FTSE 100 Analysis – January 7

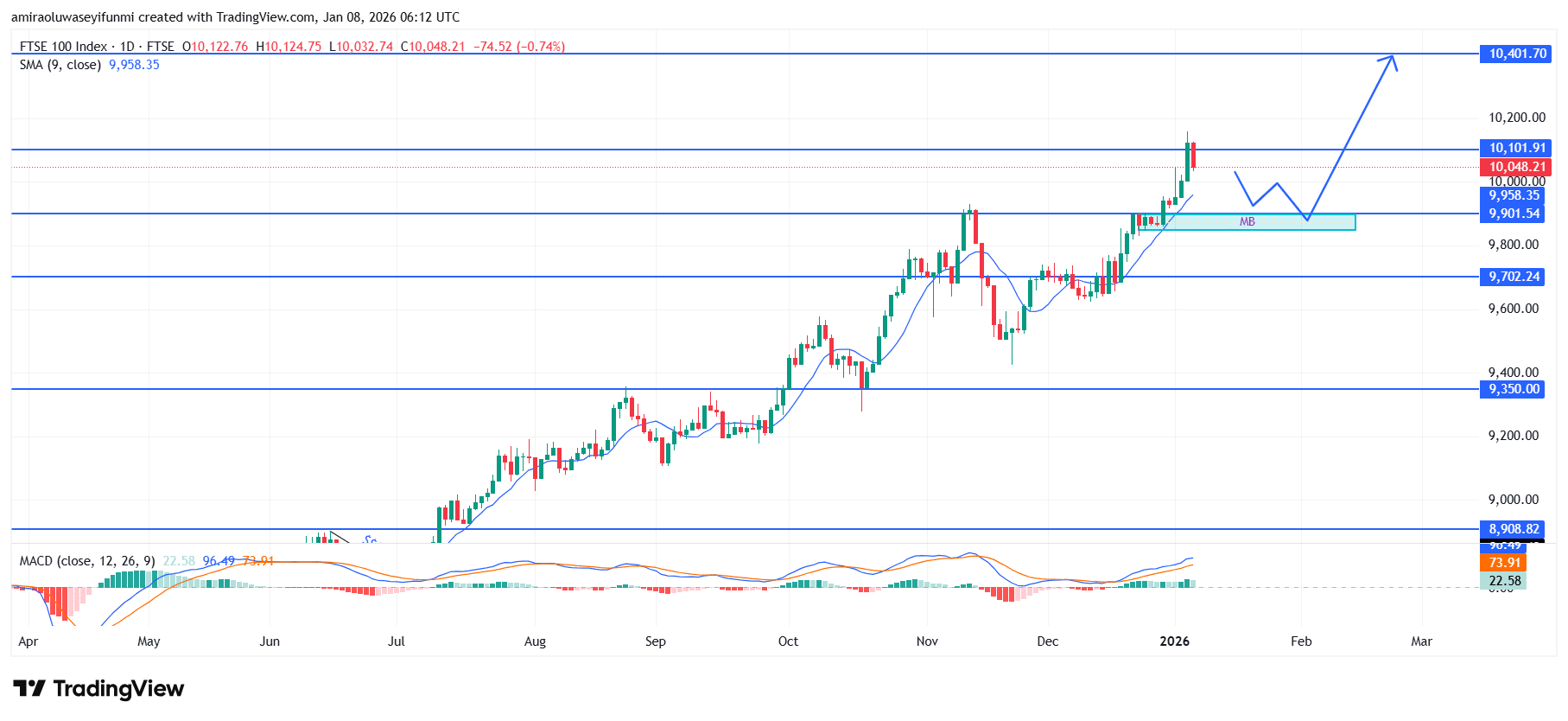

FTSE 100 maintains bullish structure supported by improving momentum indicators. The FTSE 100 continues to trade within a clearly defined bullish environment, with price holding firmly above the short-term moving average near $9,960. Trend alignment remains constructive, as momentum indicators reflect sustained upside pressure rather than exhaustion. The MACD is stabilizing in positive territory, signaling that bullish participation remains active despite recent minor pullbacks.

FTSE 100 Key Levels

Supply Levels: $9900.0, $10100.0, $10,400.0

Demand Levels: $9700.0, $9350.0, $8900.0

FTSE100 Long-Term Trend: Bullish

Price action continues to display a sequence of higher highs and higher lows, confirming the integrity of the prevailing trend. The recent advance stalled just above the $10,100 resistance zone before transitioning into a controlled retracement, which has so far respected the $9,900–$9,920 demand area. This orderly pullback reflects consolidation rather than distribution, reinforcing the view that buyers remain structurally dominant.

