The EURNZD selling pressure may increase Further.

Sell traders might take the leading in the market soon.

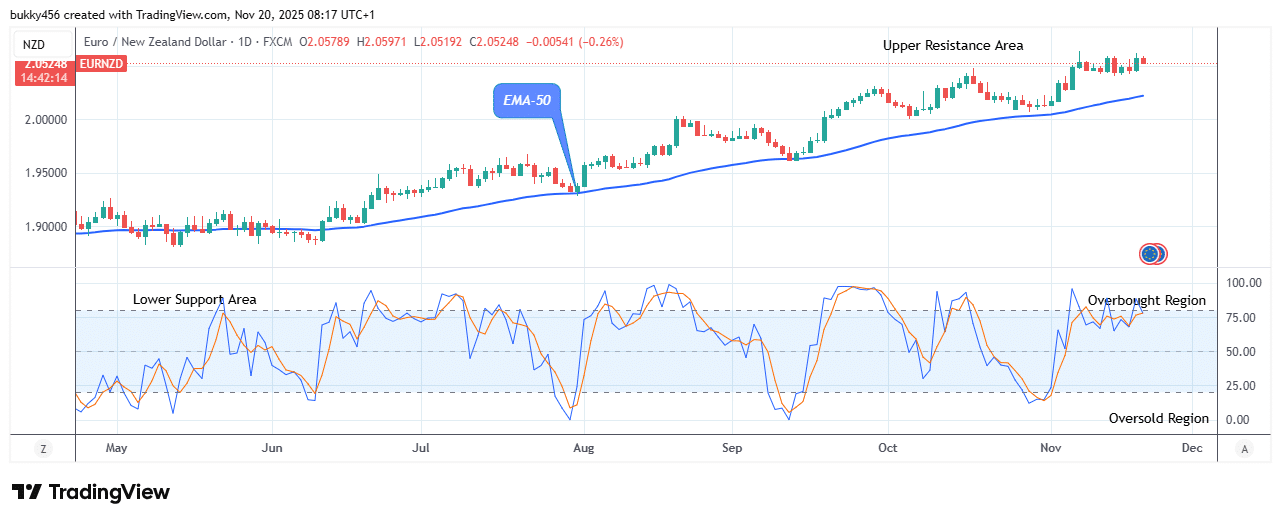

EURNZD Weekly Price Analysis – November 21

The EURNZD bearish run may continue, following the brief return of short traders in the market at the $2.05 support, as the new drops begin above the supply level. The selling pressure progressing towards the support level may intensify if selling traders increase their aggression and break down the $1.88 prior low value. In this case, the potential slump may reach the $1.85 lower support level, suggesting a sell signal and entry point for short traders.

EURNZD Market

Key Levels:

Resistance levels: $2.06, $2.07, $2.08

Support levels: $2.04, $2.03, $2.02

EURNZD Long-term Trend: Bullish (Daily Chart)

The EURNZD pair is bullish. The price bar is in red above the supply level, indicating that the long-term chart is in a bullish momentum.

Today’s daily chart opens on a bearish note at the $2.05 support level mark above the EMA-50, implying that the bearish trend has just begun, and this may continue.

Thus, if the selling pressure persists, the EURNZD price may drop to the previous low value of $1.88, preventing further bullish continuation.

Additionally, the daily signal pointing down at the overbought region suggests the overall outlook shows downward momentum and may drop further to a $1.85 lower support level in the days ahead, offering a good entry point for short traders in the higher time frame.

EURNZD Medium-term Trend: Bullish (4H)

Despite the bears’ action, the EURNZD pair is bullish on the medium-term view. The price is above the resistance level, indicating a bullish trend.

However, at the press time, the bears’ activities caused a decrease in the market value of EURNZD to a low of $2.05 above the moving averages as the 4-hourly session opens today, suggesting short traders are returning to stage a play.

Such a move suggests that the bearish run may slump further as sellers return to the market, putting any buying pressure on hold.

Therefore, a 4-hour candle closing and a breakdown below the $2.00 low barrier will provide sellers a strong foundation to drive the EURNZD price lower, providing short traders an excellent entry opportunity.

In addition, dropping towards the oversold region, as indicated by the price projector, shows a high possibility for bearish continuation, setting the stage for a potential drop to the $1.85 lower support level before the bulls resume in the medium-term forecast.

Thus, sellers must wait for the action before taking a position.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.