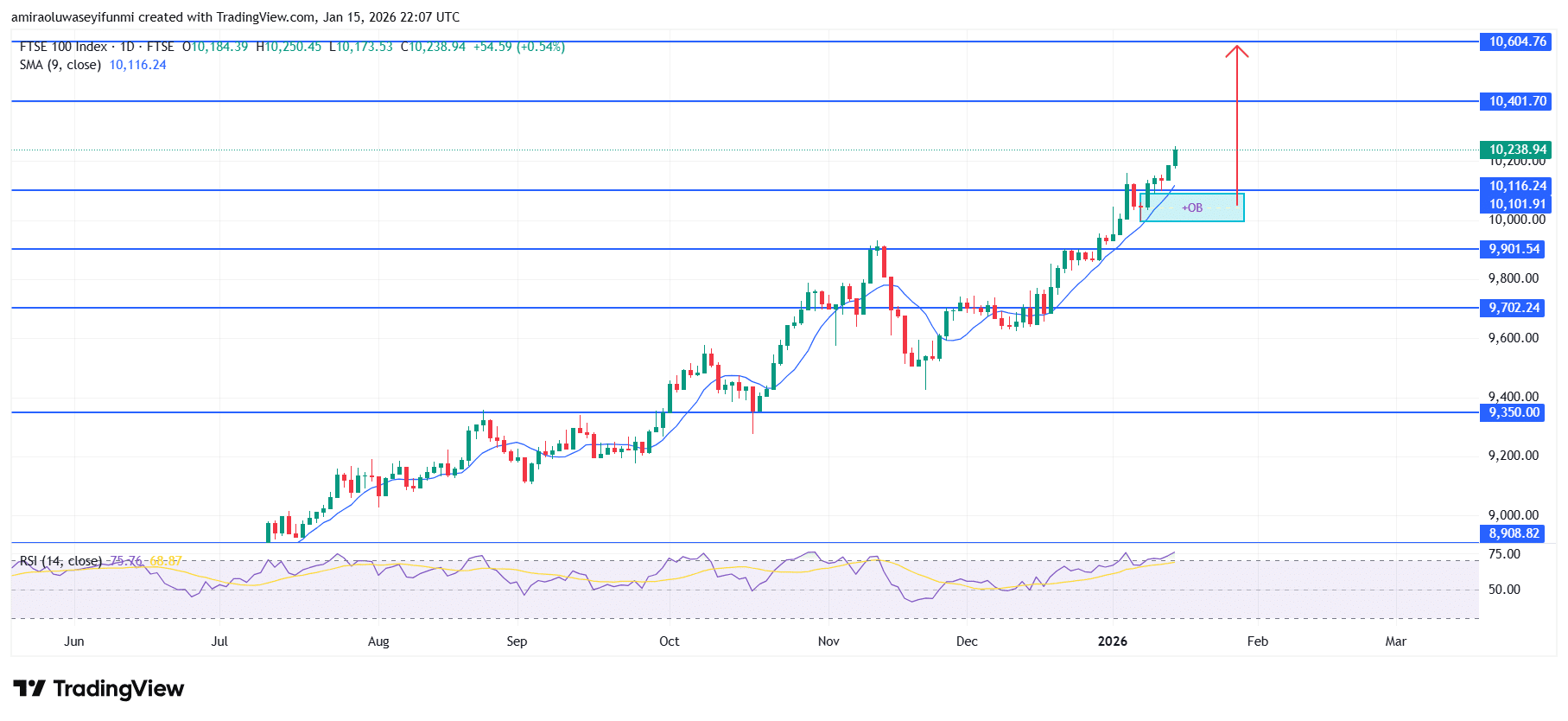

FTSE 100 Analysis – January 14

FTSE 100 preserves uptrend as price strength remains intact. The FTSE 100 continues to operate within a clearly constructive trend, with overall price action aligned with supportive momentum and trend indicators. Price remains firmly above the short-term average near $10,120, emphasizing directional strength rather than mean reversion behavior. Momentum conditions stay steady without signs of exhaustion, suggesting participation remains broad and orderly. This technical environment indicates that upside control is still firmly held by buyers.

FTSE 100 Key Levels

Supply Levels: $10,120, $10,400, $10,600

Demand Levels: $9,900, $9,700, $9,350

FTSE100 Long-Term Trend: Bullish

From a technical standpoint, the index has maintained a steady advance characterized by rising swing highs and higher reaction lows. Sustained acceptance above the $9,900 and $10,100 regions confirms a successful transition from prior resistance into demand. The market is consolidating constructively above the $10,100–$10,120 zone, using this area as a continuation base rather than showing signs of breakdown. Pullbacks have remained shallow, reflecting contained selling pressure and persistent buyer interest.

