Market Analysis – December 26

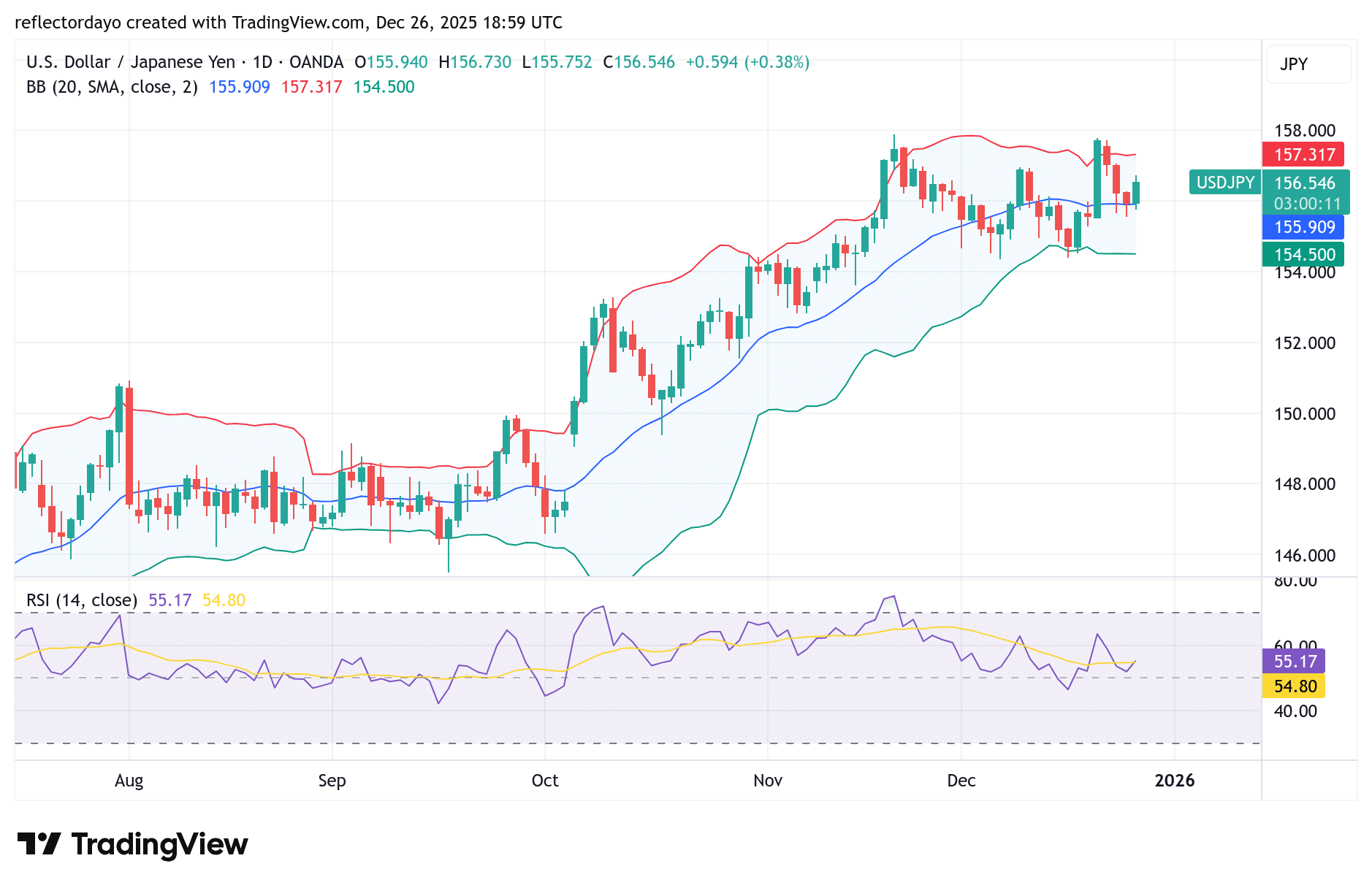

Recently, the price attempted to break above the 158 level but failed to do so. On December 19, the market opened around the 155 level and surged strongly toward 158; however, price action was rejected at this point, triggering a pullback back toward the 155 level. The repeated rejection around 158 reflects a long-term bullish trend encountering a strong psychological and technical resistance zone. This resistance has been further reinforced by intervention risks and seasonally low liquidity, resulting in the current phase of price consolidation.

USD/JPY Key Levels

Supply Levels: 158, 159, 160

Demand Levels: 145, 140, 135

USD/JPY Continues to Hold Near 155

The USD/JPY market was recently rejected at the 158 level after a period of one-sided price action in which bulls dominated, largely driven by sustained weakness in the Japanese yen. The current phase of consolidation suggests that measures may have been implemented to stabilize the yen.

