Market Analysis – January 9

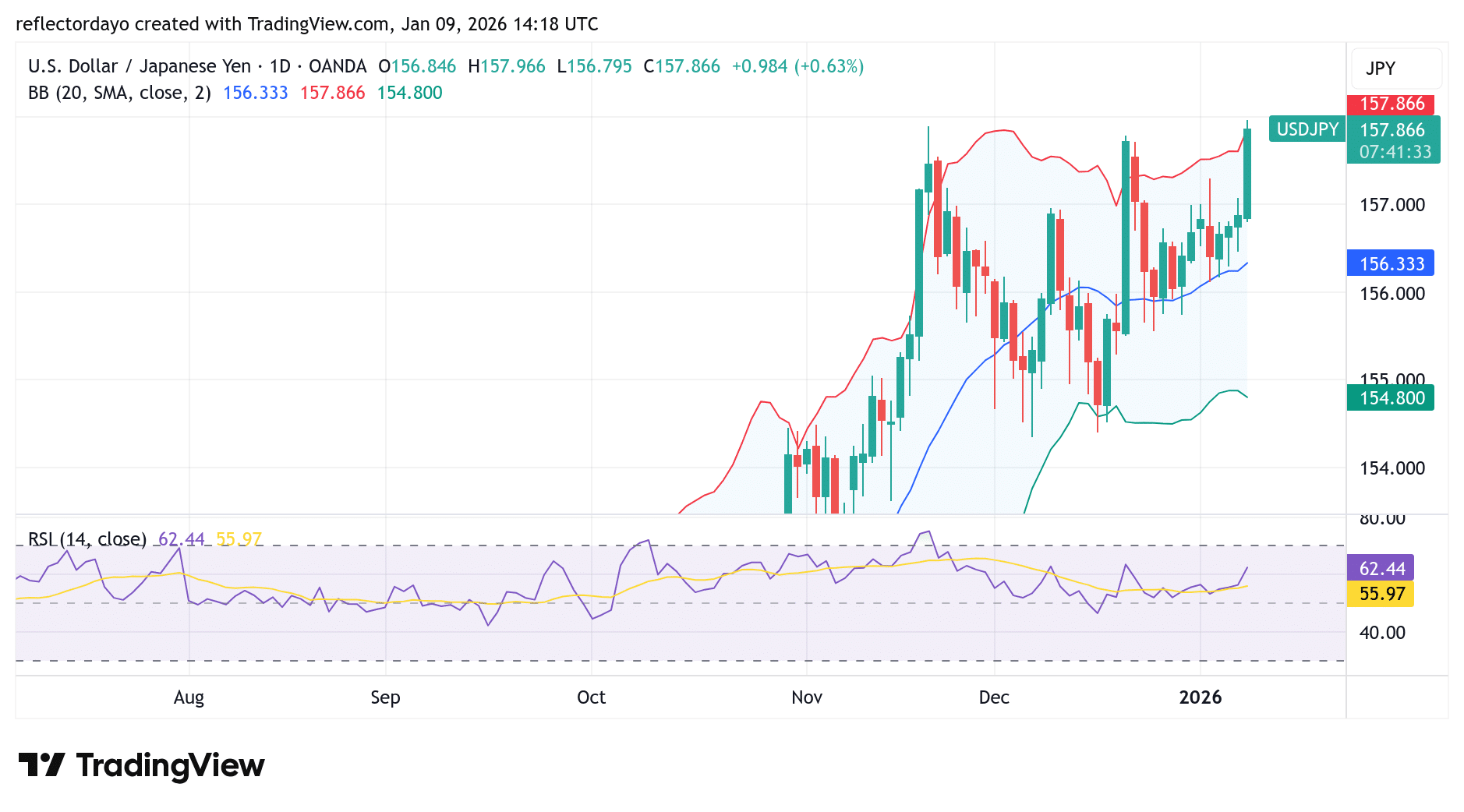

USD/JPY is trading on the front foot, extending its upside momentum as diverging macro forces continue to favor the US Dollar over the Japanese Yen. The pair climbed roughly 0.5% on Friday, pressing toward the 157.75 area and testing levels not seen in nearly a year. While recent data from Japan points to resilience in domestic consumption and growth, the Yen remains broadly under pressure, suggesting that positive fundamentals alone are not yet enough to reverse its weakening trend.

On the US side, the Dollar continues to draw support from firm labor market signals and renewed attention on Nonfarm Payrolls data, which reinforce expectations that US economic conditions remain robust. At the same time, ongoing discussions around trade tariffs have added another layer of support to the Greenback, keeping demand elevated. This combination of Yen fragility and sustained US Dollar strength continues to underpin USD/JPY, leaving the pair biased to the upside as traders weigh monetary policy divergence and global risk dynamics.

