Market Analysis – January 24

USD/JPY has declined by approximately 1.4% as market concerns about potential intervention by Japanese authorities resurfaced. The pair is also facing additional downside pressure from broad-based weakness in the US Dollar, reflecting softer risk sentiment and mixed economic signals from the United States. Meanwhile, the Bank of Japan (BoJ) maintained its policy rate at 0.75%, but its recent statement carried a cautiously hawkish tone, suggesting that while accommodative policies remain in place, policymakers are monitoring inflationary pressures closely. These fundamental developments are shaping near-term dynamics for the pair and may influence its trajectory in the coming sessions.

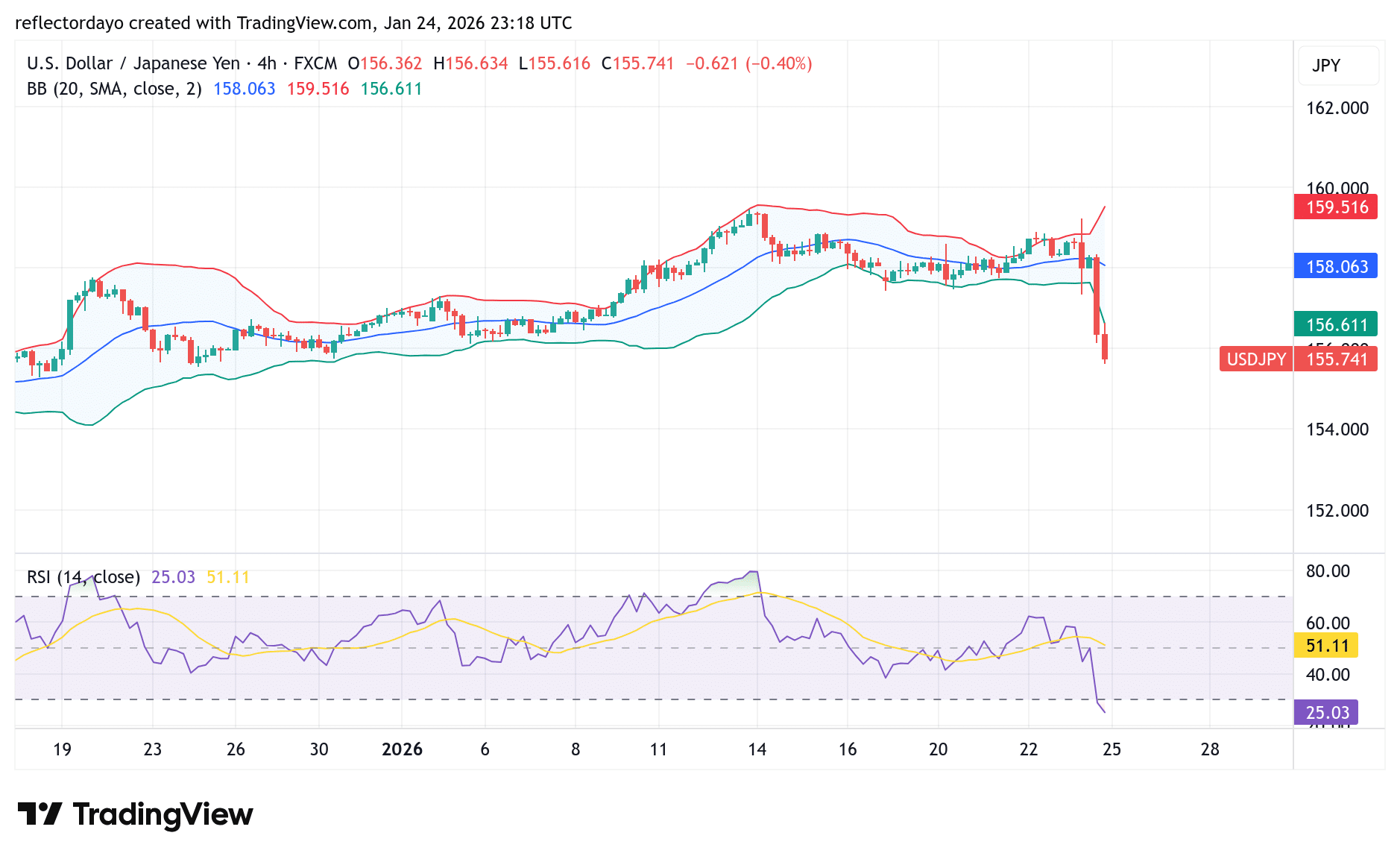

USD/JPY Key Levels

- Supply Levels: 159, 160, 161

- Demand Levels: 155, 150, 145

USD/JPY Sinks by 1.4%

The 156 level had acted as a key support during the second half of December. In today’s bearish session, this level once again attracted buying interest from some traders. However, selling pressure was strong, pushing the price down to around 155. The small lower shadow on the bearish candlestick suggests that some buy orders have resurfaced at this level. If this support continues to hold, a rebound could soon materialize from here.

USD/JPY Short-Term (4-Hour)

This sharp bearish move has increased market volatility, with price action moving outside the divergent Bollinger Bands. Considering this development, bearish traders might choose to pause their activity for a while, as there is a higher likelihood that price could rebound from the 155 area.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.