AI Trading. Artificial intelligence (AI) is an emerging technology that is yet to reach its full potential. In fact, the possibilities of what AI will one day achieve are virtually endless. With that being said, AI still plays a major role in a number of key industries.

Whether it is Facebook suggesting content that matches your historical activity or Amazon recommending products based on prior purchases – AI has the capacity to outperform the human brain by some distance.

With that being said, variants of AI have also been used in the financial markets for near-on three decades. Big banks and other financial institutions rely on these algorithms to outperform the markets on a consistent basis. As such, it was only a matter of time before the AI trading phenomenon reached the retail space.

If you are keen to learn the ins and outs of what AI trading is, how it works, and what platforms allow you to buy and sell assets in an autonomous manner – be sure to read our guide on AI Trading for Beginners.

Note: Artificial intelligence trading software is only as good as the underlying algorithm. In other words, if the software is badly designed, you could end up losing money.

Best AI Trading Providers 2024

If you have read our guide up to this point, you should now have a firm grasp of what an AI trading robot is and how they work, as well as the benefits and risks of using one. If you like the sound of what an automated software application offers for your long-term trading needs, we are now going to list our recommended AI trading platforms for 2024. For more check these “machine learning books”

Note: The following list of recommended providers includes AI share trading, AI stock market trading, AI forex trading, and AI cryptocurrency trading.

1. Try the Best Crypto Bot!

More than just signals are required if you intend to take your round-the-clock cryptocurrency trading seriously. Because of this, we developed a cutting-edge cryptocurrency trading bot that enables you to automate trades based on current market conditions. Learn 2 Trade Algorithm, our most recent offering, runs on its own. It searches the market for profitable trading chances as one of the top crypto trading bots and immediately notifies our subscribers via Telegram. In other words, it is no longer necessary to overlook profitable trades or keep an eye on the markets. Also, our Learn 2 Trade Algorithm works with the top cryptocurrency exchanges in addition to Cornix. This implies that you can conduct trades automatically, without any human involvement.

- Service for copy trading

- Up to 40 trades Per month

- 79% Success rate

2. Skilling– Best Forex Trading Platform for Beginners

We are on a mission to create a unique trading platform designed to cater to traders of all levels, from beginners who have never traded to seasoned pros. We want to create a platform that connects everybody to the world’s financial markets and showcases its potential to them.

- A proprietary trading platform designed for traders of all levels, from beginners to seasoned pros.

- $100 minimum deposit, no hidden fees and all charges clearly displayed in your account currency.

- Fast registration and KYC process

- Accounts are denominated in USD only

3. CFD Trader – Become Financially Independent With Online Trading

If you are reading this, it means we still have some spots left. That means you will have a shot at making the fastest gains you will ever see, and collecting profits of €261, €7,541 and even up to €67,454 trade after trade. And you can get started as soon as you enter your name, email, password, and phone number in the secure at the top of this page.

And all it takes is a minimum of €250 to get started. You can also withdraw your capital whenever you want because you will already have an established deposit account!

- Direct free access to the #1 best CFD broker of UK

- 1 free 1on1 coaching call within the first 48 hours of signing-up

- A personal mentor that will help you week after week

4. Profit Pros Make $1,500 To $4,200 Daily With The World’s Most Intelligent Trading Software

Our specialised trading technology monitors the world’s crypto and profit Pros 24/7

Massive data crunching mainframes spot patterns in the markets

Our patented ‘Profit Pros’ trading algorithm guarantees our users make over $2000 per day

- 88% Claimed Win Rate

- $/£ 250 Min Deposit

- Accepts Debit and Credit Card

5. Prime Advantage – Earn Up To $3,000 Per Day Starting Today

With Our FREE Auto Trading Software

Our servers allow our trading software to spot small changes in trading conditions 3 millionths of a second before the fastest Wall Street traders.

Technical support team will set up and monitor your trading software to get you started and give you a peak advantage over every other trader and investor.

Our vast infrastructure guarantees rapid responses to the markets whether they be high or low... volatile... or calm. Our software constantly adapts and learns, galvanising in our trading platform to never lose a trade.

- Cutting-Edge Technology

- 5 Star Client Support

- 100% In-house Logistics

What is AI Trading?

The term ‘AI Trading’ is somewhat of a broad one. Not least because it can cover multiple aspects of automated trading. In its most basic form, Artificial intelligence trading typically refers to the buying and selling of assets without any human interaction. Instead, the underlying software will trade on your behalf – based on the conditions it has been programmed to follow.

For those unaware, the overarching concept of AI is that it has the capacity to analyze millions of potential scenarios in a split second. It does so by evaluating large chunks of historical data. And then it makes a decision based on the information it has available to it.

Although large financial institutions have access to some of the most advanced artificial intelligence trading robots, they keep the underlying software highly guarded at all times. This prevents their ‘Secret Sauce’ from getting into the wrong hands. As such, retail traders have little access to the same level of AI trading algorithms as their institutional counterparts.

With that being said, there are a number of online platforms that allow you to trade in an automated manner. While not as advanced as the AI bots held by financial institutions, these do at the very least allow you to trade automatically – with virtually no requirement to buy and sell assets on a manual basis.