USD/JPY Key Levels

Supply Levels: 158, 159, 160

Demand Levels: 145, 140, 135

USD/JPY Breaks Above 157.00

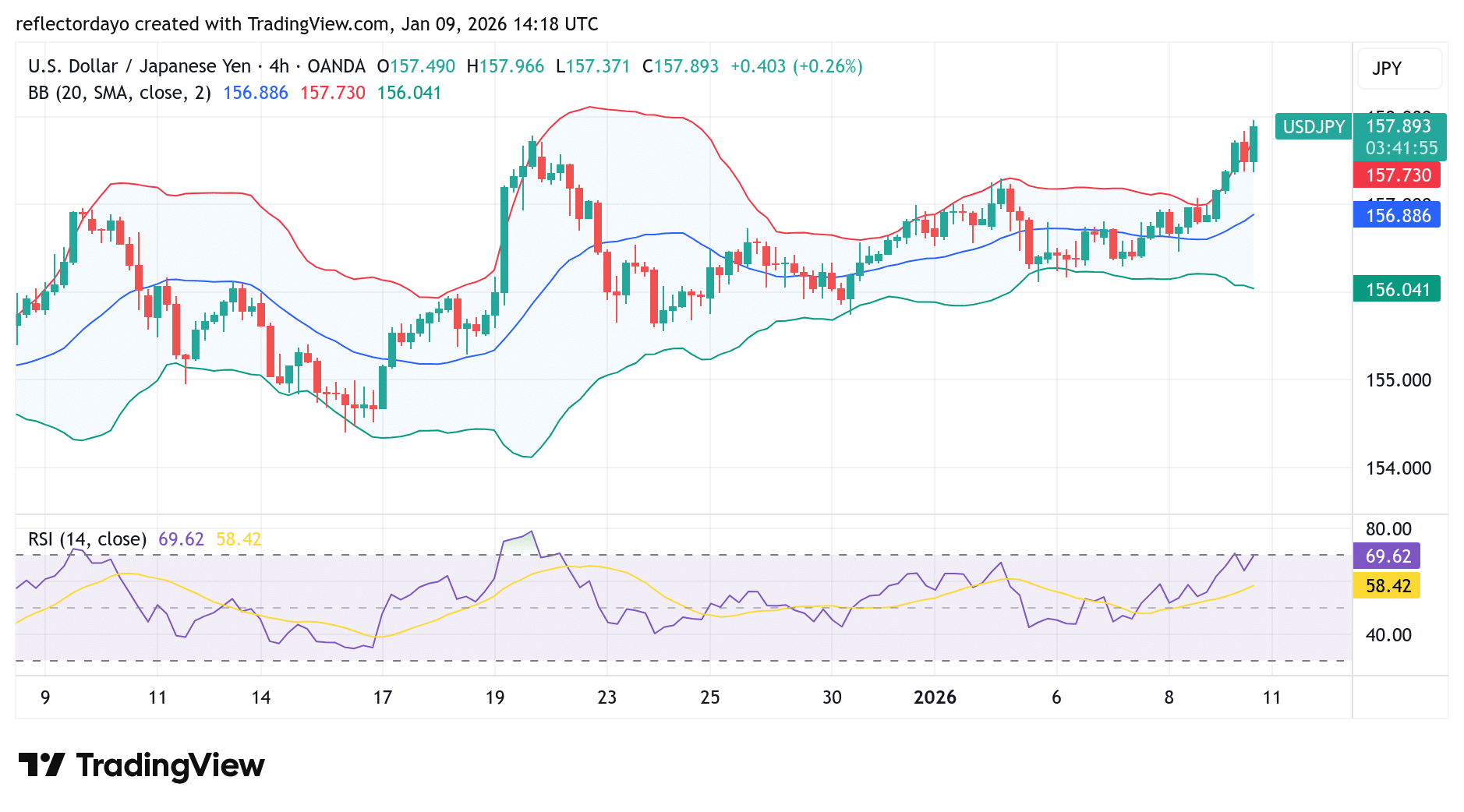

The 157.00 price level has acted as a long-standing resistance in previous trading sessions, capping bullish advances since Christmas 2025. However, as the market moves toward the close of the week, price has finally surged above this critical threshold and has, so far, remained firmly supported above it.

Historically, price action has oscillated around the 157.00 level due to heightened volatility in past periods. More recently, however—particularly from late December 2025 to the present—a gradual buildup of bullish momentum has been evident. This is reflected in a series of higher lows, as traders increasingly entered long positions at progressively higher price levels. This sustained accumulation of buying pressure has ultimately culminated in a decisive breakout above the 157.00 resistance.

USD/JPY Short-Term Trend

Following the breakout above the critical 157.00 price level, the USD/JPY market extended its advance and peaked near 157.86, where a bout of profit-taking emerged. While this pullback signals some short-term bearish activity, selling pressure has so far remained limited and insufficient to reverse the broader bullish structure.

The prevailing outlook suggests that the pair may continue forming higher lows, indicating sustained buying interest as traders position for a potential move toward higher price levels in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.