Market Analysis – January 16

The USD/JPY pair is trading with a cautious tone, hovering near the 158.35 level as renewed verbal warnings from Japanese officials weigh on market sentiment. Japan’s Vice Finance Minister for International Affairs, Atsushi Katayama, reiterated that all options remain on the table to counter excessive one-way movements in the Yen, reviving concerns over potential market intervention. Meanwhile, the pair’s pullback comes as investors broadly expect the US Federal Reserve to leave interest rates unchanged at its upcoming policy meeting, adding to the consolidation dynamics around the key 158.00 level.

USD/JPY Key Levels

Supply Levels: 159, 160, 161

Demand Levels: 145, 140, 135

USD/JPY Bulls Trying to Salvage the Market at 158

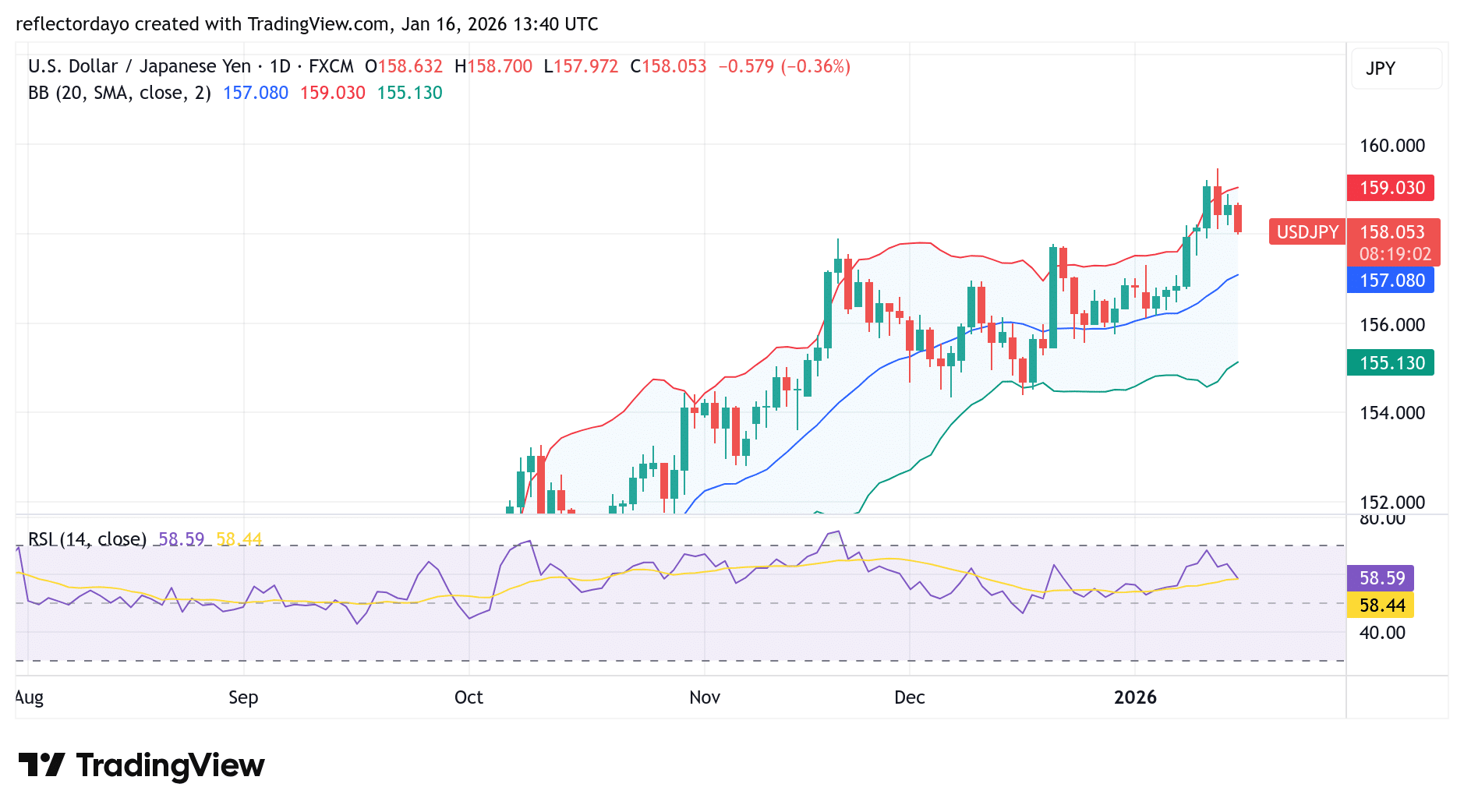

In last week’s analysis of USD/JPY, we observed the pair posting a strong bullish advance. The upward momentum originated around the 156 level, with buying pressure proving strong enough to decisively break through the 157 resistance. Following this key breakout, price action accelerated above 158 and continued higher to peak near the 159 level.

