Market Analysis December 3

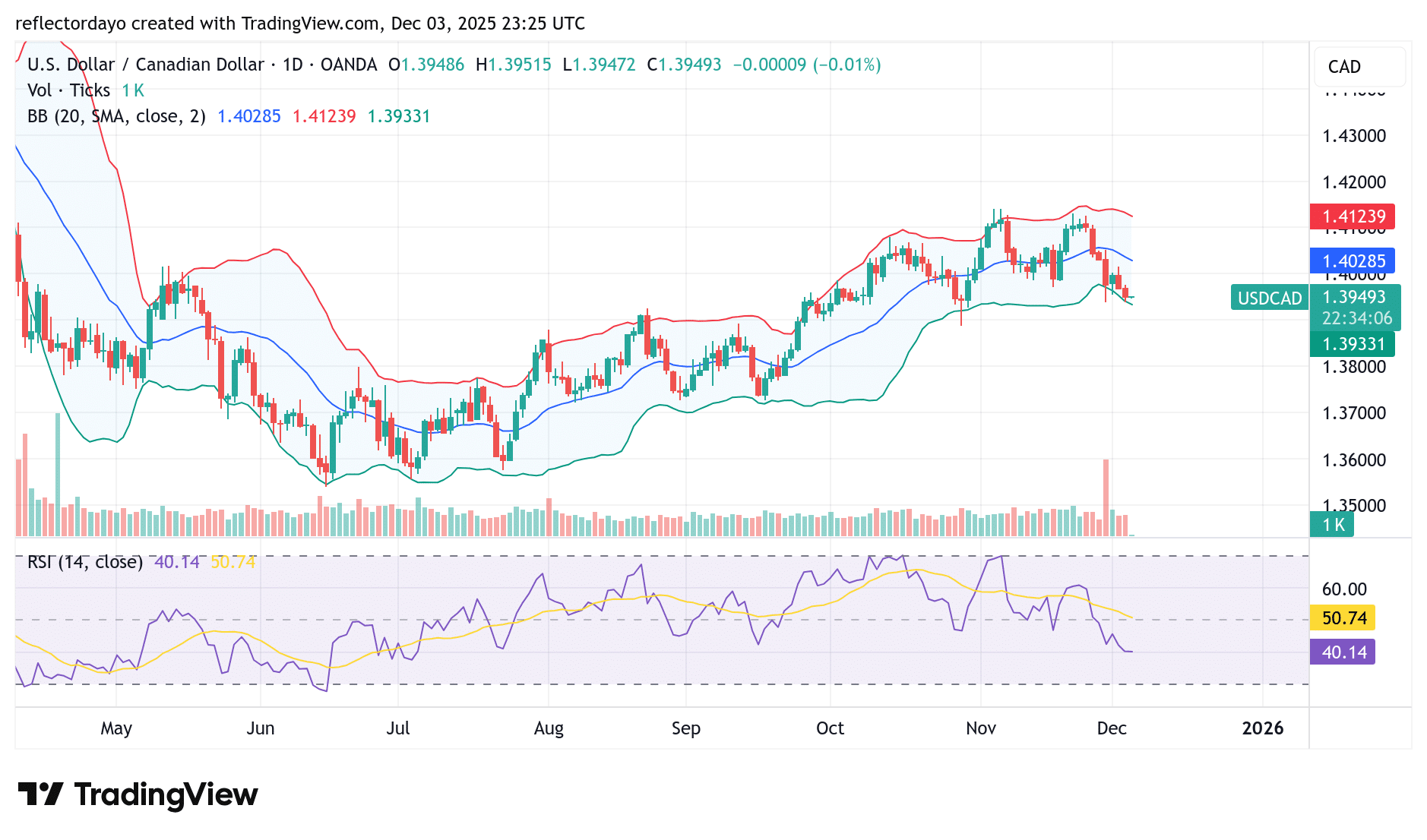

Recent macroeconomic indicators reveal a notable contrast between the United States and Canada, offering insight into the current downward movement of the USD/CAD pair. In the U.S., GDP stands at $30.616 trillion, inflation (CPI) remains steady at 3%, and interest rates hover around 4%, painting a picture of moderate growth with inflation still above the Federal Reserve’s 2% target. In comparison, Canada’s latest readings reflect a relatively stronger economic position: CPI has eased to 2.2%, interest rates sit at 2.25%, and GDP has expanded by 2.6% year-over-year as of October. This combination of cooler inflation and firmer economic growth in Canada may be underpinning the current bearish pressure on the USD/CAD market.

USD/CAD Key Levels

- Demand Levels: 1.3900, 1.3800, 1.3700

- Supply Levels: 1.41000, 1.42000, 1.43000

USD/CAD Losing Ground at 1.4000, Potential Support May Emerge at 1.3900

Over the past few trading sessions, the USD/CAD pair has struggled to sustain momentum above the 1.4000 level. This price area previously held a notable concentration of bullish sentiment, keeping the market consolidated for some time as buyers and sellers battled for control. However, in today’s session, bearish pressure appears to be gaining the upper hand, pushing the price below the 1.4000 threshold.

