Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Navigating the unpredictable terrain of digital assets can be a daunting task for investors, especially given the inherent volatility in the market. Dollar-cost averaging (DCA) emerges as a beacon of stability in this dynamic landscape, offering a simple yet powerful strategy to weather the storm.

Here, we delve into Coin Metrics‘ latest State of the Network weekly report to evaluate the performance of DCA across various market cycles and shed light on its role in today’s investment landscape.

Unlocking the Power of Dollar-Cost Averaging

DCA is more than just a strategy; it’s a mindset that shields investors from the stress and risks associated with volatile assets. By consistently investing a fixed amount, irrespective of market fluctuations, DCA provides a pragmatic approach to managing investment risks. Coin Metrics employs a meticulous methodology, simulating a daily $10 investment across different periods, to unravel the effectiveness of DCA in over 200 assets.

The report meticulously dissects the performance of DCA during bull and bear markets, revealing intriguing insights. Since 2019, DCA has showcased resilience, though not without surprises. Approximately 60% of the tested assets fall below the breakeven threshold, emphasizing the importance of quality assets even in a DCA strategy.

However, as the report transitions to the bull market of 2021, cautionary notes emerge. Despite its reputation as a safeguard, DCA doesn’t shield investors from losses during fervent bull markets, underscoring the need for prudence amid market uncertainties.

2023 paints a picture of rejuvenation in the digital asset market, hinting at a potential new bull market. The chart reflects a widespread upswing, echoing the positive sentiment. Yet, it serves as a reminder that not all assets ride the wave equally, with some experiencing conservative growth and others failing to reach the breakeven point. The report subtly prompts investors to discern between substantial appreciation and more tempered growth.

Putting DCA to the Test

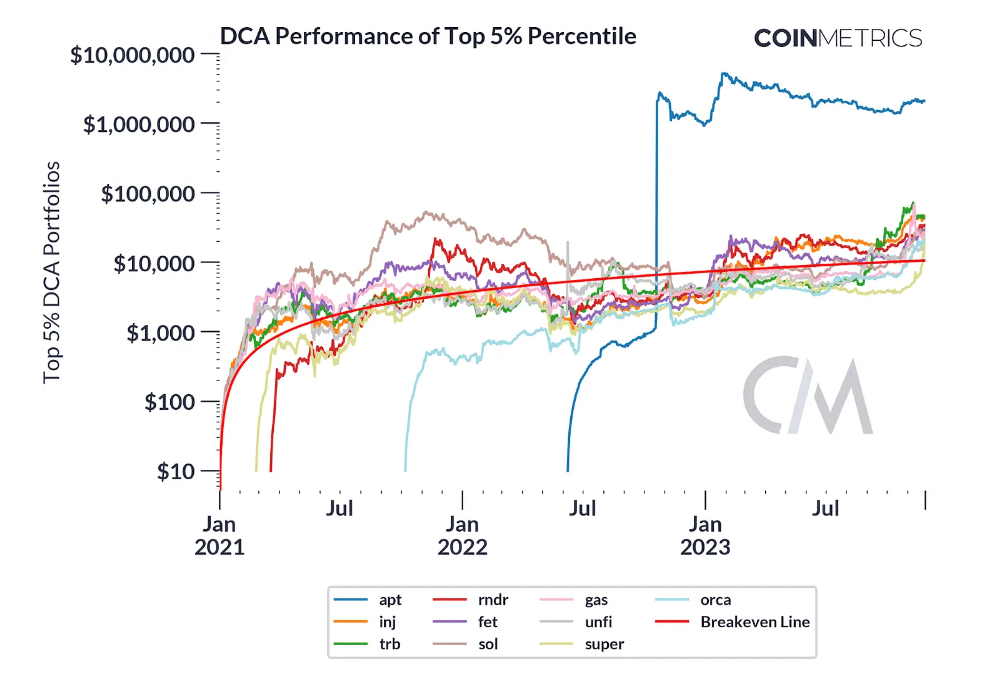

Turning the spotlight on the top 15 assets, sorted by market capitalization, the chart unfolds a narrative of contrasts. While DCA portfolios lag behind their cash equivalents, standouts like Solana (SOL) and Polygon (MATIC) yield impressive returns, emphasizing the importance of thorough asset selection. This logarithmic graph of the top 5% percentile by Coin Metrics reinforces the outlier performances, with recent market entrants like Aptos (APT) shining at 194 times the cash equivalent.

