Market Analysis – December 17

The EUR/CHF pair has found a temporary balance around the 0.93300 level after pulling back from recent highs near 0.94000, as traders navigate a wave of heightened volatility. This period of consolidation reflects a market caught between competing fundamental forces shaping both currencies.

On one side, the European Central Bank (ECB) has signaled that it may be approaching the end of its monetary easing cycle, offering some underlying support to the euro. On the other, the Swiss National Bank (SNB) continues to maintain a notably dovish stance, keeping interest rates at 0% and reiterating its readiness to intervene if the Swiss franc strengthens excessively.

Adding another layer of complexity, persistent safe-haven demand for the Swiss franc—driven by ongoing global political and economic uncertainties—has helped cap upside momentum in the pair. During periods of heightened risk aversion, this demand tends to push EUR/CHF lower, offsetting euro strength and contributing to the pair’s recent stabilization near the 0.93300 handle.

EUR/CHF Key Levels

Demand Levels: 0.93000, 0.92500, 0.92000

Supply Levels: 0.94000, 0.95000, 0.96000

EUR/CHF Continues to Hold Near 0.93300

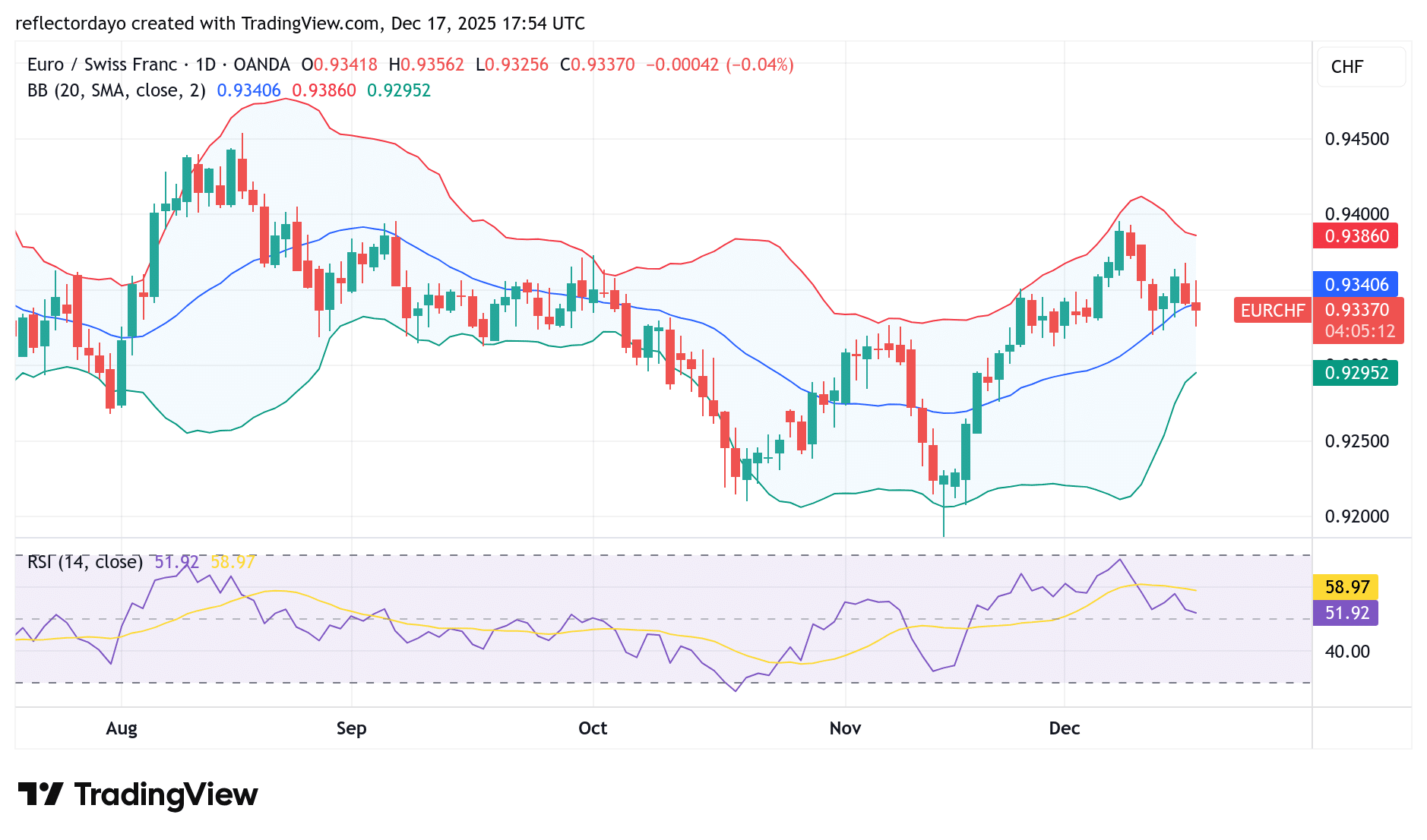

In recent analysis, the euro was observed gaining ground against the Swiss franc. However, after the pair peaked near the 0.94000 level, price action reversed, leading to a pullback that has since stabilized around 0.93300.

