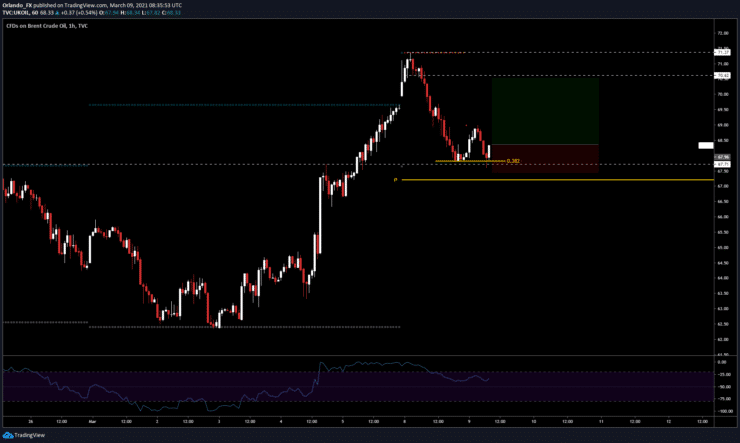

Key Resistance: 69.60 – 70.50

Long Term View

Brent has been very strong in its recovery from the Pandemic lows that took oil prices negative (WTI) the reason Brent was not that affected is because Brent future contracts are settled in cash.

Fundamental view

With the reopening of the economies and air travel, the demand for crude oil products is rapidly rising whilst the supply remains capped. This makes for a bullish pressure in this market and here is where we want to get in.

1H chart Analysis

Yesterday Brent prices fell 5.40% from the highs breaking the short term bullish structure and trapping mid to long term bears in the process.

Today we saw a 4H candle reject the February 25th highs to give us the setup to go long at the break of the 68.10 level. No divergence is detected but the confluence of those highs plus the weekly pivot and the 38.2% retracement of the last bullish move is confirmation enough of a possible bullish continuation at the break of today´s structure

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.