US30 Analysis – December 30

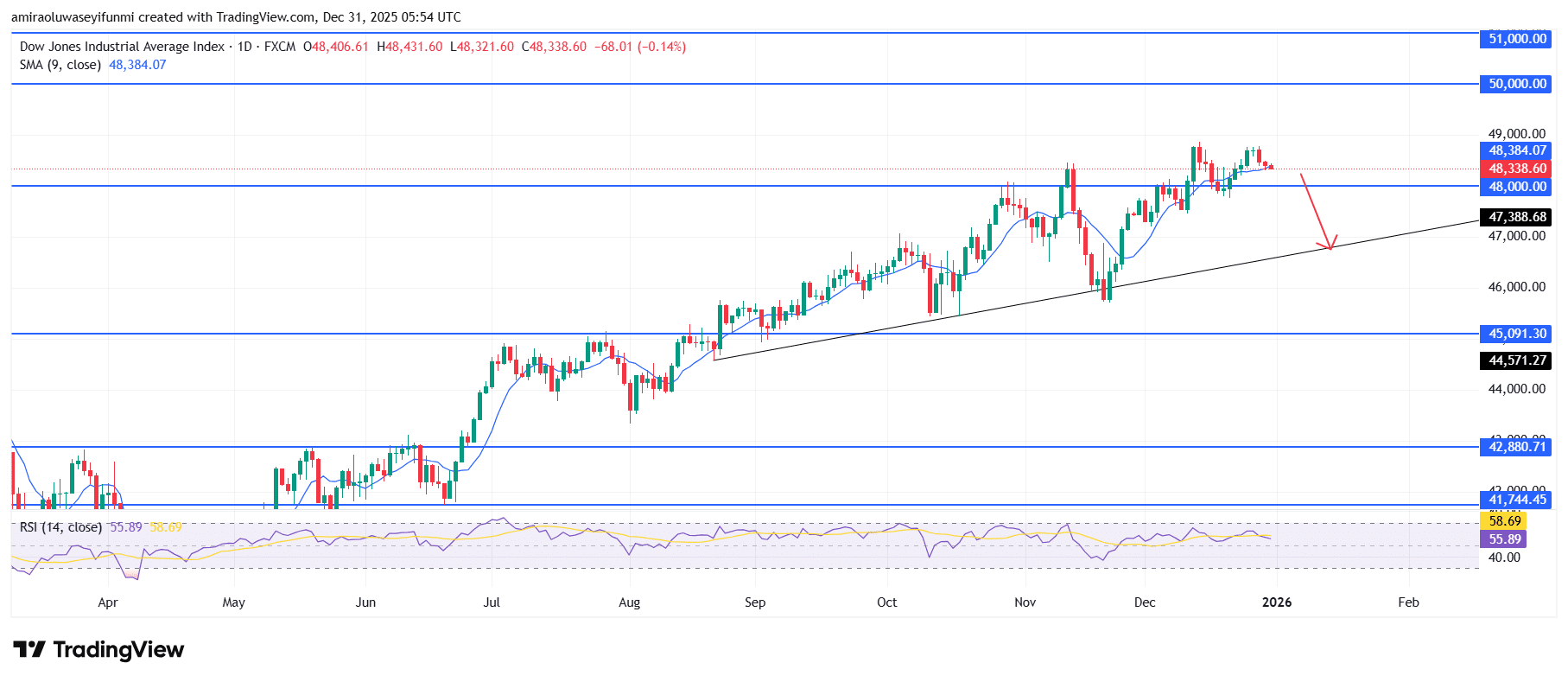

US30 signals near term consolidation as uptrend momentum softens. The US30 market is beginning to display signs of short-term exhaustion following an extended upside move, as momentum indicators gradually lose strength. Price continues to trade marginally above the short-term moving average around $48,380, though the indicator has started to flatten, signaling reduced upward momentum. The RSI remains in the mid-50 range, pointing to weakening buying conviction rather than a decisive shift toward selling pressure, a condition that often precedes corrective pauses.

US30 Key Levels

Resistance Levels: $48270, $50000, $51000

Support Levels: $45090, $42880, $41740

US30 Long-Term Trend: Bearish

From a price behaviour perspective, market activity has tightened beneath the recent high near $48,900. Repeated upper-shadow candles indicate persistent selling interest between $48,700 and $48,900, confirming this zone as a notable supply area. Meanwhile, price action is gradually drifting toward the ascending structural trendline around $47,400, while the $48,000 support region is being tested with increasingly weaker rebounds, suggesting distribution rather than renewed trend expansion.