However, significant bearish pressure emerged around 159, turning this zone into a formidable resistance and triggering a pullback. At present, bullish sentiment appears to be attempting to stabilize the market around the 158 level. This area stands out as a potential support zone, where buyers may look to re-enter long positions. Meanwhile, the Bollinger Bands indicator shows a notably wide bandwidth, signaling elevated market volatility. As a result, traders should remain cautious of sudden and unexpected price swings.

USD/JPY Short-Term Trend

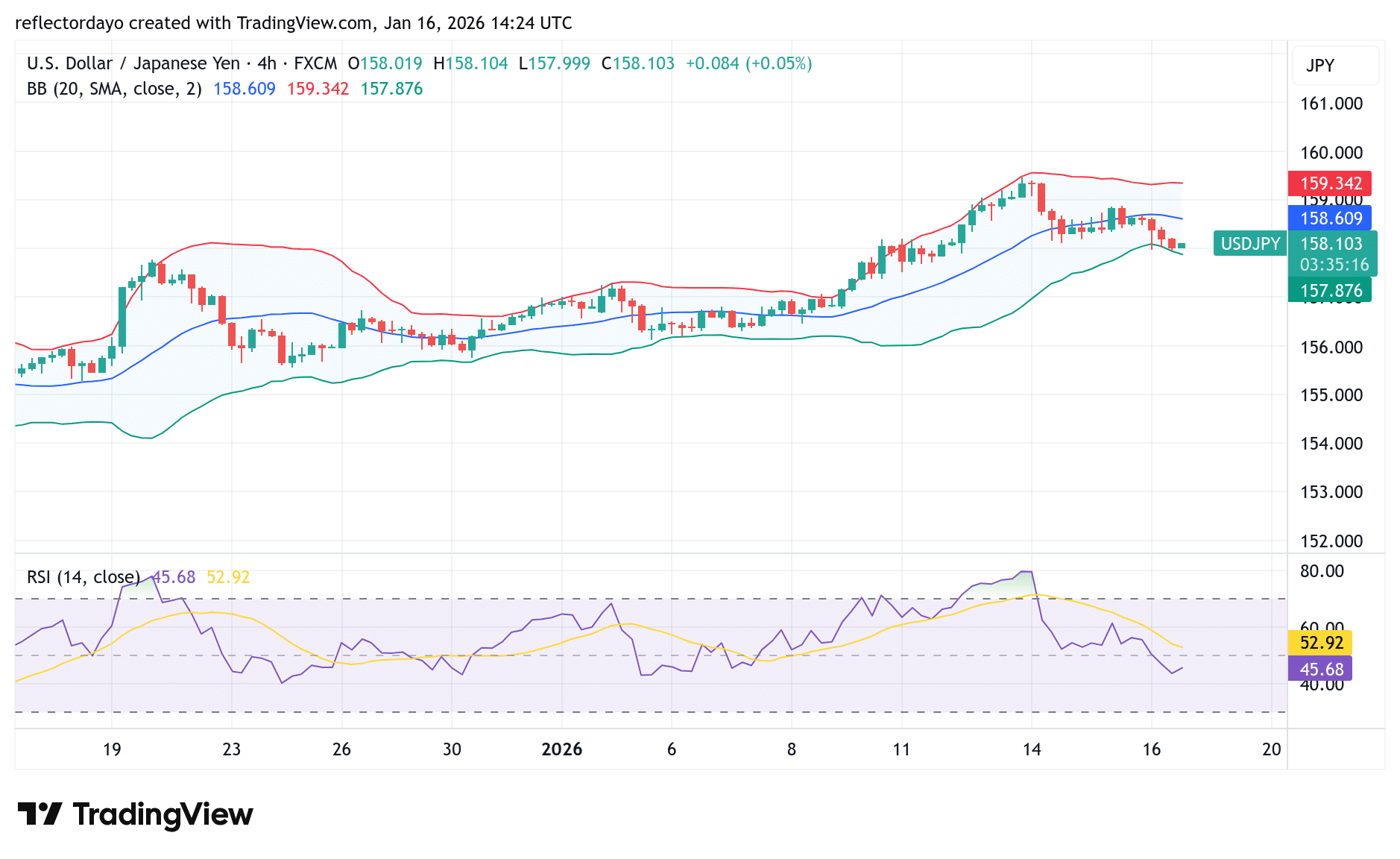

Bringing the USD/JPY pair into perspective on the 4-hour chart, the market presents a mixed outlook. On one hand, repeated bearish candlesticks testing the 158 support level over the past three trading sessions suggest that buyers remain resilient, consistently rejecting lower prices in this zone.

On the other hand, bearish momentum appears to be gradually building, placing increasing pressure on this key support. Notably, in each of the last three sessions, sellers have entered the market at progressively lower price levels, indicating sustained selling interest and mounting pressure on the bulls’ defensive line.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.