Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) brought about significant changes, particularly in how users secure the network and earn rewards. However, staked ETH is typically locked, limiting its utility. Enter EigenLayer.

EigenLayer, a groundbreaking protocol built on top of the Ethereum blockchain, offers an innovative solution that unlocks the true potential of staked assets while fostering a more secure and innovative ecosystem for dApps.

Understanding EigenLayer

EigenLayer introduces the concept of a “restaking collective,” allowing ETH stakers to contribute their staked assets to support and secure specific applications within the Ethereum ecosystem.

By doing so, this protocol creates a dynamic marketplace for decentralized trust, enabling developers to benefit from the security provided by the collective pool of stakers, while stakers can actively support the development of their projects.

The Modular Approach to Security

At the heart of EigenLayer lies a modular approach to security. The protocol allows stakers to contribute their ETH to secure specific functionalities within the network, referred to as “modules.”

These modules can cover a wide range of applications, from decentralized storage solutions like Arweave to in-game item validation for blockchain-based games or fostering trust within DeFi applications like Aave.

EigenLayer achieves its modular security through the use of smart contracts.

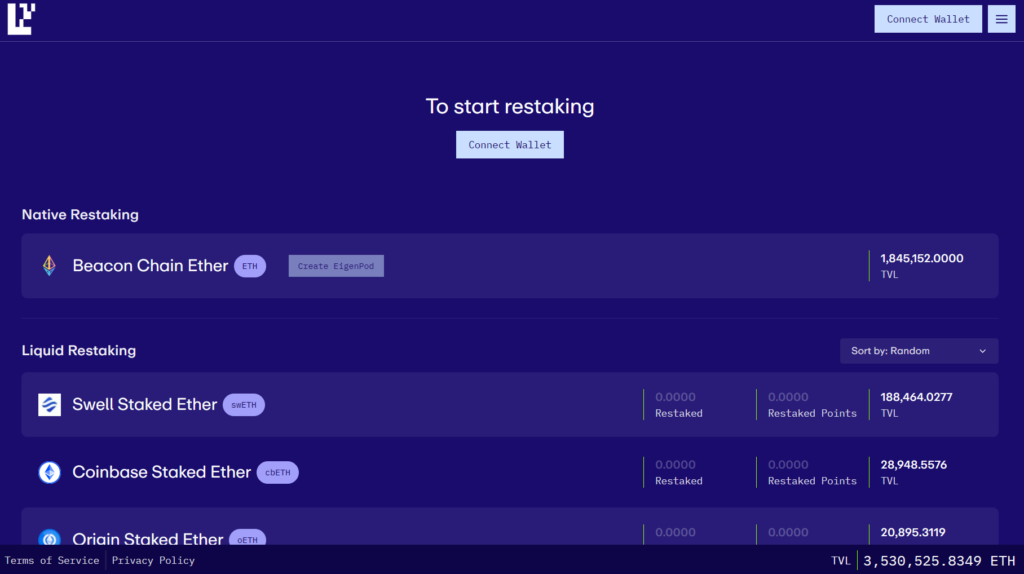

Ethereum stakers can “restake” their staked ETH via these contracts, offering a new set of security and validation services to specific modules in the network. This is made possible by granting EigenLayer contracts the ability to set certain conditions on staked assets.

The restaking process itself can be performed in two ways:

- Solo staking

- Delegation

Solo staking allows users to operate their own nodes and actively validate transactions for the modules, while delegation allows users to contribute to EigenLayer without the technical complexities of node operation by delegating the task to other participants.

EigenLayer recognizes that stakers may have varying preferences, capabilities, and risk tolerance levels. Consequently, the protocol allows modules to adjust their requirements to match specific stakers, fostering a more flexible and inclusive network.

Traditional Staking vs. EigenLayer Staking

EigenLayer disrupts the traditional staking model on Ethereum, offering a unique approach with its “restaking collective” concept. Here are the key differences between traditional staking and EigenLayer staking:

1. Liquidity: In traditional staking, staked ETH becomes temporarily locked and inaccessible. In contrast, while the underlying ETH remains staked, EigenLayer allows users to leverage it for additional purposes, such as increasing the security of various applications being built on Ethereum.

2. Participation and Rewards: Traditional staking involves a relatively straightforward process of locking up ETH and earning rewards based on the chosen staking protocol. EigenLayer, on the other hand, offers a wider range of participation options, including solo staking and delegation. Additionally, modules with higher security needs may offer greater rewards for stakers who secure them.

3. Security Focus: In traditional staking, staked ETH directly contributes to the security of the Ethereum blockchain. With EigenLayer staking, security becomes modular, allowing users to contribute to the security of specific modules within the Ethereum ecosystem, with the overall security of a module depending on the collective staking power directed towards it.

Advantages and Challenges of EigenLayer

As with any innovative technology, EigenLayer presents both advantages and potential challenges.

Some advantages include:

1. Enhanced Security for dApps: By leveraging a pool of validators for various modules, EigenLayer strengthens the overall security of decentralized applications built on those modules, fostering a more trustworthy environment for users.

2. Testing Ground: EigenLayer serves as a platform for testing and validating new Ethereum functionalities, such as danksharding (a core feature of the Ethereum Cancun upgrade), before integrating them into the mainnet.

3. Permissionless Innovation: Developers no longer need to build their own validator sets to secure their applications. Instead, they can leverage the existing pool of secure validators offered by this protocol through restaking, lowering the entry barrier, and fostering more innovation on Ethereum.

On the flip side, there are challenges, such as:

1. Complexity: This protocol introduces a new layer of complexity to the Ethereum ecosystem. Understanding how restaking works, choosing the right modules to participate in, and managing the technical aspects (for solo stakers) can be challenging for some users.

2. Centralization Risks: While EigenLayer promotes decentralized trust, a few dominant staking pools may emerge, leading to a degree of centralization within the restaking collective.

3. Module Collusion Risks: The modular design of this protocol offers flexibility but also introduces a potential risk of collusion between malicious actors controlling multiple modules.

Final Word

EigenLayer’s “restaking collective” represents a potential game-changer for decentralized trust on Ethereum.

By enabling permissionless innovation and providing a testing ground for Ethereum features, EigenLayer may play a crucial role in shaping a future of robust, secure, and scalable decentralized applications.

As the ecosystem continues to evolve, it will be fascinating to witness how EigenLayer navigates the challenges and unlocks new possibilities for the world of dApps.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.