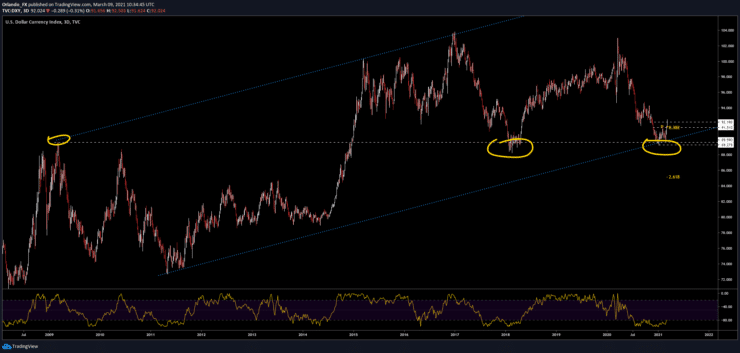

This comes from a rejection of a 12 year bullish structure (chart below) that, because of how fundamentally bearish the US Dollar is, was the make it or brake it level.

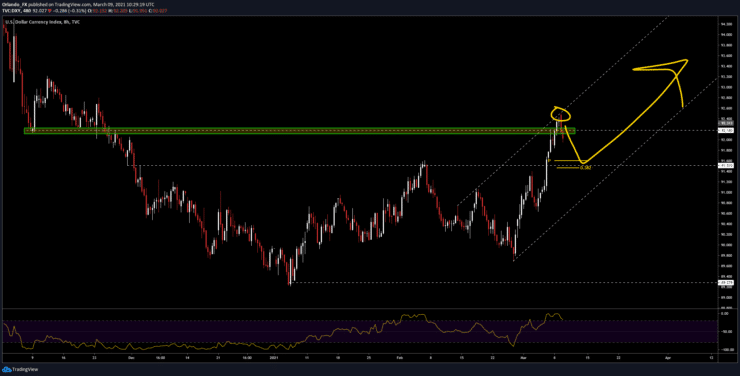

Having said that, the break above 92.20 was capped by the 92.50 level and now price has pulled back below that November 2020 base.

Should price pull back to this level, sellers will have trouble swiping all those buy orders and if this level holds we will look for opportunities to buy USDs on a super high probability trade.

This is what we do, this is what we need to focus on, being patient and get in hard when these scenarios play out. The most likely markets that we will trade USD longs will be short metals, short EURUSD or long USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade-USDMXN.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.