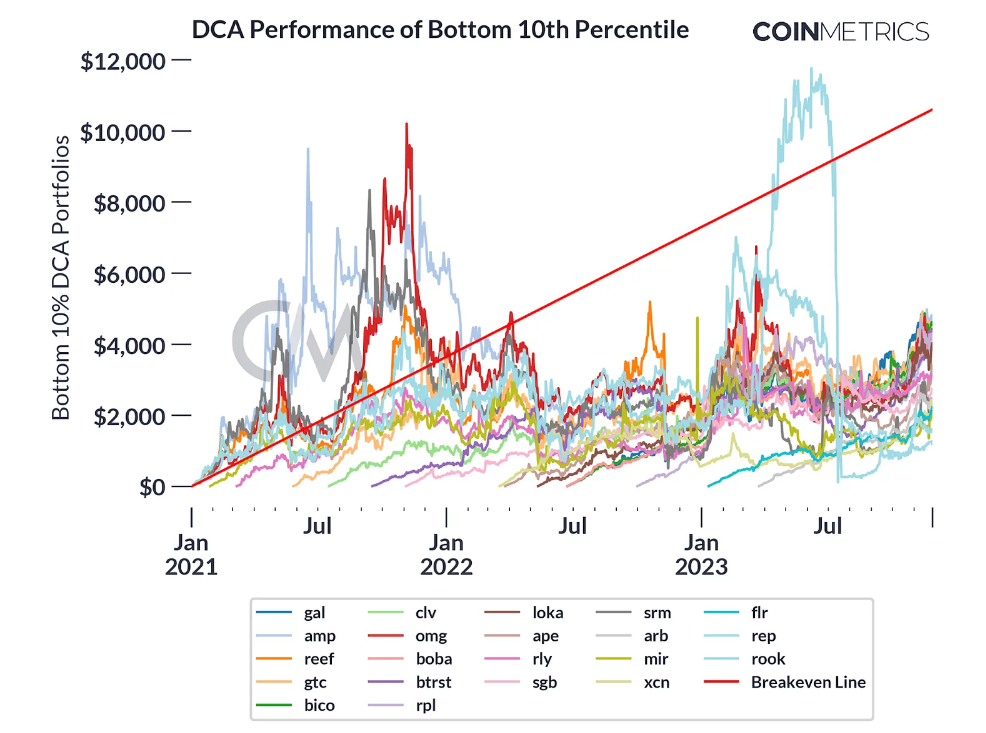

The report doesn’t shy away from showcasing the flip side—the bottom 10th percentile. A cautionary tale unfolds here, with many newly issued tokens sinking into obscurity. Even the DCA method struggles to shield investors from the drastic swings of these highly volatile assets. This revelation underscores the necessity of meticulous research and risk assessment, especially when venturing into newer tokens.

BTC: The DCA Success Story

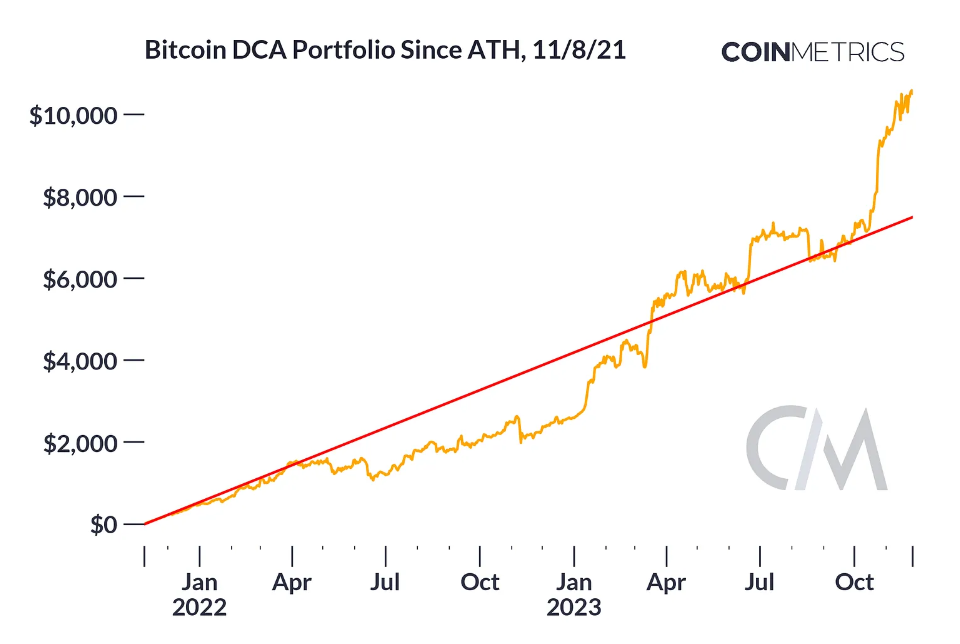

Highlighting Bitcoin’s (BTC) journey, the report illuminates the power of DCA during tough times. Starting the daily $10 DCA strategy at BTC’s all-time high in November 2021 resulted in a surprising 33% gain, even after enduring a challenging period from fall 2021 to fall 2022. This example underscores the importance of time in the market over futile attempts to time the market.

Conclusion: Navigating Complexity with Dollar-Cost Averaging

In conclusion, the examination of DCA within the digital asset market by Coin Metrics paints a nuanced picture. While DCA proves effective in managing volatility, it’s not a guaranteed path to positive returns. The limitations of the strategy are evident, urging investors to incorporate trading fees and choose exchanges wisely. Rigorous research and adaptability are key as the digital asset landscape evolves, making education and vigilance crucial in investment decisions.

Mastering market volatility requires more than a one-size-fits-all solution, and DCA, with its strengths and limitations, emerges as a valuable tool in the investor’s toolkit. As the market evolves, so must our strategies, and staying informed is the key to unlocking success in the ever-shifting digital asset landscape.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.