Market Analysis – December 4

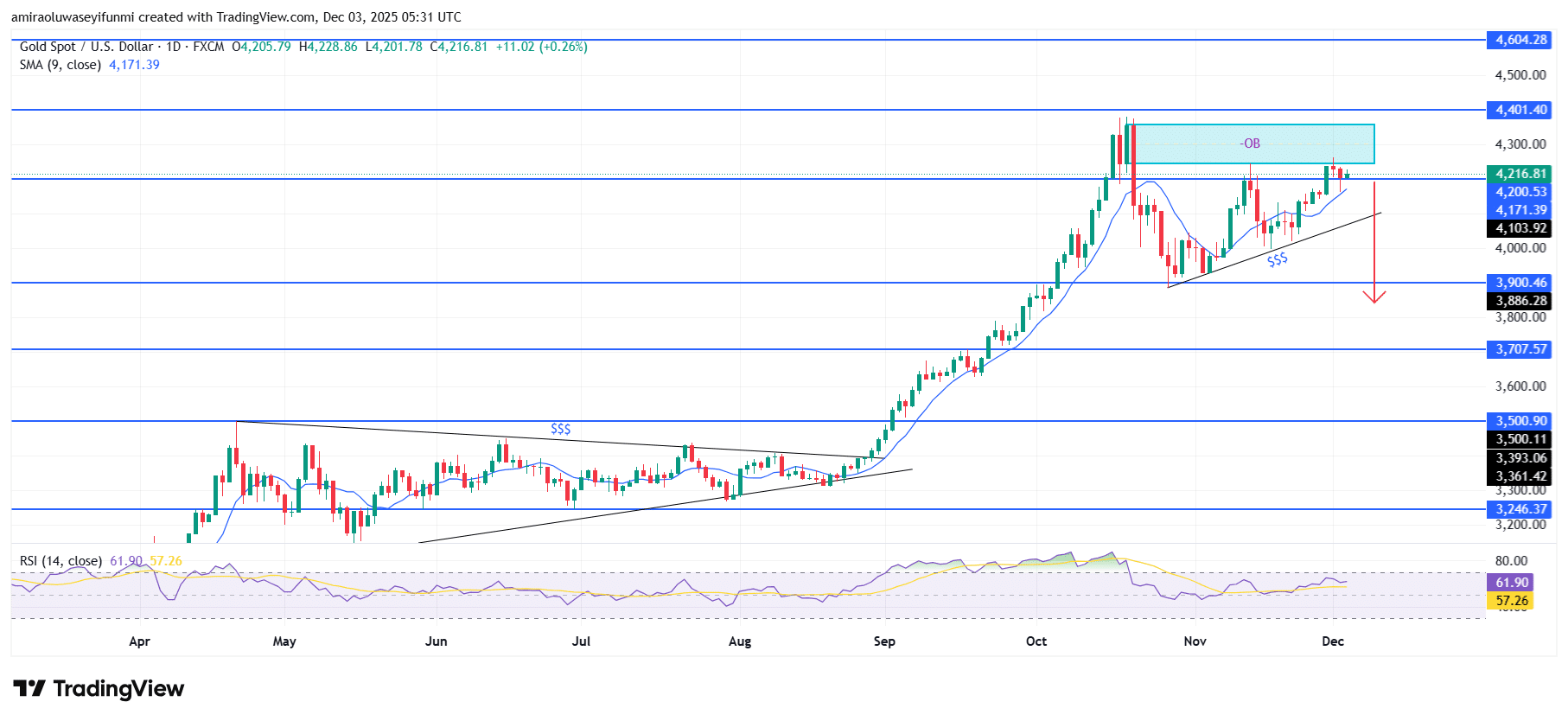

Gold (XAUUSD) reflects emerging downside bias as momentum fades. Gold is beginning to show clearer signs of softening demand, with the broader structure gradually shifting toward a bearish recalibration. Price is now clustering around the short-term average near $4,170, marking a slowdown in upward commitment after multiple failed attempts to break through the $4,300–$4,310 ceiling. The RSI has also retreated from previous highs, signalling reduced buyer engagement and a shift from accumulation into early distribution.

Gold Key Levels

Resistance Levels: $4200, $4400, $4600

Support Levels: $3900, $3710, $3500

Gold Long-Term Trend: Bearish

The metal has approached the $4,300–$4,310 supply zone several times without securing a sustained breakout, reinforcing sustained seller strength at that level. Recurrent upper-wick rejections and a narrowing upward structure indicate that buyers are steadily losing control. A drop through the local trendline support near $4,200 would confirm a momentum shift and open the path for a deeper retracement toward the next value region around $3,900–$3,910. Price slipping beneath the short-term average further supports the emerging bearish tilt.

