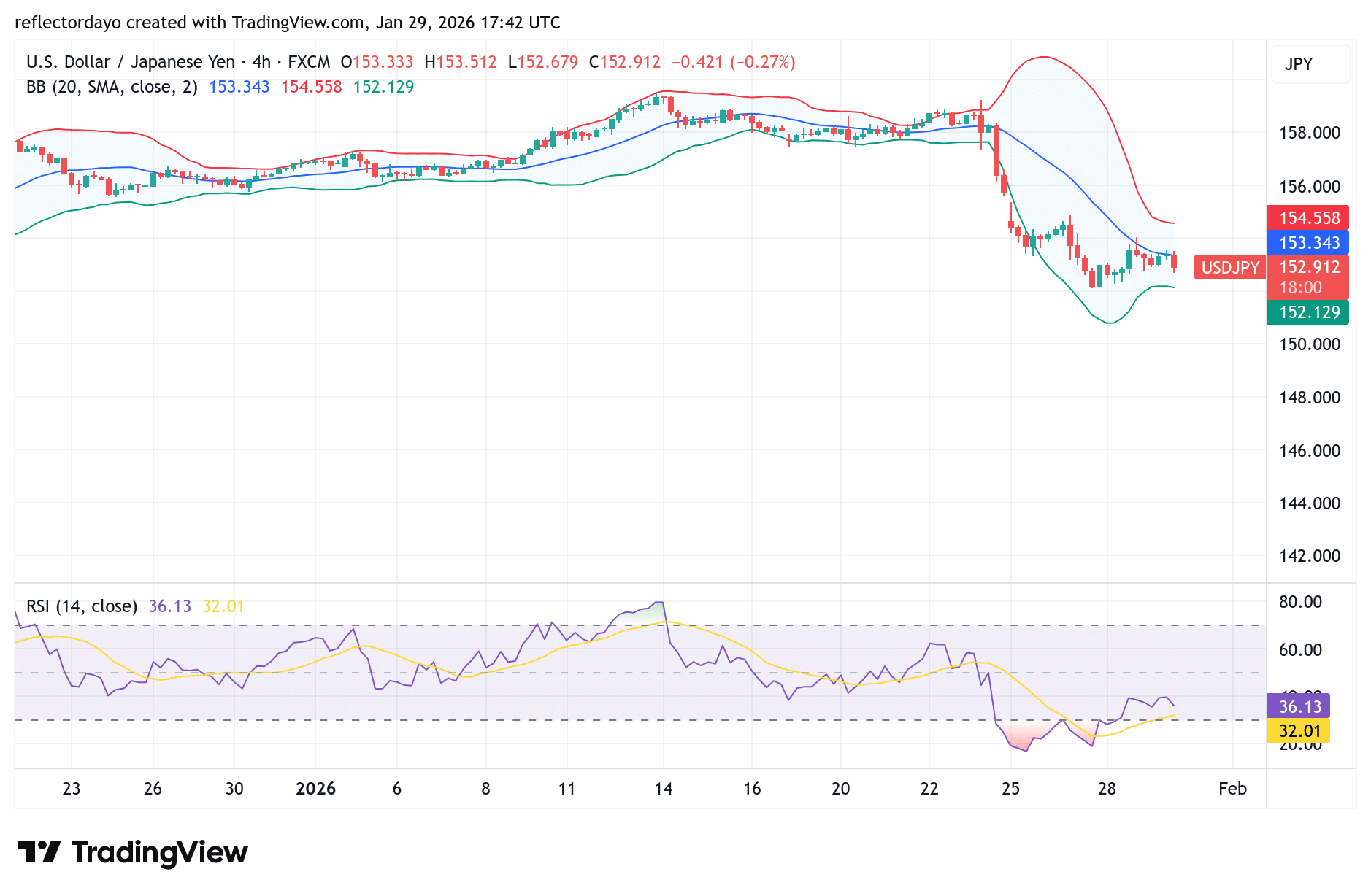

Short-Term Outlook (4-Hour Chart)

On the 4-hour chart, USD/JPY is consolidating just below the 153.00 level, indicating that bulls are attempting to defend against persistent bearish pressure. Despite these efforts, the pair remains under strain, and a breakdown toward the 152.00 zone is possible. Should this level be breached, it could trigger increased safe-haven flows, benefiting the Japanese Yen against the US Dollar and reinforcing downward momentum in the short term.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.