However, with price still holding slightly above the key 155 level—often viewed as a point of equilibrium—bulls continue to maintain a slight upper hand. There are valid reasons for bullish expectations of a potential breakout toward 158. Notably, buyers were able to re-enter positions around the 155 level, forming an ascending low. If bulls continue to defend this area, the market could eventually break above 158 and resume its upward trajectory.

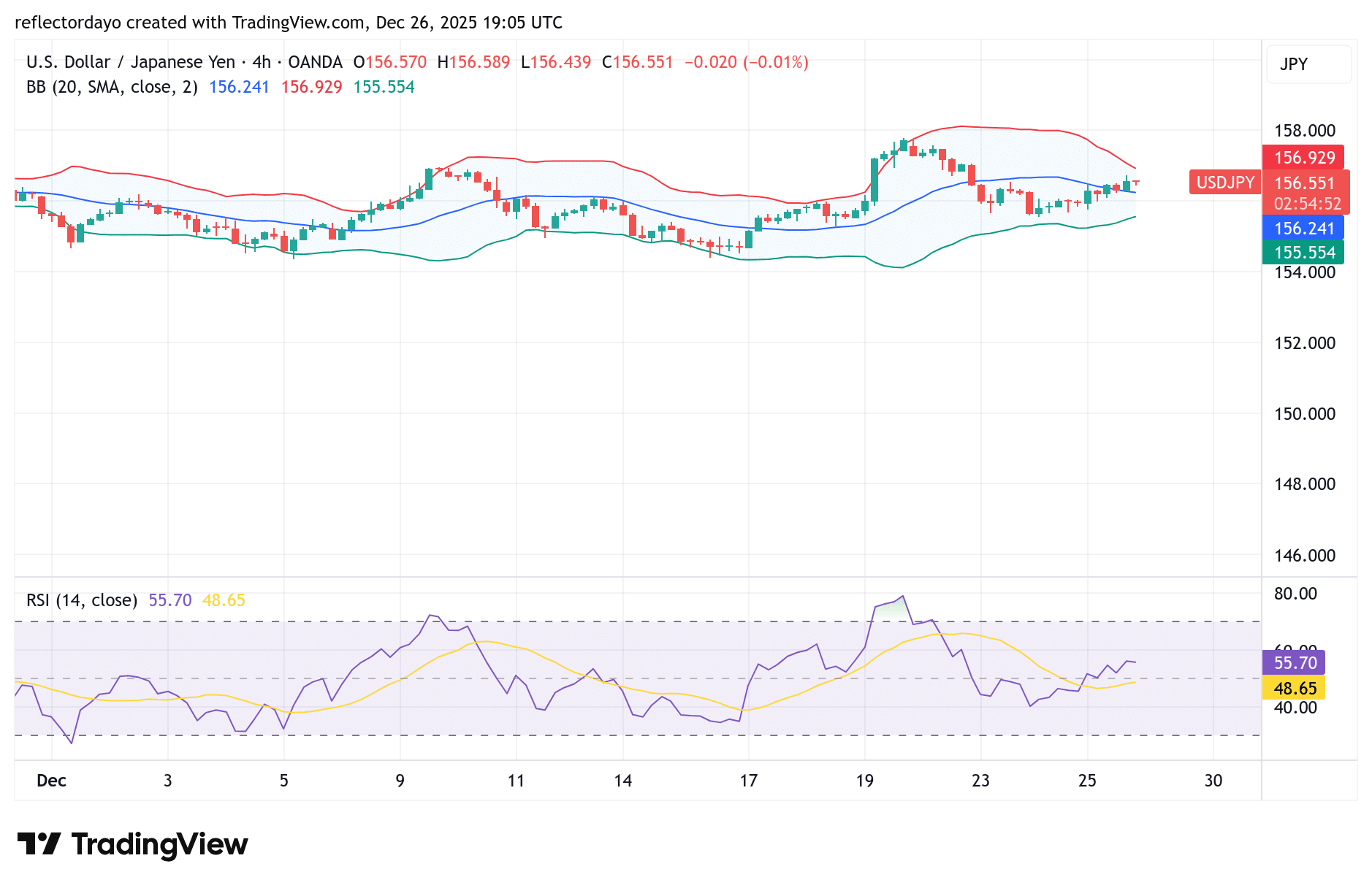

USD/JPY Short-Term Trend: Indecision

The lower time frame provides a clearer view of the market’s intraday progression. At present, price action reflects a cautious bullish bias, with traders showing hesitation around the 156 level. If a rejection occurs in this area, the 155 support level is expected to act as a buffer against downside pressure. Should this support hold, buying pressure may gradually build, increasing the likelihood of a renewed test of the 158 resistance level and potentially forcing a bullish breakout.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.