Market Analysis – January 1

Fading demand for the safe-haven Swiss franc has supported an improvement in EUR/CHF this week. This shift comes amid signs of improving geopolitical and economic conditions heading into late 2025 and 2026, which have reduced risk aversion across global markets.

As uncertainty eased, investors began unwinding long CHF positions that were accumulated during earlier periods of heightened risk. This repositioning has placed downward pressure on the franc, allowing the euro to strengthen against it.

Another contributing factor is monetary policy divergence. The Swiss National Bank (SNB) continues to maintain a 0% interest rate and a generally dovish stance, while the European Central Bank (ECB) has adjusted its policy outlook, making euro-denominated assets relatively more attractive to investors.

EUR/CHF Key Levels

Demand Levels: 0.92500, 0.92000, 0.91500

Supply Levels: 0.93000, 0.94000, 0.95000

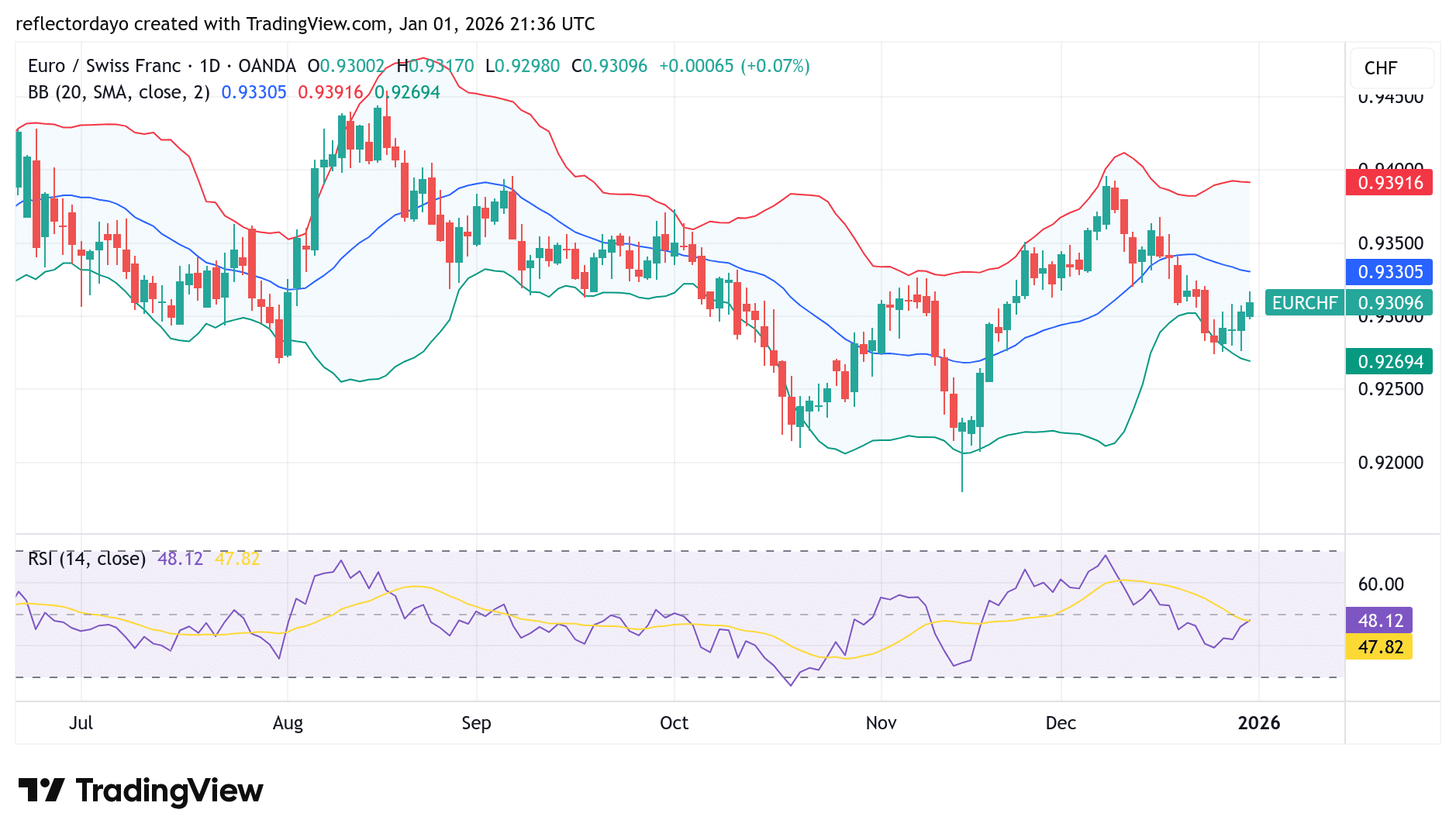

EUR/CHF Recovers Above 0.93000

In our previous analysis, we highlighted how EUR/CHF failed to sustain gains above the 0.9300 level as the Swiss franc strengthened on renewed safe-haven demand. Following the rejection, the price slipped below 0.9300 and later found support around the 0.9270 level during the 2025 Christmas period.

