Market Analysis – December 24

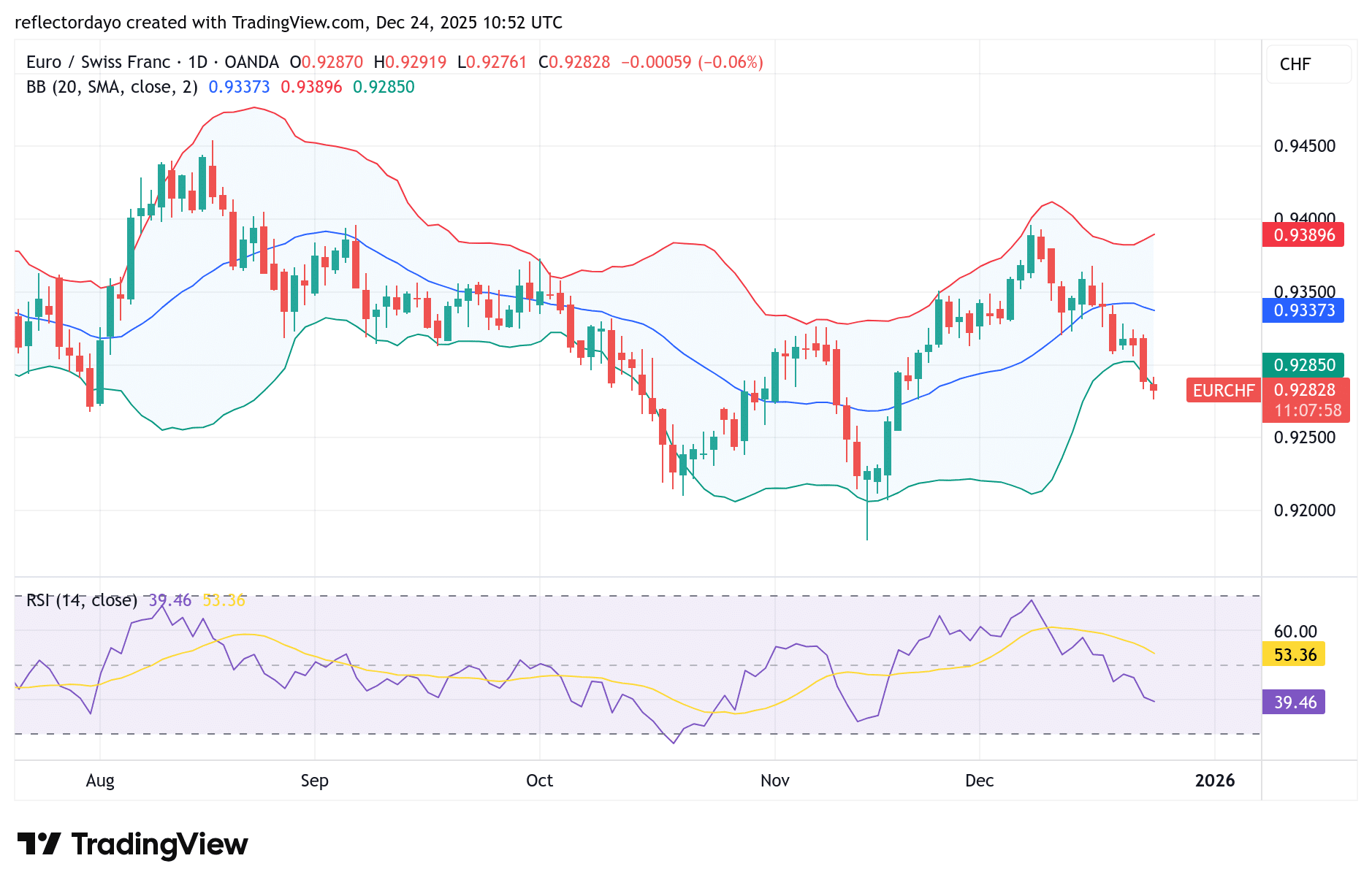

The EUR/CHF pair has slipped into clear bearish territory, reflecting a noticeable change in market sentiment. For some time, price action hovered around the key 0.9300 level, with buyers frequently pushing the pair slightly above this zone. However, that balance has now shifted. The market has broken decisively lower, printing fresh lows and confirming growing downside pressure.

This decline is largely being fueled by renewed demand for the Swiss franc, which continues to attract investors as a safe-haven currency in times of global uncertainty. Even though interest rate dynamics still offer some support to the euro, they have not been strong enough to counter the franc’s defensive appeal. As a result, sellers remain in control, keeping downward momentum firmly in place.

EUR/CHF Key Levels

Demand Levels: 0.92500, 0.92000, 0.91500

Supply Levels: 0.93000, 0.94000, 0.95000

EUR/CHF Falls Short at 0.93000

The break below the key 0.93000 price level marks a significant development, signaling a surge in selling pressure across the market. With bears firmly in control of this zone, the former support is now likely to act as a new resistance area, as sellers are expected to defend this level aggressively.

