Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Storj market has grown by a notable 6.42%. This may seem moderate, but it keeps the token trading near key technical levels. Also, the market can be seen maintaining a slight upward trajectory.

Storj Statistics

Current Price: $0.1475

Market Capitalization: $61.13M

Circulating Supply: 422.97M

Total Supply: 424.99M

CoinMarketCap Rank: 384

Key Levels

Resistance: $0.1500, $0.1750, $0.2000

Support: $0.1400, $0.1200, $0.1000

STORJ/USDT May March to Higher Grounds

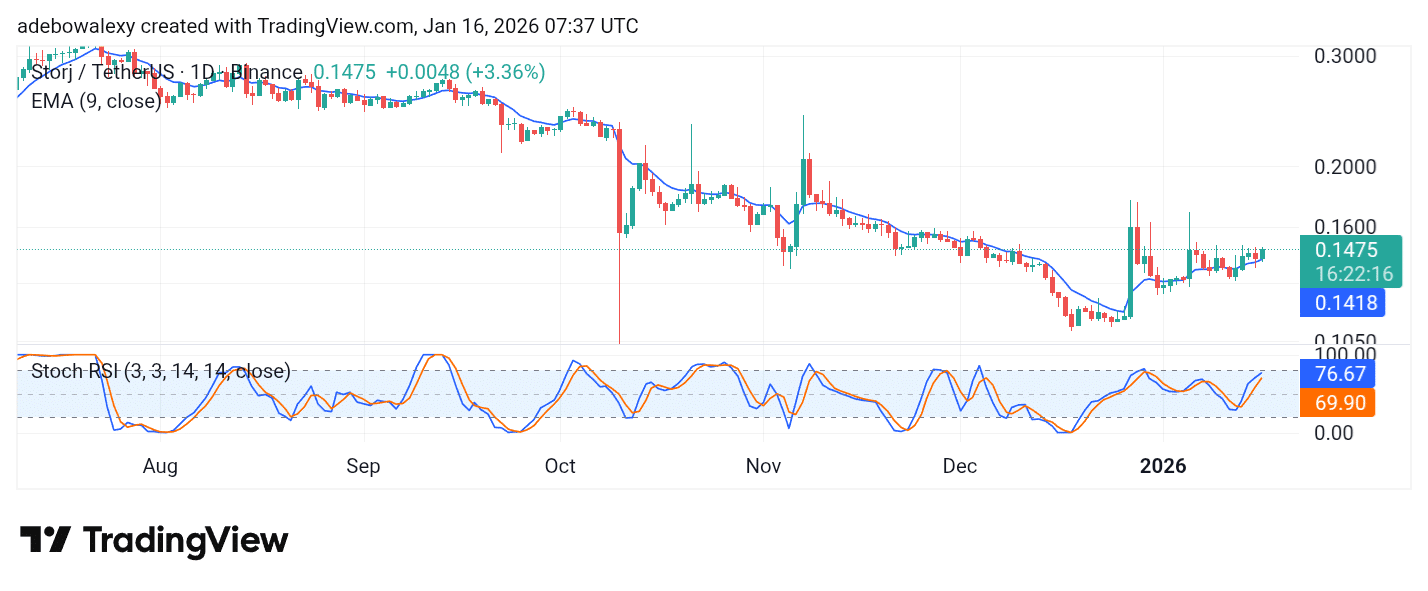

The ongoing session in the Storj daily market can be seen remaining bullish above a key technical level. The corresponding price candle for the ongoing session is a green one and stands just above the 9-day Exponential Moving Average (EMA) line.

The lines of the Stochastic Relative Strength Index (SRSI) indicator are also still rising steadily toward the 80 mark of the indicator. This points to the likelihood that price action may edge higher subsequently.