Looking ahead, the FTSE 100 retains room for further upside as long as structural support above $10,100 remains intact. A confirmed push through the $10,400 level would likely shift focus toward the $10,600 area as the next upside reference. While short-term consolidation may occur, the broader technical structure continues to favor higher prices, with bearish risk only increasing on a decisive failure below $9,900.

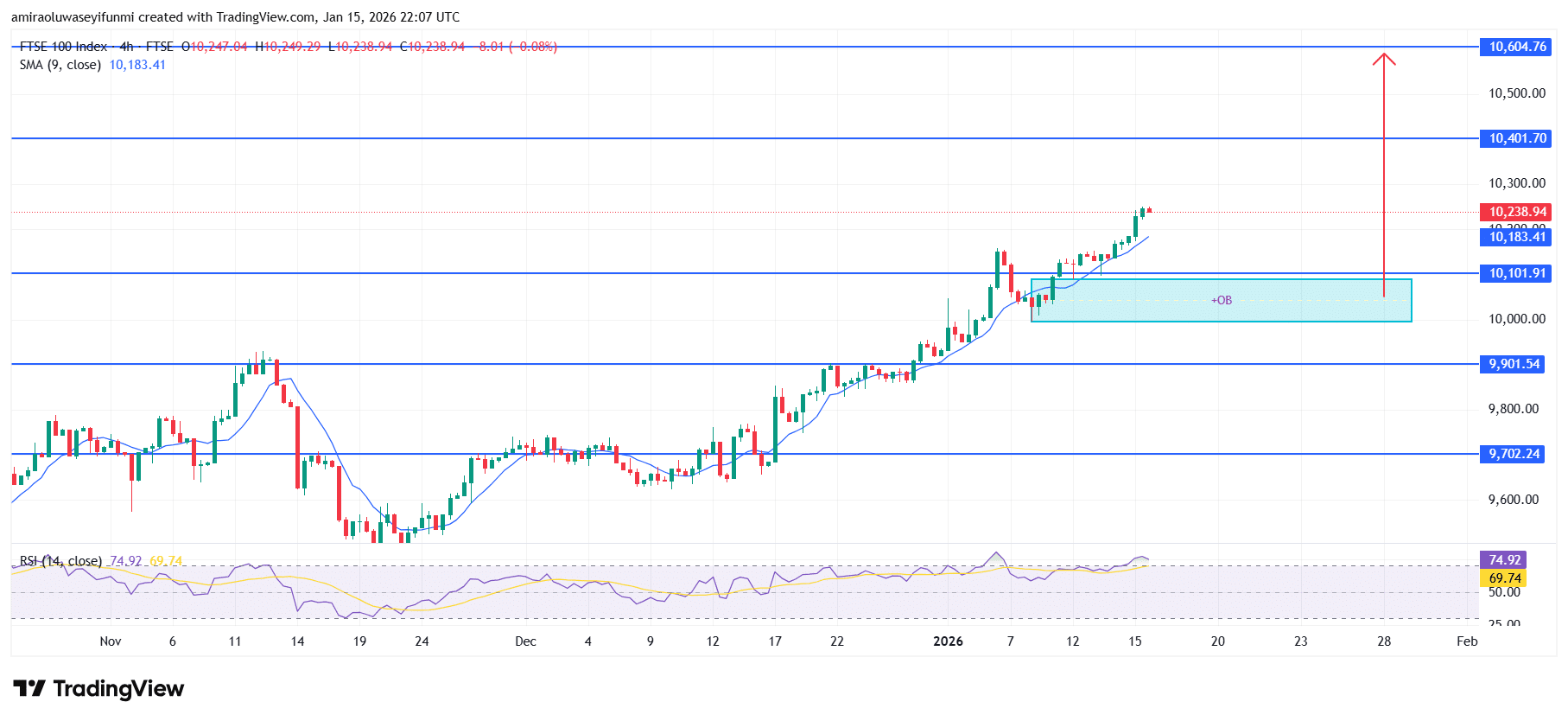

FTSE100 Short-Term Trend: Bullish

FTSE 100 maintains a bullish configuration on the four-hour chart, with price holding firmly above the rising 9-period moving average. The recent breakout followed by consolidation above the $10,100 region reflects sustained buyer control and healthy continuation dynamics.

Momentum remains supportive as RSI stays elevated, indicating strong demand without evident bearish divergence. Any pullback into the highlighted order block is likely to attract buyers, keeping upside objectives toward the $10,400 and $10,600 levels in focus, in line with prevailing forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.