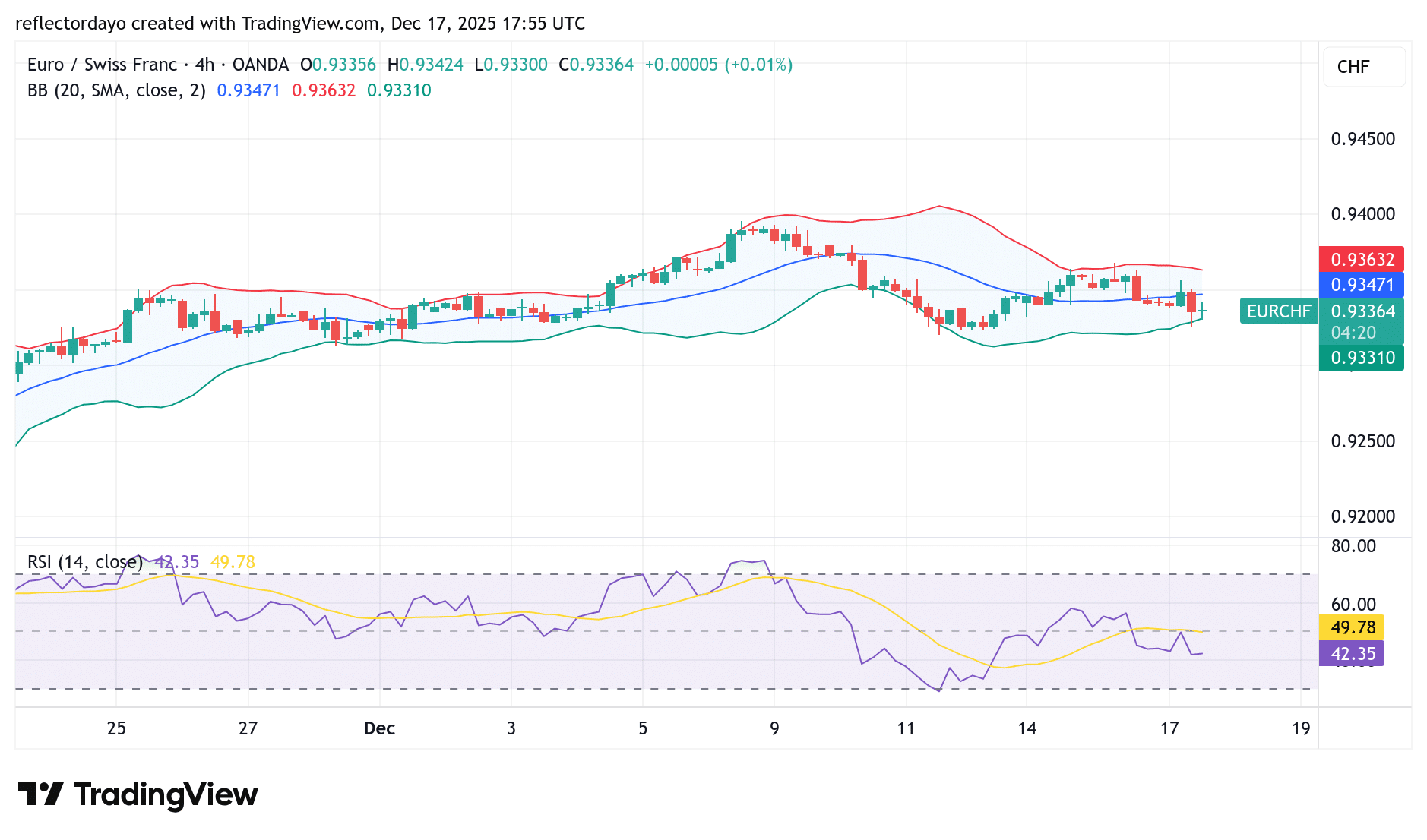

Today’s trading session was notably volatile, marked by sharp intraday swings between the session highs and lows before the pair eventually found balance near the 0.93300 price level. This consolidation reflects a period of indecision, as neither bulls nor bears have been able to assert clear control.

From a technical perspective, the Bollinger Bands are beginning to converge, signaling declining volatility amid the ongoing standoff between EUR/CHF buyers and sellers. Such compression often precedes a stronger directional move, as the market awaits a fresh catalyst.

EUR/CHF Short-Term Trend: Indecision

From a lower-timeframe perspective, momentum in the EUR/CHF market, as indicated by the Relative Strength Index (RSI), is currently consolidating slightly below the midpoint, within the bearish zone. However, the flattening of RSI suggests that selling pressure is easing, with bulls gradually stepping in.

This stabilization in momentum indicates that buyers are beginning to challenge bearish control, increasing the likelihood that a short-term rebound may be developing from this area.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.