Market Analysis – November 27

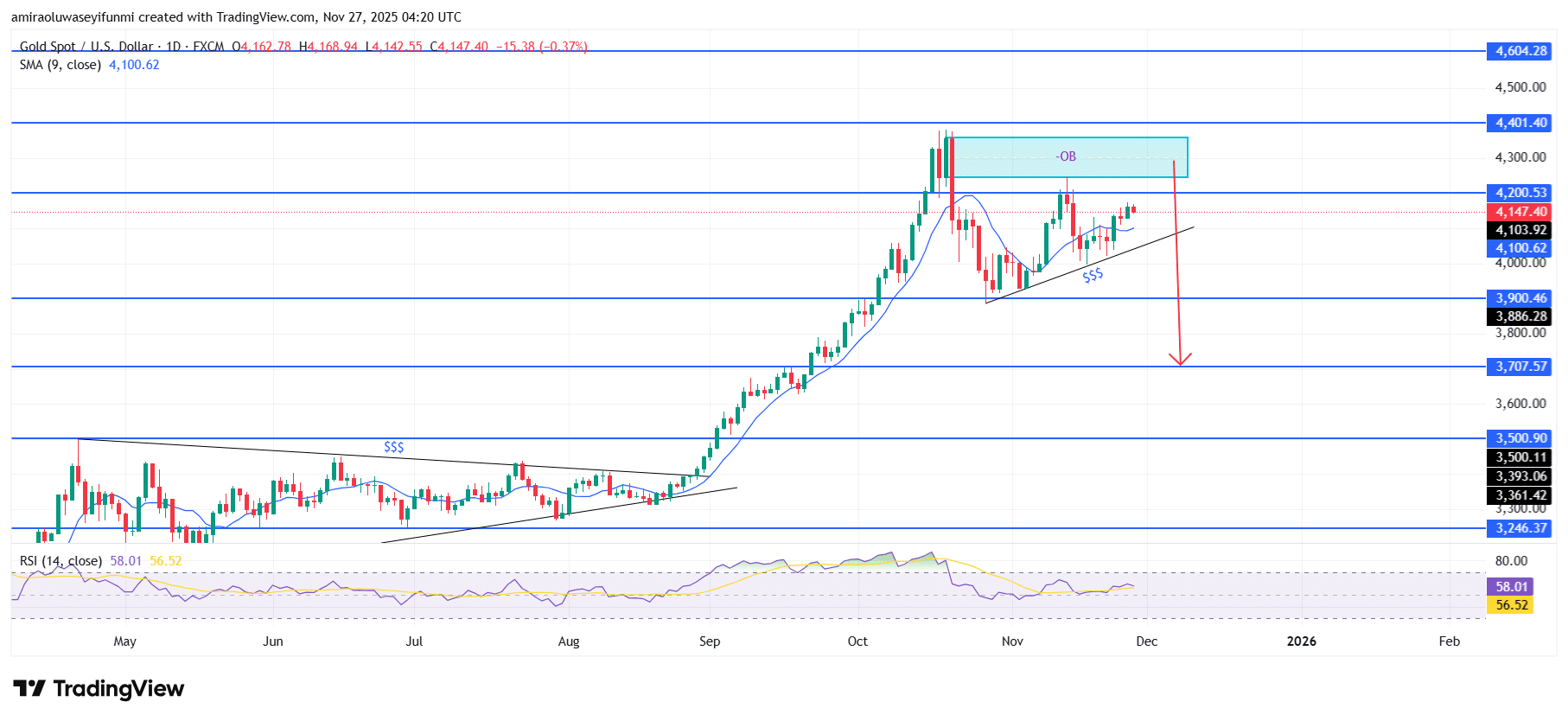

Gold (XAUUSD) outlook highlights growing reversal risk as bearish tone emerges. The broader structure is beginning to lose upward momentum, with indicators reflecting a clear reduction in buying strength. The RSI has retreated from previous highs, and price is struggling to hold above the short-term moving average near $4,100. While the market recently experienced a strong upward phase, current behaviour signals slowing demand, suggesting an early shift toward seller dominance and weakening bullish commitment.

Gold Key Levels

Resistance Levels: $4200, $4400, $4600

Support Levels: $3900, $3710, $3500

Gold Long-Term Trend: Bearish

On the technical side, gold encountered firm resistance within the refined supply region between $4,300 and $4,400, prompting a decisive rejection. Price has since moved toward the rising support line, hesitating around $4,150 without showing any convincing indication of renewed bullish strength. The inability to break above the upper resistance band, combined with the development of a lower high, strengthens expectations of an emerging downside rotation as underlying support begins to weaken.