Despite this emerging weakness, the bulls are still demonstrating some resilience, managing to keep the market temporarily stabilized around the 1.3950 zone. If bearish momentum intensifies and the pair breaks decisively below this level, the next potential support is likely to form near 1.3900, where buyers may attempt to slow or reverse the decline.

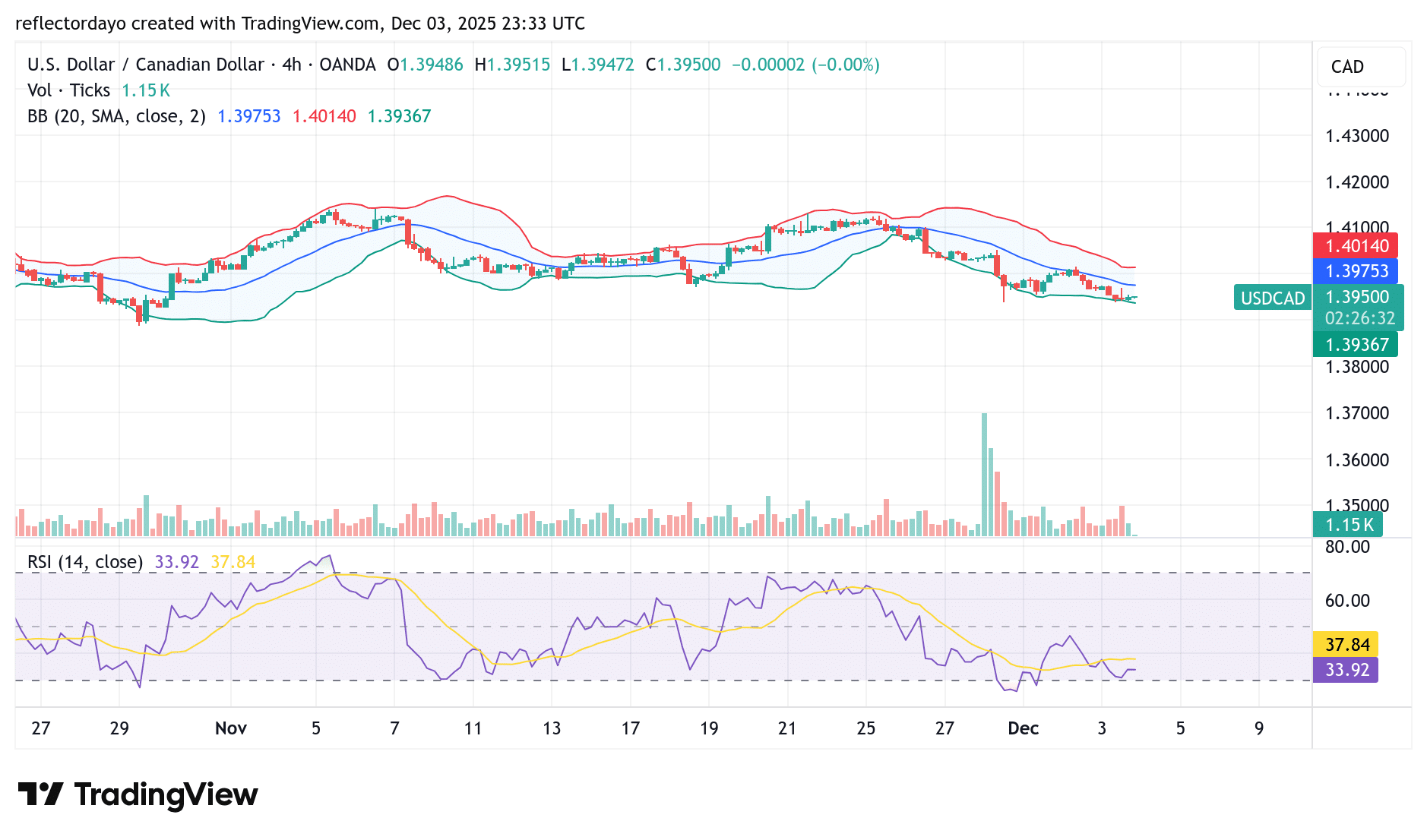

USD/CAD Short-Term Trend: Bullish

On the lower timeframes, the market appears to be stabilizing around the 1.3950 price region. Current indicators suggest a slowdown in momentum, with the volume histogram also declining—reflecting cooling volatility. This easing bearish pressure may signal that sellers are losing strength, potentially setting the stage for a bullish breakout. If buyers regain control, the market could gather enough momentum to push back above the 1.4000 level.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.