The US Treasury’s latest report shows a measured stance on digital assets, highlighting both opportunities and challenges in this rapidly growing sector.

While the Treasury acknowledges significant growth in digital assets, their direct impact on Treasury markets remains limited, according to the October 2024 advisory committee findings. This careful assessment comes at a time when digital assets continue to gain mainstream attention and institutional interest.

Understanding the Connection Between the Treasury and Digital Assets

The Treasury’s primary focus centers on short-term Treasury securities, which have become increasingly important for stablecoin backing. This connection represents the most immediate intersection between traditional financial markets and digital assets, suggesting a gradual rather than sudden integration of these two sectors.

The relationship between stablecoins and Treasury securities marks a significant development in how traditional finance adapts to emerging digital innovations.

Digital Assets’ Growing Influence on Treasury Markets

Several key insights emerge from the Treasury’s analysis:

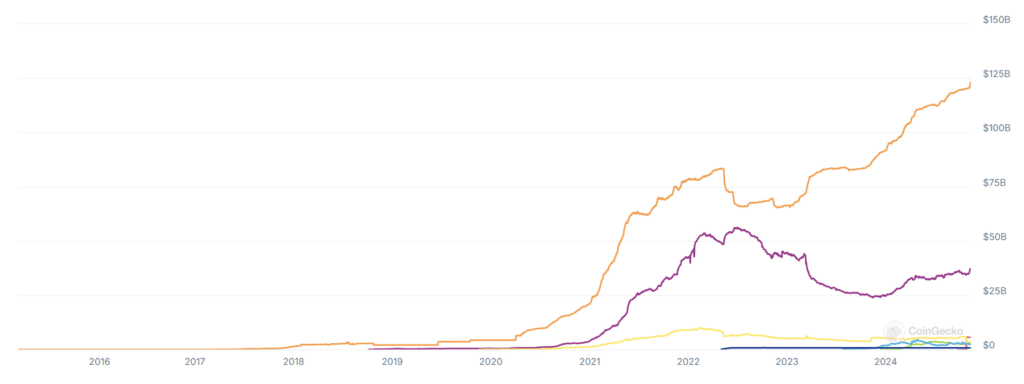

1. Stablecoin Growth

The report indicates that stablecoins currently represent the strongest link between digital assets and Treasury markets.

As stablecoin adoption increases, demand for short-term Treasury securities is expected to grow proportionally, creating new market dynamics. This trend suggests a deepening relationship between digital assets and traditional financial instruments.

2. Institutional Evolution

Traditional institutions are slowly expanding their involvement with digital assets. This shift could lead to increased Treasury security demand for hedging purposes, pointing to a deeper integration between conventional and digital finance.

The Treasury notes that this institutional adoption pattern requires careful monitoring and appropriate risk management frameworks.

3. Treasury Tokenization Prospects

The Treasury has explored the potential tokenization of US Treasury securities. This initiative could bring several benefits:

- Enhanced operational efficiency

- Improved economic processes

- Streamlined trading mechanisms

- Reduced settlement times

- Better market accessibility

- Enhanced transparency in transactions

However, the Treasury emphasizes that any movement toward tokenization requires:

- Robust regulatory frameworks

- Strong official sector oversight

- Comprehensive legal infrastructure

- Careful consideration of technological risks

- Thorough assessment of financial stability impacts

- Enhanced cybersecurity measures

- Clear operational guidelines

- Strong market participant coordination

Looking Ahead

Looking ahead, the Treasury advocates for a conservative approach to digital asset integration. They recommend development under a trusted central authority’s guidance, with significant private sector participation and careful attention to risk management. This approach aims to balance innovation with market stability.

The report suggests that while digital assets present promising opportunities for market efficiency and innovation, their implementation must be carefully managed to maintain market stability and security. This balanced perspective indicates the Treasury’s commitment to fostering innovation while protecting market integrity.

For investors and market participants, this means:

- Continued growth in stablecoin-Treasury relationships

- Gradual implementation of digital asset initiatives

- Increasing institutional participation

- Enhanced regulatory oversight

- Careful attention to risk management

- Development of new market infrastructure

- Evolution of trading systems

- Adaptation of risk models

The Treasury’s approach signals a future where digital assets play a larger role in financial markets, but through careful, measured steps rather than rapid changes. This strategic position aims to harness the benefits of digital innovation while maintaining market stability and security.

The focus remains on creating sustainable, long-term solutions rather than quick implementations.

These findings suggest that market participants should prepare for gradual but meaningful changes in how Treasury securities interact with digital assets while maintaining a focus on regulatory compliance and risk management.

The Treasury’s cautious yet forward-looking stance indicates a commitment to embracing innovation without compromising market stability or security.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.