Storj Looks Gallant Even in the Short Term

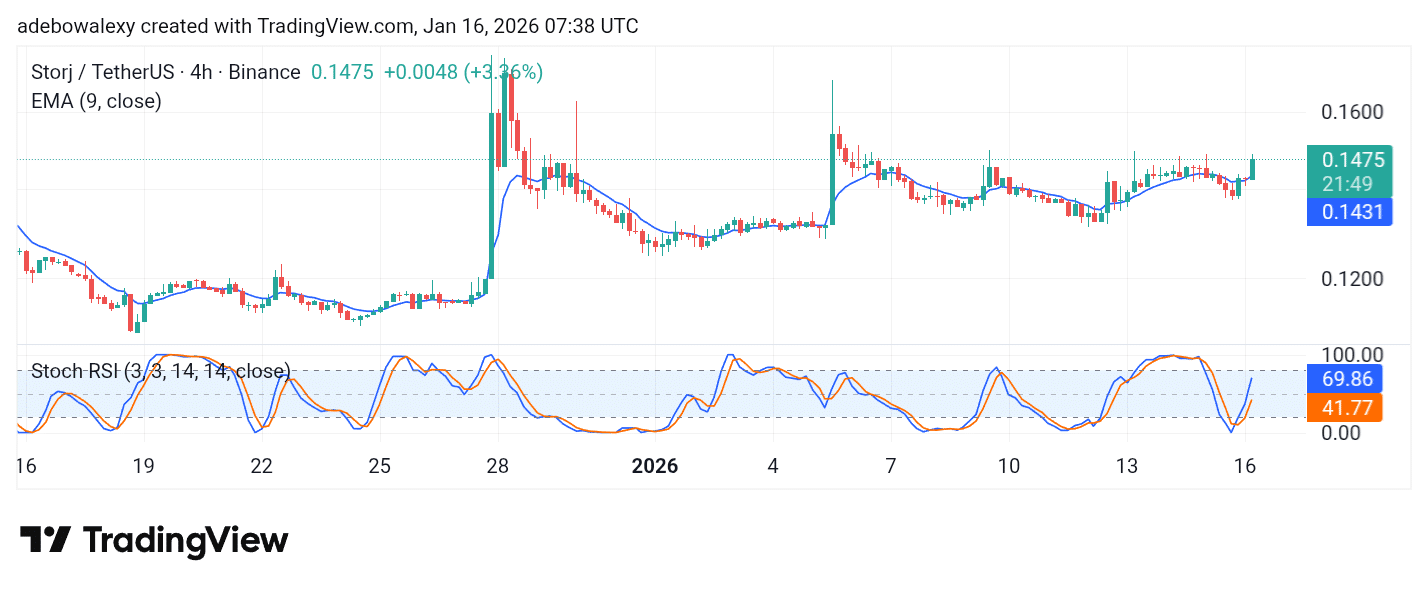

The STORJ 4-hour chart shows that price action continues to edge higher. The latest price candle maintains a consistent position above the 9-day EMA curve and keeps a green appearance as it sits at the mentioned technical support level.

Training at scale is no longer optional.

💪 H100 clusters starting at ~$1.40/hr per GPU

🖥 10-node minimum

📍 Amsterdam / NYThe kind of infrastructure AI growth depends on. Is scale or flexibility more important to you? @storj#H100 #AITraining #ComputeScale

— Storj (@storj) January 14, 2026

Storj: Training at scale is no longer optional.

Powering AI Growth With Scalable Infrastructure

💪 H100 GPU clusters starting at ~$1.40/hr per GPU

🖥 10-node minimum

📍 Amsterdam and New York

This is the kind of infrastructure modern AI development depends on. When choosing your setup, is scale or flexibility more important to you?

Storj Looks Gallant Even in the Short Term (Continued)

The lines of the Stochastic Relative Strength Index (SRSI) indicator are also staying poised upward as they rise toward the 80 mark of the indicator.

Summing things up still tilts the scale in favor of upside forces, suggesting that this market may edge toward the $0.1550 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.