Market Analysis – December 4

Despite both the U.S. and Japan posting similar inflation readings at around 3%, the USD/JPY pair is not responding to inflation data alone. Instead, the recent decline from the November peak near 158 is being driven by shifting monetary expectations on both sides. Softer U.S. economic data—especially unexpected job losses and rising jobless claims—has strengthened market expectations of a Federal Reserve rate cut, weakening the dollar. Meanwhile, Japan’s persistent inflation above the Bank of Japan’s 2% target has boosted speculation that the BoJ may finally step away from its long-standing ultra-loose policy. With the Fed turning dovish and the BoJ turning increasingly hawkish, the balance of momentum has tilted in favor of the yen, helping to explain the pair’s downward slide and the current consolidation around 155.

USD/JPY Key Levels

Demand Levels: 156, 157, 158

Supply Levels: 154, 153, 152

USD/JPY Stabilizes at 155

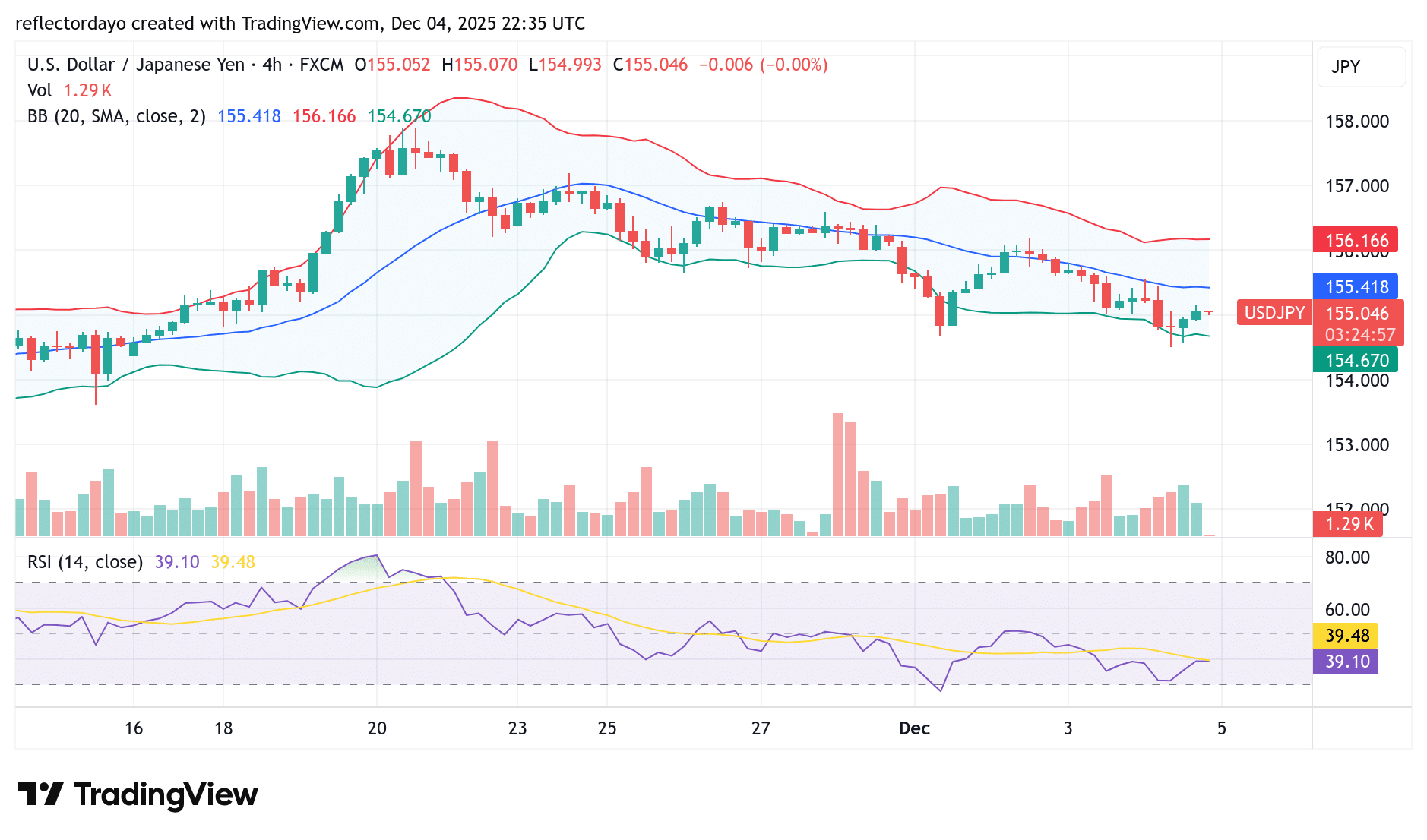

In November, USD/JPY posted an impressive rally. The bullish momentum that began in early October continued steadily, breaking several key resistance levels before eventually peaking near the 158 mark. This upward surge was followed by a period of profit-taking, which triggered a pullback in price.

However, around the 155 level, bearish pressure appears to have stalled. The candlesticks from yesterday and today suggest that sellers are losing steam, and the market may be positioning itself for another potential bullish attempt.

Technical indicators, particularly the Relative Strength Index (RSI), show momentum stabilizing near the midpoint, indicating a balanced market environment. This equilibrium at the 155 level could become a pivotal point for determining USD/JPY’s next directional move.

USD/JPY Short-Term Trend: Indecision

From the perspective of the 4-hour chart, the significance of the 155.00 price level becomes even more apparent. This level has served as an important reference point in recent trading sessions, and the market’s rebound from it on December 1st reinforces its relevance as a key support area for both traders and investors.

At the moment, however, market participants appear uncertain about the next directional move. This indecision is reflected in the series of flat candlesticks and the low-height histogram bars, both of which signal a lack of strong momentum on either side. Until a clear breakout or decisive price action emerges, the short-term outlook for USD/JPY remains neutral, with traders cautiously watching how price behaves around the 155.00 zone.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.