Market Analysis – January 2

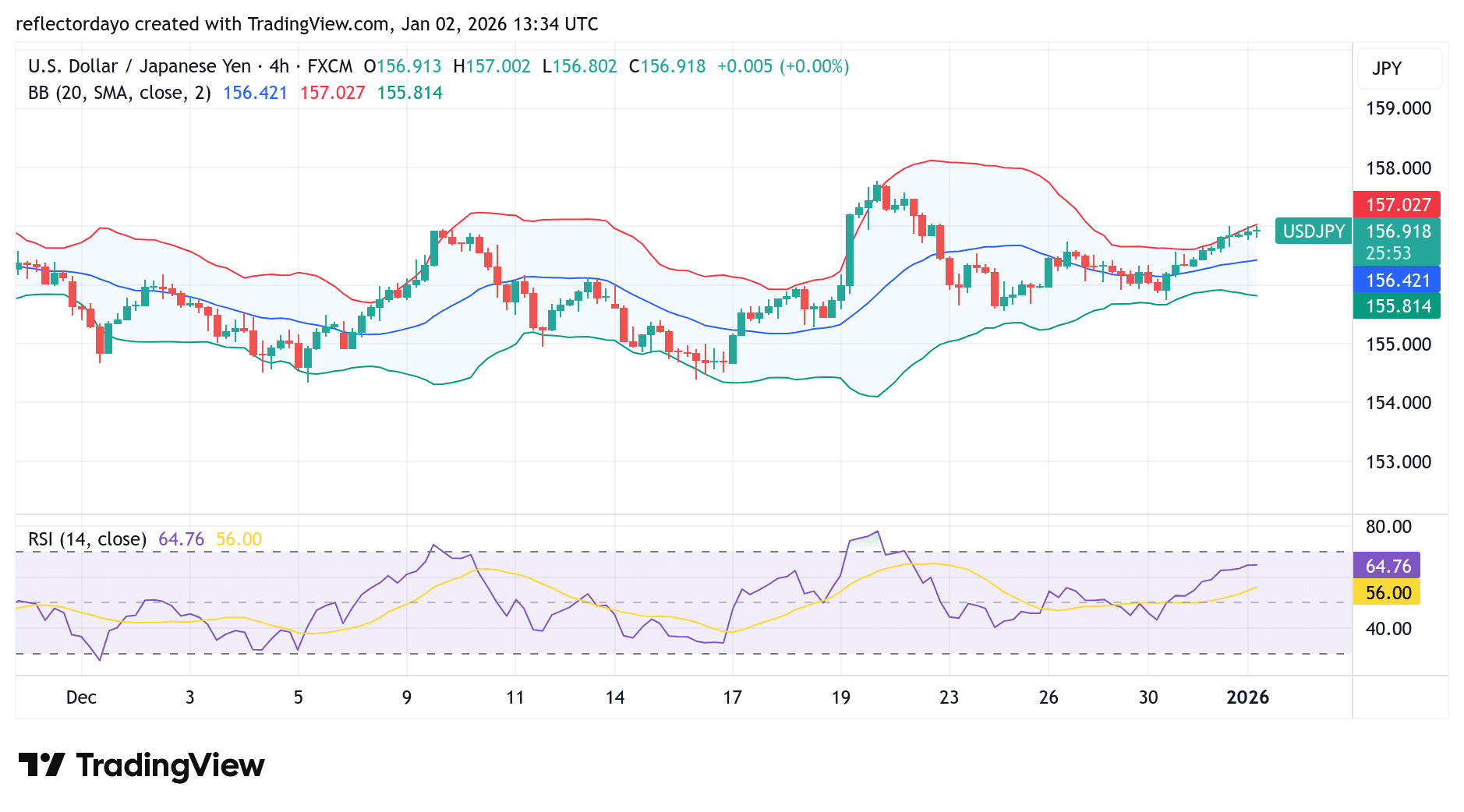

The USD/JPY pair recently pulled back after facing resistance near the 157.00 level, following modest adjustments in the Bank of Japan’s monetary policy stance. Despite this brief rejection, the broader trend remains constructive.

USD/JPY continues to find firm support as monetary policy divergence between the United States and Japan remains a key driver of price action. While the US maintains relatively higher interest rates alongside a data-dependent policy outlook, the Bank of Japan’s cautious approach to policy normalization continues to weigh on the Japanese yen.

This imbalance has allowed the US dollar to retain the upper hand, keeping the pair near multi-decade highs, even as ongoing concerns about potential official intervention limit the scope for excessive yen weakness.

USD/JPY Key Levels

Supply Levels: 158, 159, 160

Demand Levels: 145, 140, 135

USD/JPY Soars Toward 157.00

Over the past two trading sessions, USD/JPY has benefited from strong bullish tailwinds, driving price action higher toward the 157.00 level. This zone represents a critical technical area, having acted as a key resistance point in the pair’s historical price structure.

The significance of this level helps explain the cautious price behavior observed during today’s session, with price action flattening as it approaches the 157.00 mark. This consolidation highlights the area as a major resistance zone currently under close scrutiny by market participants.

The Relative Strength Index (RSI) is hovering around 57, indicating that bullish momentum remains intact and suggesting there may still be room for further upside. Should bulls manage to reclaim this level and establish a higher low, the pair could extend its advance and push further into bullish territory.

USD/JPY Short-Term Trend: Potential Ascending Low

As the market shows signs of indecision around the 157.00 level, traders are closely monitoring price action for a potential breakout. This zone has become a key crossroads, attracting increased market attention.

If a breakout to the upside materializes, the pair would likely establish a higher low, reinforcing the bullish structure and adding momentum to the ongoing uptrend. Such a development could open the door for a continued advance, with the 158.00 level emerging as the next upside target.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.