Looking ahead, the risk of an extended decline continues to increase as downward pressure builds across the current framework. A decisive break below $4,170, followed by weakness under $4,100, may accelerate selling interest toward the key lower zone near $3,900. Should bearish momentum persist, price could slide toward the $3,710 region. Unless buyers reclaim firm control above $4,300, the prevailing technical landscape points toward a sustained bearish phase rather than a renewed upward advance.

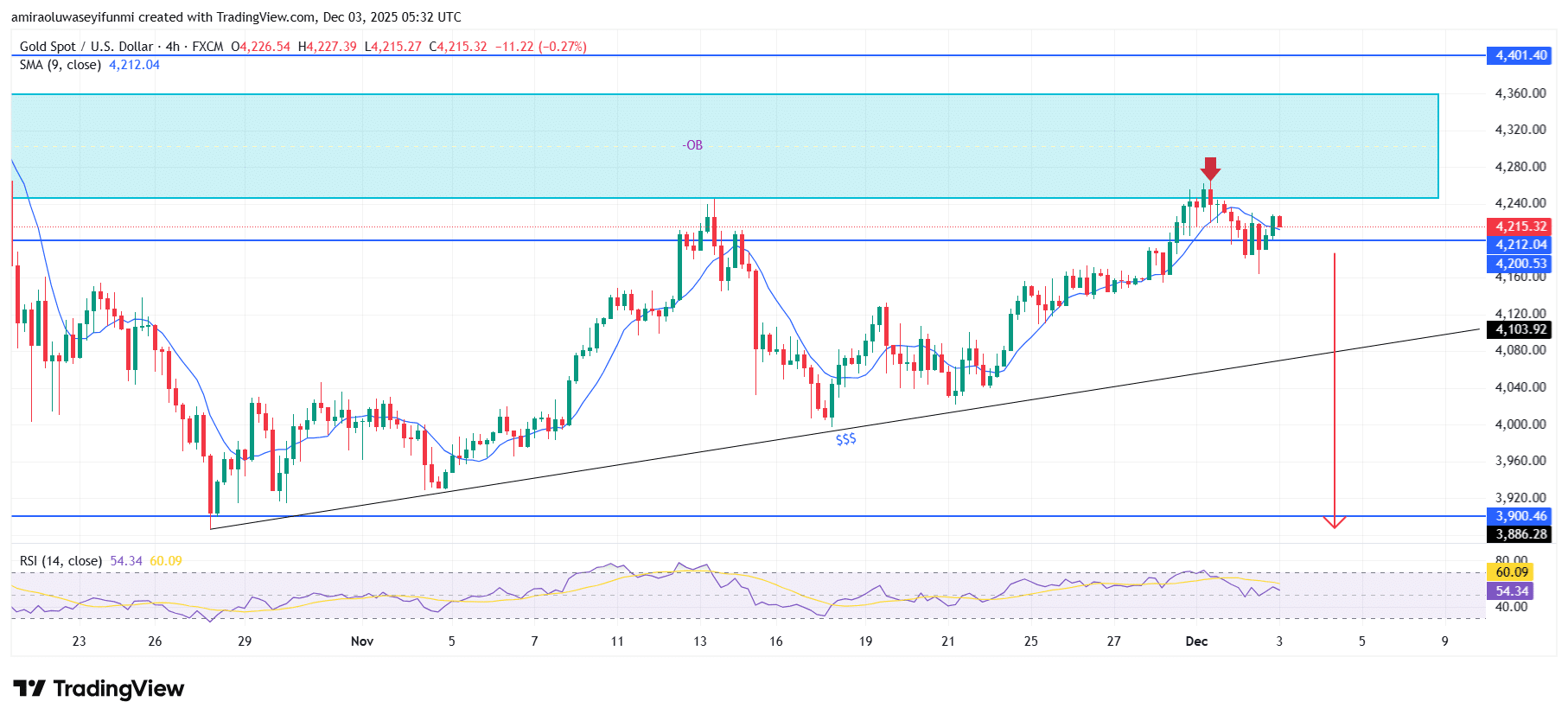

Gold Short-Term Trend: Bearish

Gold (XAUUSD) is encountering repeated rejection from the bearish order-block between $4,280–$4,360, signalling renewed downside pressure on the four-hour chart. Price has slipped beneath the 9-period SMA, indicating weakening momentum and reinforcing bearish dominance.

The inability to maintain levels above the $4,212–$4,200 support zone suggests that sellers are gaining full control following the recent lower-high formation. With structure continuing to weaken, a move toward $4,100—and potentially the $3,900–$3,890 region—appears increasingly likely, aligning with broader expectations often highlighted in forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.