Market Analysis – December 11

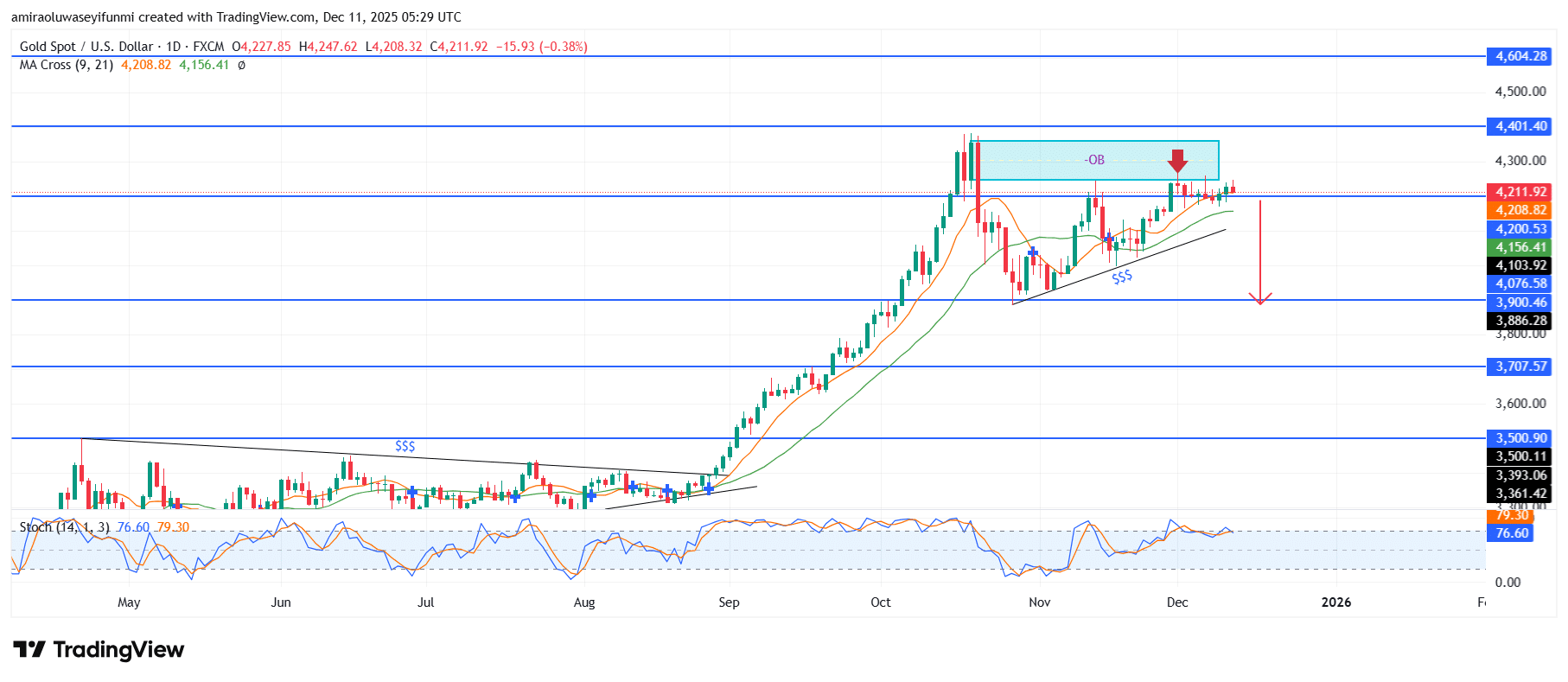

Gold (XAUUSD) indicates persistent downward bias within the prevailing configuration. The broader structural outlook for XAUUSD reflects a clear erosion of bullish momentum, as daily-chart moving averages flatten and begin to tilt lower. Price action continues to trade beneath the near-term average, signalling a shift from impulsive upside movement into a corrective phase. Momentum indicators, particularly the Stochastic Oscillator, are retreating from previously elevated levels, reinforcing the view that the market is transitioning into a more defensive posture aligned with a bearish undertone.

Gold Key Levels

Resistance Levels: $4200, $4400, $4600

Support Levels: $3900, $3710, $3500

Gold Long-Term Trend: Bearish

From a technical perspective, the metal has repeatedly failed to gain acceptance above the $4,320–$4,400 supply corridor, with successive rejections confirming the presence of strong overhead pressure. The sharp rejection near $4,380 highlights active distribution, forcing price back toward the $4,210 region. The recent break of a short-term ascending trend structure validates downside-leaning order flow and points to a sustained distribution environment. Buyers’ inability to reclaim the $4,280 level further reinforces a directional bias in favour of sellers.