Toward the end of the year, market momentum improved, allowing EUR/CHF to rebound and reclaim the 0.9300 level, which has since acted as a key support zone. The pair reached a session high of 0.93157 during today’s trading before mild profit-taking triggered a pullback toward 0.93096.

With the week nearing its close and only Friday’s session remaining, the pair appears positioned to finish the week comfortably above the 0.9300 level, reinforcing the near-term bullish bias.

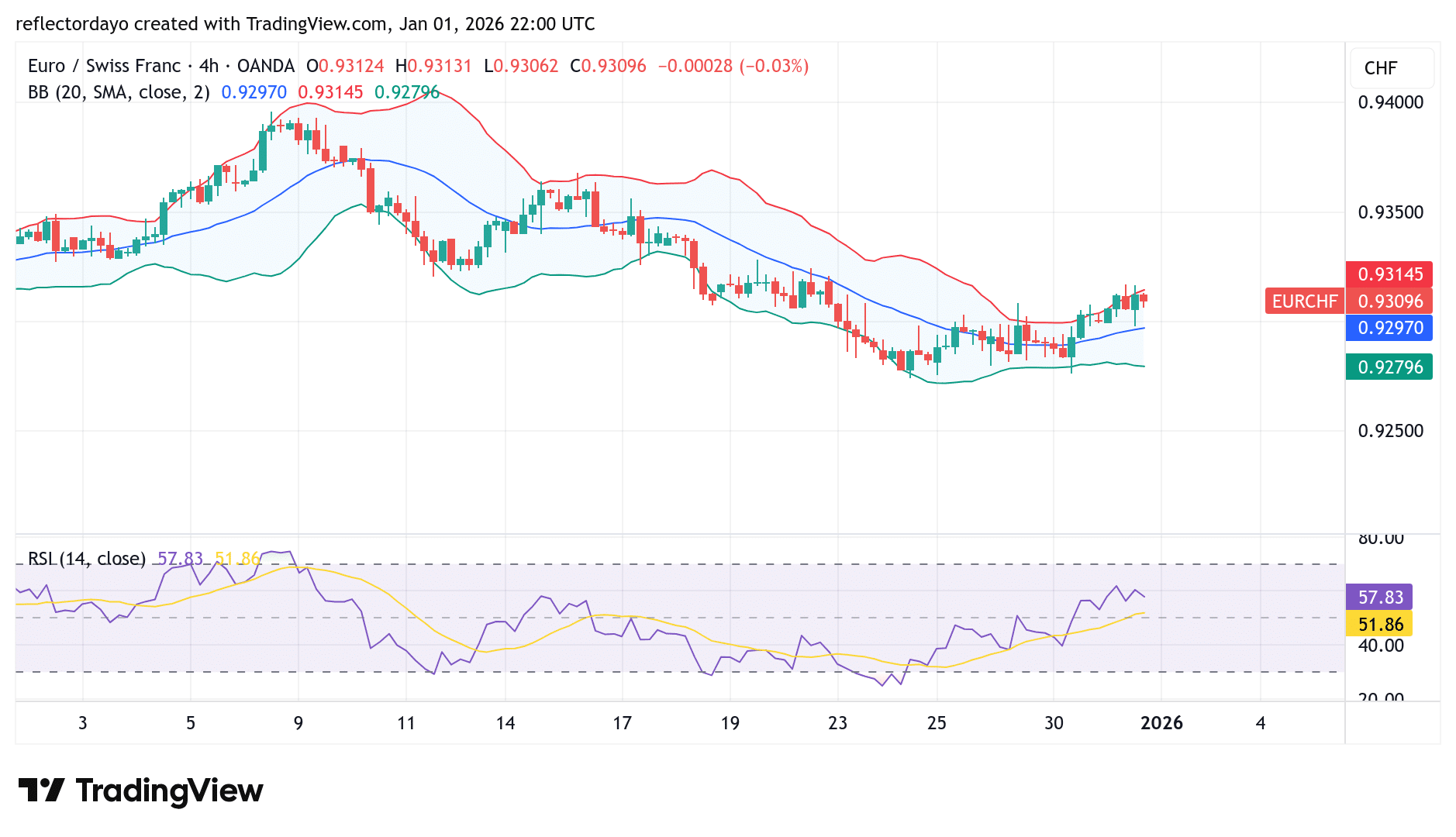

EUR/CHF Short-Term Trend: Bearish

Zooming into the lower timeframe, particularly the 4-hour chart, reveals that as the market approached the 0.93100 level, bullish momentum began to cool. Traders appear to be exercising increased caution around this key price threshold.

As a result, bullish and bearish pressures have balanced, leading to a convergence of demand and supply at this level. The market is currently positioned at a critical inflection point, with participants closely monitoring price action for signs of a potential breakout or reversal.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.