Looking ahead, sustained defense of the $9,900 region is likely to support renewed upside continuation. A decisive break above $10,100 would open the path toward the next upside objective near $10,400. Overall, the broader outlook remains bullish, with short-term retracements viewed as rotational pauses aligned with prevailing forex signals rather than a threat to trend structure.

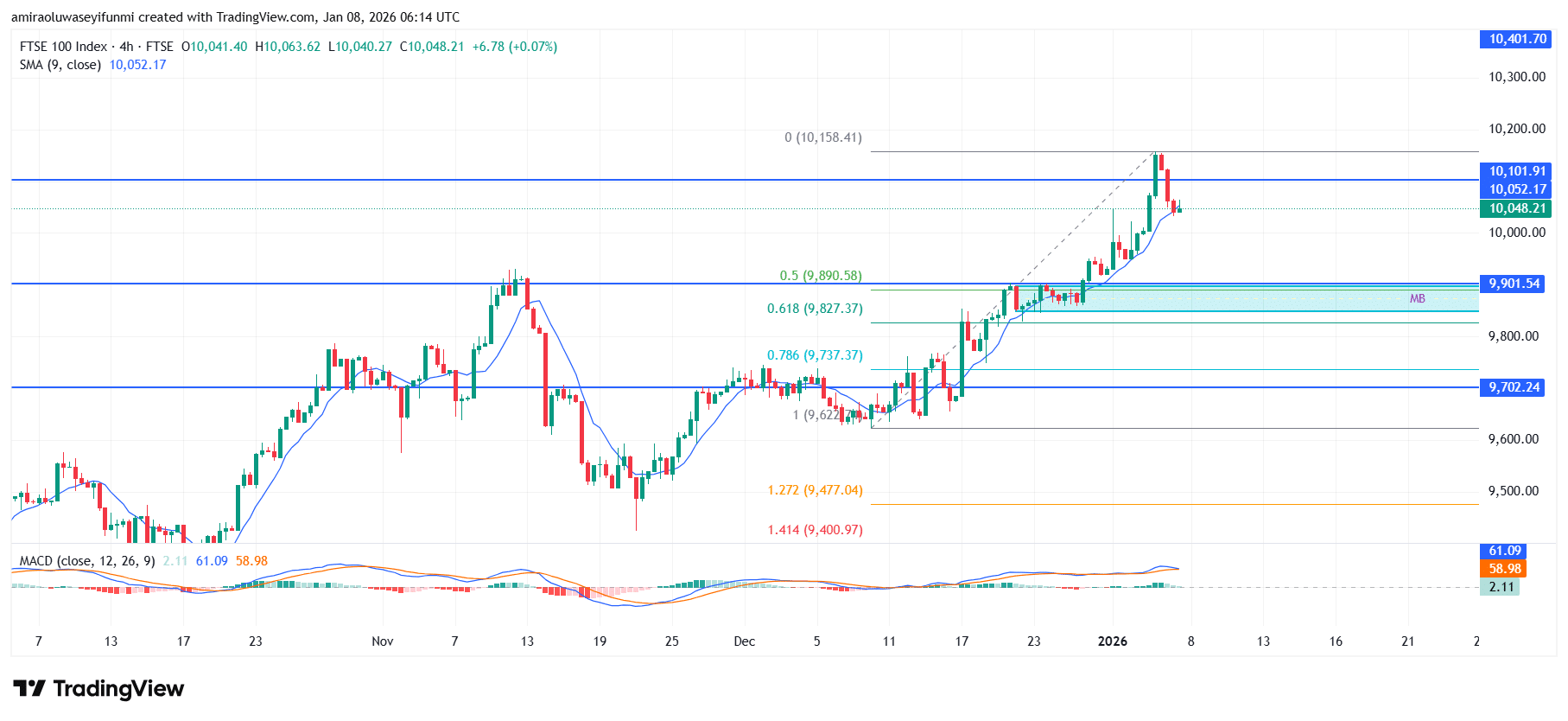

FTSE100 Short-Term Trend: Bearish

FTSE 100 remains structurally bullish on the four-hour chart, with price holding above key moving averages and higher swing lows still intact. However, the recent rejection near resistance suggests a short-term pullback toward the $9,900–$9,950 demand zone is likely.

Momentum indicators are cooling from previously extended levels, supporting the case for a brief corrective phase. As long as price remains above prior breakout support, the broader uptrend is expected to resume following this consolidation.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.