With downside imbalance now dominant, XAUUSD appears positioned to test the next liquidity zone near $4,080. A deeper retracement could expose the broader demand basin around $3,980 if bearish momentum accelerates. Continued seller control opens the pathway toward the $3,900 region as a realistic medium-term objective, a scenario increasingly supported by prevailing forex signals as long as price remains capped below the $4,280 threshold.

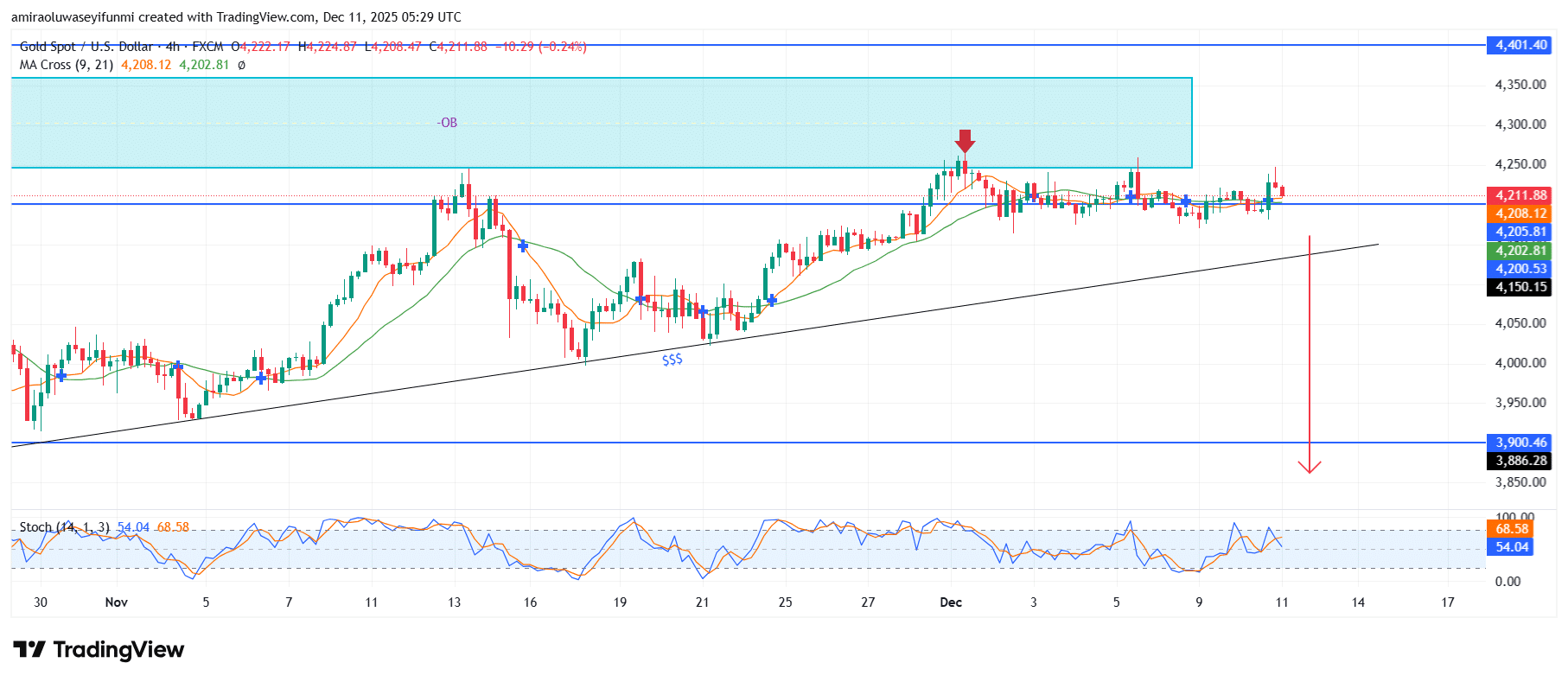

Gold Short-Term Trend: Bearish

Price has rejected the $4,320–$4,400 supply zone and continues to trade below short-term moving averages, signalling fading bullish momentum. The recent failure to sustain price above the $4,210 structural level confirms a shift toward bearish order flow.

Stochastic readings are rolling lower from the mid-range, pointing to renewed downside pressure as sellers regain control. With structure now compromised, price is positioned to target the $3,900 demand zone in the coming sessions.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.