In the exciting world of decentralized exchanges (DEXs), one platform stands tall as the reigning champion: Uniswap. With its innovative technology and unique fee structure, Uniswap has revolutionized the way we trade cryptocurrencies. Let’s dive into the details and explore how Uniswap has emerged as the leading DEX in 2023.

Pioneering Automated Market Makers

When it comes to DEXs, Uniswap is the trailblazer. Unlike traditional centralized exchanges that rely on order books, Uniswap employs automated market makers (AMMs) fueled by mathematical formulas. This groundbreaking approach eliminates the need for intermediaries to set market prices. In simpler terms, Uniswap cuts out the middleman and lets the math do the talking.

Gone are the days when centralized exchanges had to meticulously vet and add new tokens. Uniswap takes a software-based approach, automatically supporting any Ethereum-compatible token with sufficient supply and demand. This flexibility has allowed Uniswap to scale rapidly and become the go-to platform for traders seeking efficiency and convenience.

Uniswap’s Unique Fee Structure

Let’s talk fees—something that usually causes groans in the world of finance. Unlike most centralized exchanges that charge separate fees, Uniswap keeps it simple with a flat fee of 0.30% per token swap. But here’s the twist: Instead of pocketing these fees, Uniswap rewards liquidity providers.

All the revenue generated through these fees goes directly to the liquidity pools. In other words, the users who provide token pairs for swapping are the ones reaping the rewards. It’s a win-win situation, ensuring that those who contribute to the platform’s liquidity receive their fair share of the profits.

Uniswap V2 introduced the concept of a “fee switch.” While not implemented yet, this feature could potentially allow Uniswap to retain a percentage of the fees for its own earnings. However, any decision to activate the fee switch must be approved through an open vote among UNI token holders, ensuring a democratic and transparent process.

Uniswap vs. DEX Competitors: A Battle for Supremacy

While Uniswap has enjoyed its position on the DEX throne, it faces stiff competition from other ambitious contenders. Let’s take a quick look at some of its noteworthy rivals:

- SushiSwap and PancakeSwap: These DEXs are like Uniswap’s clones, built on its open-source code. They offer similar features and fee structures, aiming to attract users with familiarity and competitive advantages.

- Compound: Introduced in 2017, Compound is a specialized DEX that enables users to earn interest by creating tokens for locked assets on its platform. It provides the flexibility to transfer and utilize these assets on other platforms while still earning rewards.

- Curve Finance: With a laser focus on stablecoins like USDT, USDC, DAI, and TUSD, Curve Finance offers a tailored experience for stablecoin enthusiasts. Users can stake their stablecoins in liquidity pools or swap between different coins, ensuring stability and efficiency.

- dYdX: Established in 2017, dYdX adds a twist to the DEX landscape with its derivative trading options. It briefly dethroned Uniswap as the top DEX in terms of trading volume in September 2021, thanks to its order book functionality and a generous dYdX token airdrop.

Uniswap’s Dominance and Revenue Generation

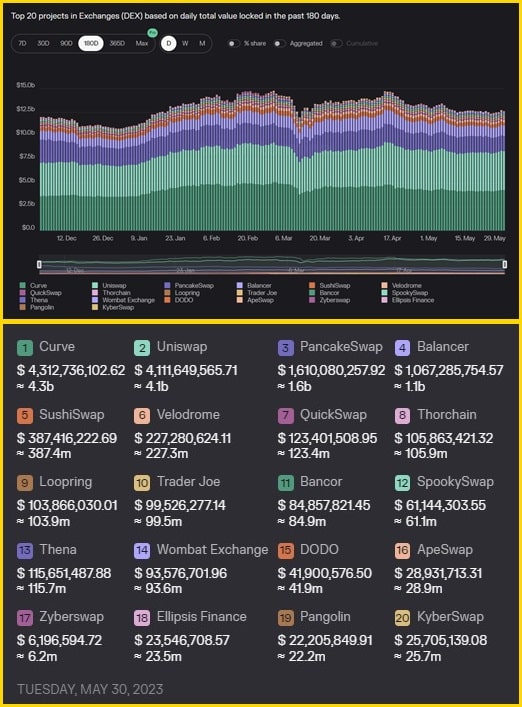

While UNI may not hold the crown for the highest total value locked (TVL), it remains a strong second player with $4.1 billion locked, trailing Curve Finance’s $4.3 billion. PancakeSwap lags behind with $1.6 billion. Uniswap’s position is a testament to its reliability and popularity among traders.

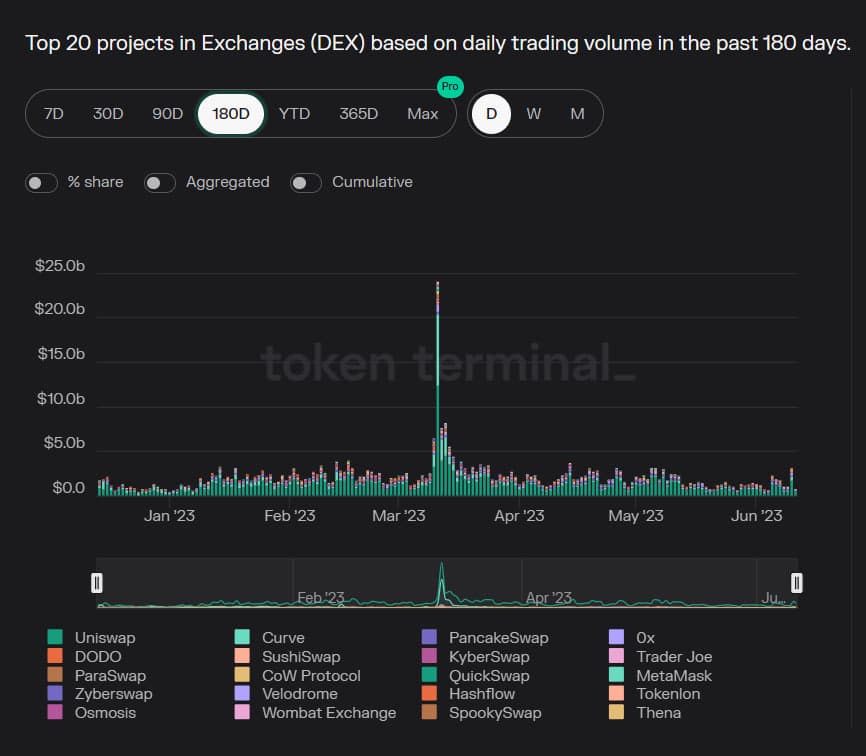

In terms of daily trading volumes, dYdX has emerged as a formidable competitor. With $621 million in daily trading volumes, it currently ranks second in the DEX tables. However, Uniswap maintains its lead, with PancakeSwap V2 as the closest contender at $139.68 million.

When it comes to generating fees from trades, Uniswap is unrivaled. In early Q2 2023, Uniswap generated substantial revenues for liquidity providers, while Curve Finance came closest with $283K in 7-day average fees. SushiSwap, with only $118K, pales in comparison to the revenues generated by Uniswap for liquidity providers.

Conclusion

Uniswap’s ascent as the leading decentralized exchange in 2023 is a testament to its pioneering technology, unique fee structure, and widespread adoption. With its automated market makers and commitment to rewarding liquidity providers, Uniswap has set a new standard for DEXs.

As the DEX landscape evolves, Uniswap faces formidable competition from other contenders, each with its own unique features and advantages. However, Uniswap’s dominance and revenue generation remain unmatched.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.