Looking ahead, a drop beneath both the trendline and the $4,100 short-term support would pave the way for a move toward the next liquidity region around $3,900. Continued weakness could extend the decline toward the broader structural level near $3,710, where prior demand may attempt to steady the market. If bearish momentum continues to intensify, XAUUSD could ultimately slide toward the deeper support zone at $3,500, marking a more complete retracement of its earlier steep advance.

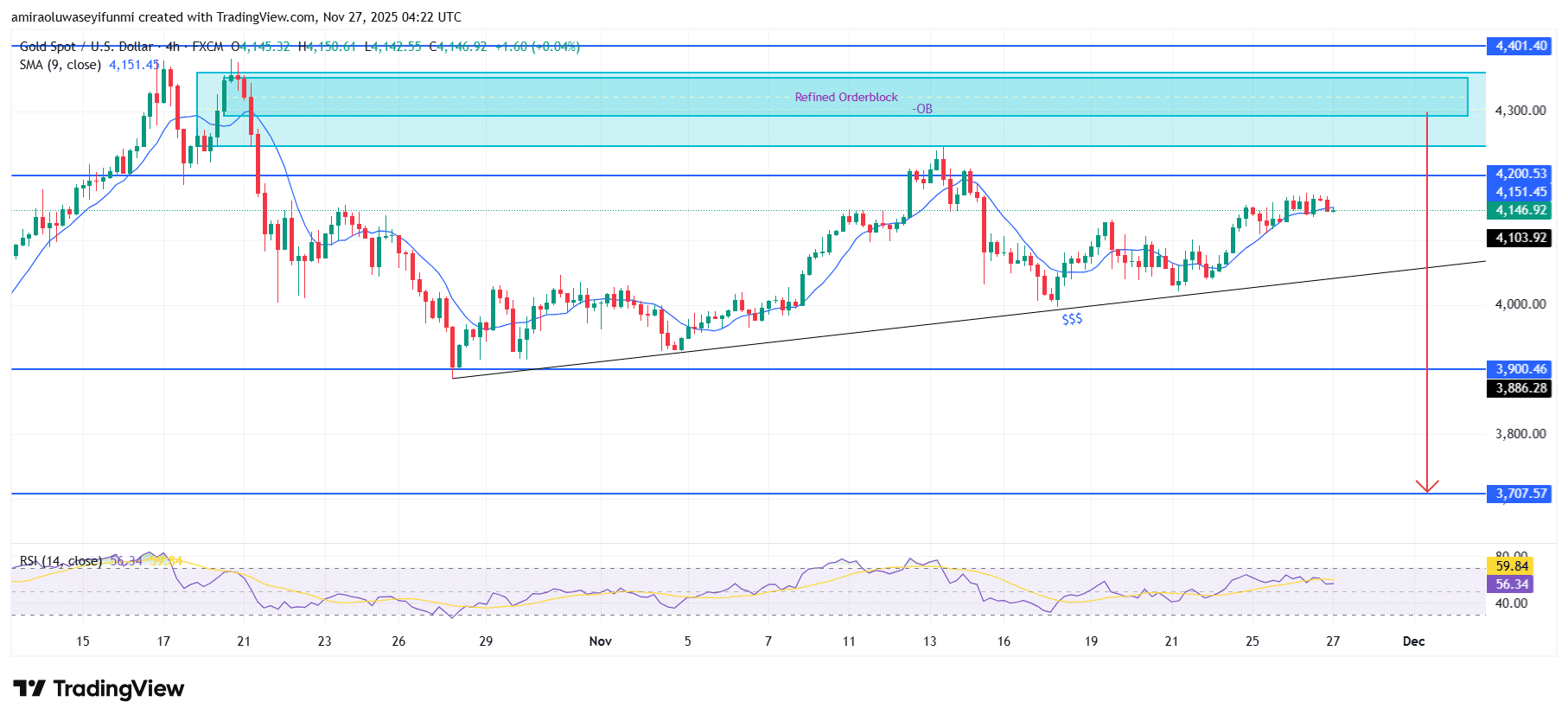

Gold Short-Term Trend: Bearish

Gold (XAUUSD) is showing continued weakness on the four-hour chart as price trades below the refined order-block region around $4,300–$4,400. The market is struggling to sustain traction above $4,150, with the RSI flattening and indicating diminishing bullish strength. Price remains capped beneath the short-term resistance shelf near $4,200, suggesting sellers are maintaining control. If downside pressure persists, the market may retrace toward the key support zone around $3,710, a movement that many traders actively monitor through forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.