Looking ahead, the US30 market appears positioned for a controlled downside adjustment in the near term. A confirmed daily close below $48,000 would likely open the path for a pullback toward the rising trendline near $47,400. If buying interest fails to support price at that level, a deeper corrective move toward $45,100 may develop before clearer directional signals emerge. Any upside attempts capped below $48,900 are expected to remain corrective in nature and unlikely to restore strong bullish momentum, in line with broader forex signals indicating consolidation risk.

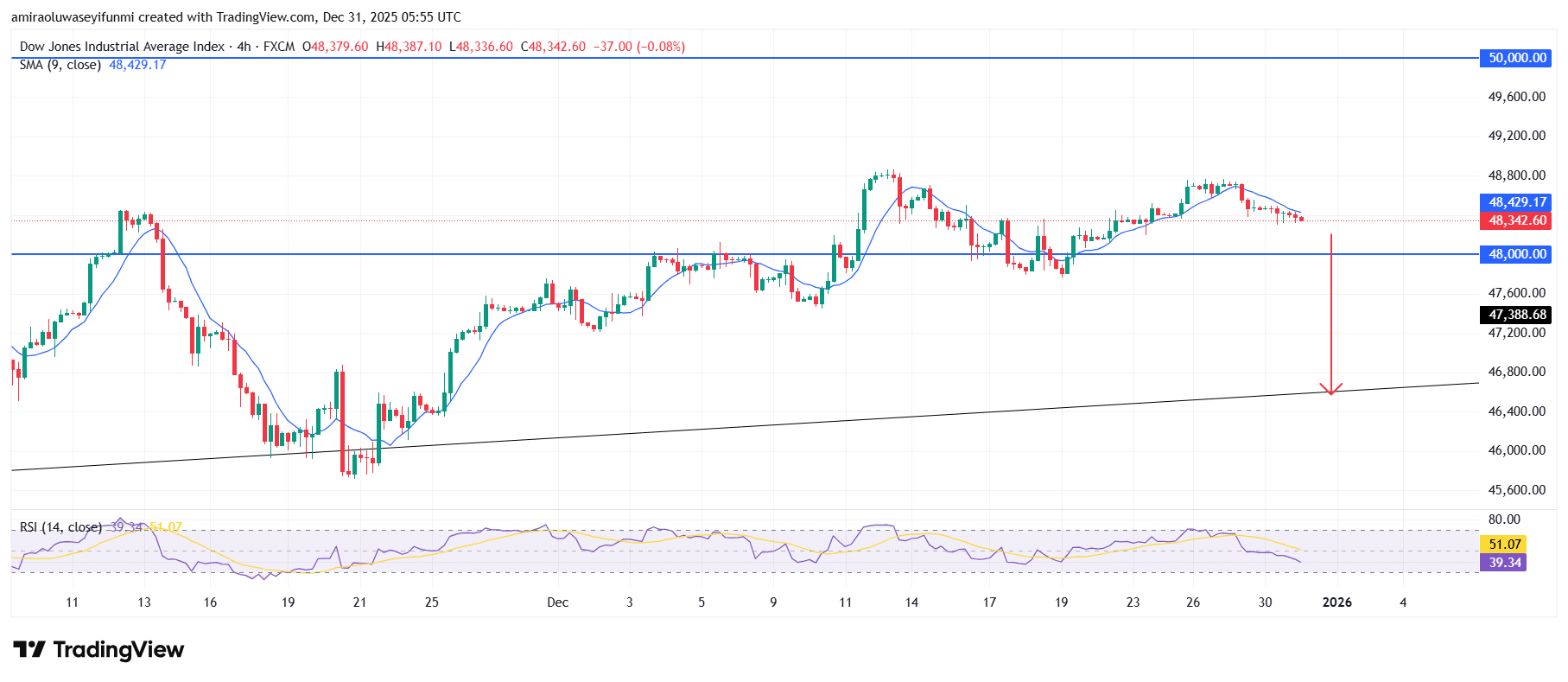

US30 Short-Term Trend: Bearish

US30 is showing a short-term bearish shift on the four-hour chart as price trades below the declining short-term moving average near $48,430. Momentum continues to weaken, with the RSI slipping toward the 40 level, confirming fading buying strength and rising downside vulnerability.

Technically, repeated rejections around the $48,700 area have reinforced a firm supply zone, while support near $48,000 is now under increasing pressure. A sustained break below $48,000 would likely expose the rising trendline support near $46,500 as the next potential downside target.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.