However, the current trading session is showing relatively small bearish candlesticks, which may indicate early signs of exhaustion in the bearish momentum. Buyers appear to be stepping in just below the 0.93000 level, slowing the pace of the decline.

If bulls are able to maintain their footing in this region, the market could attempt a rebound, potentially setting the stage for a short-term bullish recovery.

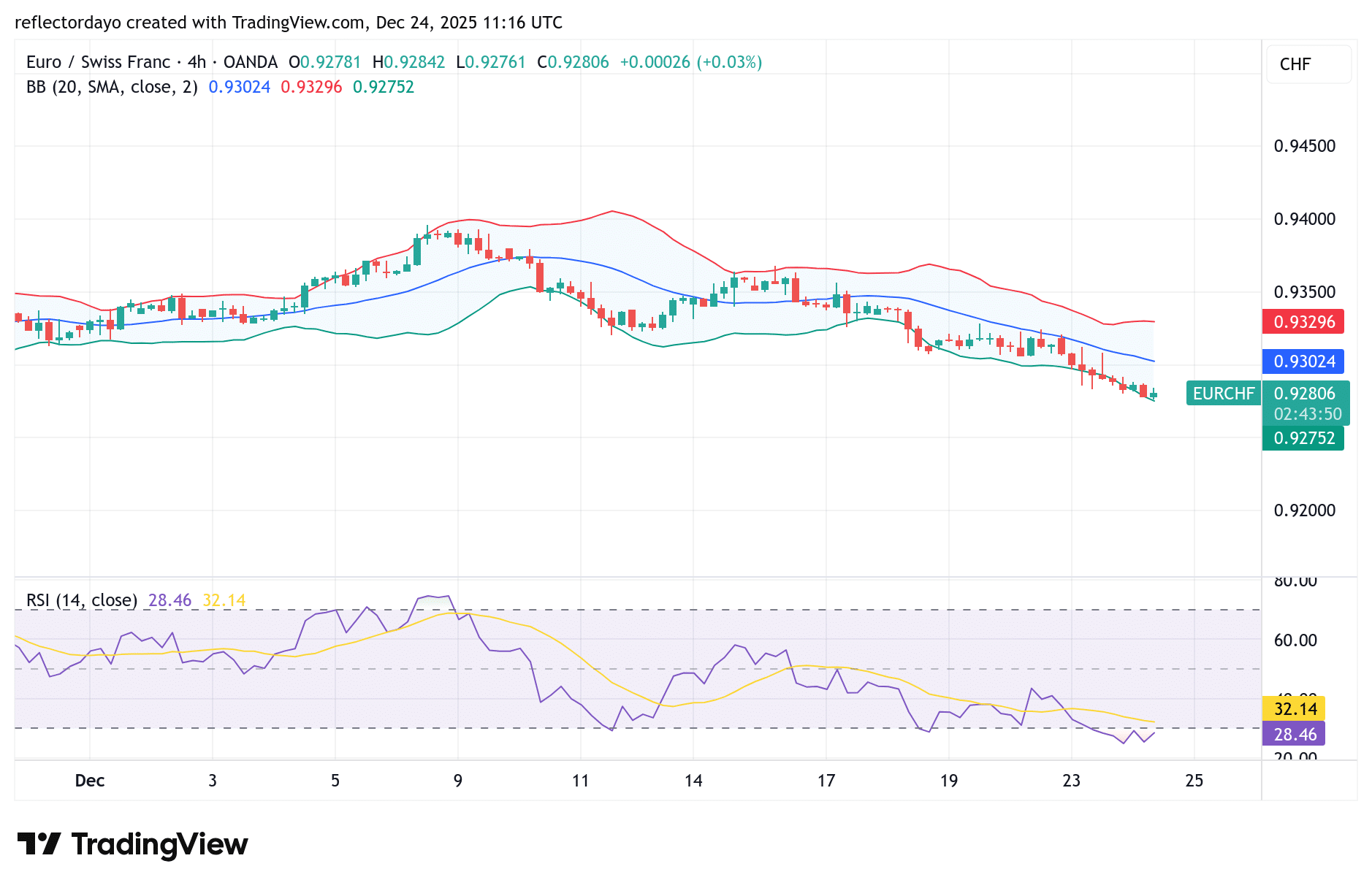

EUR/CHF Short-Term Trend: Bearish

From the perspective of the 4-hour chart, bearish momentum appears to be slowing below the 0.9300 level. While price action is attempting a rebound from the 0.9270 area, the 0.9250 level may provide stronger support should the current support fail to hold.

Meanwhile, the Relative Strength Index (RSI) is offering a potential bullish signal, as it has moved into the oversold region. This suggests that selling pressure may be nearing exhaustion, which could eventually pave the way for a sustained bullish recovery.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.