Market Analysis – November 20

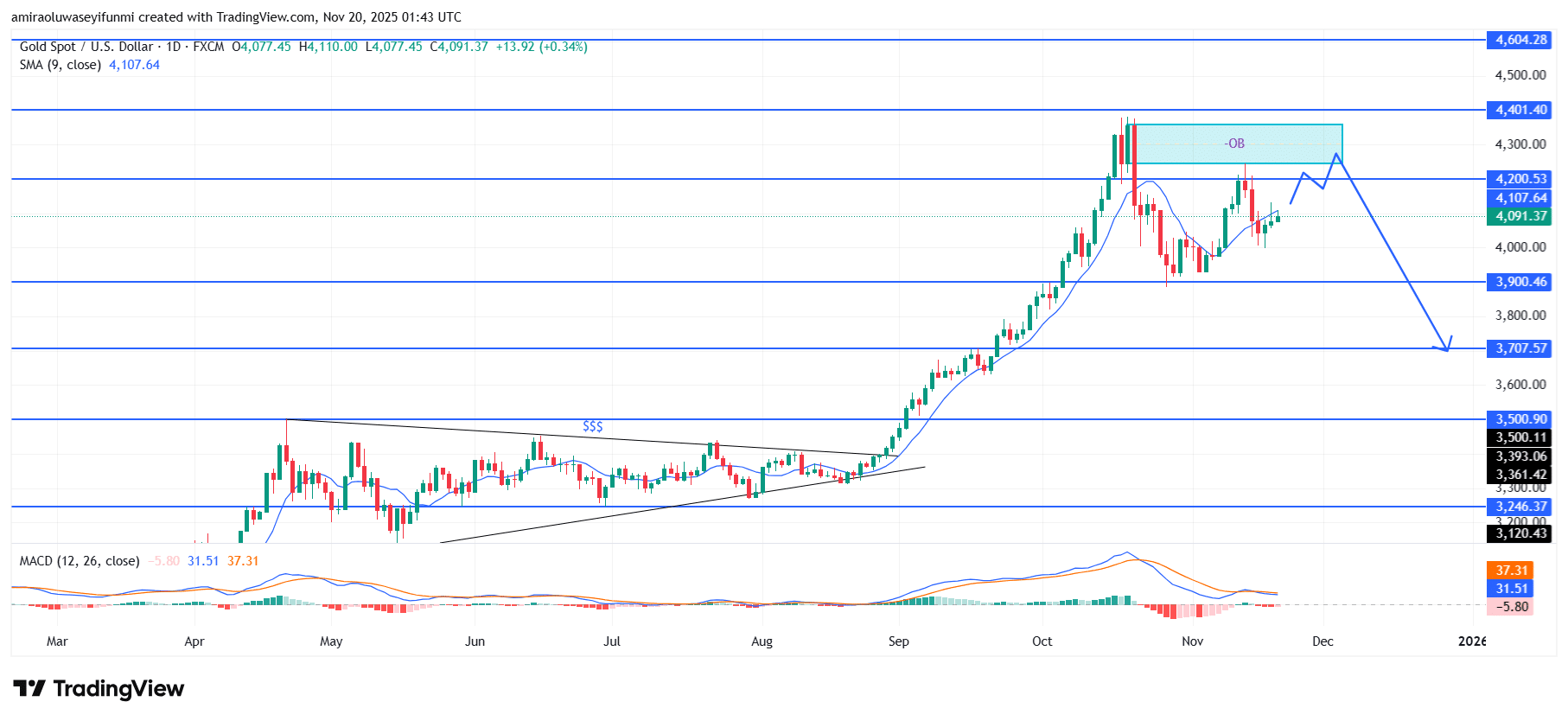

Gold (XAUUSD) outlook tilts into corrective downside pressure. The broader technical landscape for XAUUSD shows a visible cooling in bullish momentum as price action begins to diverge from its earlier impulsive advance. The MACD histogram is flattening below its signal line, while the 9-period SMA is losing its upward gradient, indicating an early slowdown in buying strength. This waning momentum around the $4,300 zone suggests that gold may be shifting from a strong trending environment into a corrective phase, particularly as volatility consolidates near key resistance.

Gold Key Levels

Resistance Levels: $4200, $4400, $4600

Support Levels: $3900, $3710, $3500

Gold Long-Term Trend: Bearish

From a structural perspective, price has reacted sharply to the supply zone between $4,300 and $4,400, with repeated rejections marking a significant liquidity barrier. The inability to secure sustained closes above $4,200 further indicates that sellers are gradually regaining dominance. The broader chart reveals the early signs of a potential distribution formation following the prior sharp rally, as lower highs begin to develop and intraday retests of $4,200 fail to attract meaningful follow-through. This dynamic highlights weakening bullish order flow and strengthens the likelihood of continued downside movement.

Looking ahead, a persistent failure to reclaim $4,200 is expected to encourage a deeper pullback toward $3,900, the next major demand zone. If bearish pressure expands beyond this level, price may slip further toward $3,710, which aligns with the subsequent structural support. Only a decisive daily close above $4,200 would soften this bearish projection; otherwise, the technical outlook remains tilted toward further downside as gold works to correct its previous extended advance.

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is currently rallying along its rising trendline, supported by a series of higher lows on the four-hour chart. Price continues to hold above the 9-period SMA, indicating that short-term bullish order flow remains intact as momentum gradually strengthens. The MACD is beginning to turn upward, reinforcing the potential for continued upside as buyers regain initiative. If this structure is maintained, price may attempt another move toward the $4,200–$4,300 supply region, where traders often monitor forex signals for confirmation during key reaction phases.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.