What are the Pros and Cons of AI Trading?

The Pros The Cons

How Does AI Trading Work?

So now that you have an overview of what AI trading actually is, let’s explore how the phenomenon works. In a nutshell, artificial intelligence trading is centered on a pre-defined algorithm that has the capacity to place trades in an autonomous manner – with decisions based on historical data. As we briefly noted in the section above, financial institutions have some of the most advanced AI trading bots in the industry. And thus – consistently outperform the markets.

Let’s look at a quick example to clear the mist.

Example of an AI Trade

Let’s say you purchase an AI robot that specializes in cryptocurrency or forex trading. The software has been programmed to place a buy order on a major forex pair when the Fibonacci Retracement level hits 61.8%.

Below we have listed some of the ‘what-if’ processes the AI robot might take.

- GBP/USD hits a Fibonacci Retracement level of 61.8%.

- This means that the AI robot ‘what-if’ condition has been met.

- As such, the bot places a buy order on GBP/USD.

- The bot also installs some stop-loss and take-profit orders.

- The bot is instructed to close the trade if GBP/USD increases by 45 pips.

- It is also instructed to close the trade if GBP/USD decreases by 10 pips.

- 2 hours after placing its trades, GBP/USD increases by 45 pips, so the trade is closed.

As you can see from the above example, the artificial intelligence trading bot was able to place a number of orders without you needing to do any of the hard work. In fact, not only was the bot scanning heaps of historical data on GBP/USD, but it was ready to ‘pounce’ on all major currencies. As such, this example illustrates just how capable a well-programmed bot can be if designed correctly.

What are the Benefits of AI Trading?

So now that you have a firm grasp of what AI trading is and how the underlying software might operate in practice. Let’s look at some of the overriding examples that AI trading presents.

🥇 Limitless Data Analysis

One of the most prominent benefits of using an artificial intelligence trading robot is its ability to perform an unlimited amount of data research. If you are a seasoned trader, you will know first-hand just how important technical analysis is in the case of online trading. Without it, you would not be armed with the required tools to place successful trades on a consistent basis.

For example, let’s say that you are a keen commodities trader. This can include anything from gold, silver, platinum, oil, natural gas, wheat, and much, much more. In reality, it would be virtually impossible to spend the necessary time analyzing historical data on all of the aforementioned commodities. On the contrary, experienced traders will typically niche down to a single asset.

With that being said, a well-programmed AI software program has the capacity to perform advanced technical research on as many asset classes as you wish. As such, the bot does all of the hard work for you, subsequently allowing you to take over the reins once you have the necessary data findings in front of you!

🥇 Never Stop Trading

Whether you are a newbie trader or a seasoned investor with years of experience under your belt – there is only so much time that you can devote to your trading endeavors. Not only does this include the data collection stage, but the actual process of placing trades, too. Those that attempt to burn the engine will ultimately find that trades are being placed in an irrational manner.

This is no different from air traffic controllers that are required to have a break after every hour of deployment. Not least because the role requires extreme mental and physical dedication. Additionally, utilizing an AI trading program will allow you to trade 24 hours per day, 7 days per week. Crucially, it can do so without encountering the very real threats of fatigue and irrationality.

🥇 Trade Any Marketplace

In a similar nature to trading fatigue, you will only have the capacity to trade a certain number of marketplaces at any given time. For example, you will not be able to trade both the Tokyo Stock Exchange and the NASDAQ, not least because of a 14 hour time difference.

This is also the case for trading the London Stock Exchange and the Australian Securities Exchange. As such, you will need to trade marketplaces that mirror your local time zone.

However, by utilizing the capabilities of an AI trading robot, you can access as many markets as you wish – 24 hours per day, 7 days per week!

🥇 An End to Emotional Trading

One of the main reasons that close to 75% of all online traders lose money in the long-run is because individuals cannot handle the emotional effects of ups and downs. In other words, when a well-thought-out trade goes in the wrong direction, newbie traders struggle to accept that this is just part and parcel of trading. In response, you will often find inexperienced traders place irrational trades with the view of “winning back what they lost”. This ultimately results in a downward spiral that sees the trader lose their entire bankroll.

🥇 Perfect for Beginners and Advanced Traders

AI trading bots are suitable for both newbie traders and seasoned investors. Regarding the former, the underlying software allows you to access the financial markets without needing any prior experience. Instead, you will authorize your AI trading bot to buy and sell assets in an autonomous manner.

When it comes to seasoned investors, AI trading programs allow you to take your online trading endeavors to the next level. You will be able to analyze a significantly larger historical data set. Also, you will be able to trade as many hours as you see fit, and access an unlimited number of marketplaces.

What are the Risks of AI Trading?

While the benefits that we have presented in the section above makes robots an attractive prospect, you also need to consider some of the risks. After all, if AI trading was that easy, would not we all be doing it to guarantee indefinite profits? Unfortunately, AI trading is not a 100% fool-proof phenomenon, so be sure to review the following risks.

⚡ Only as Good as the Underlying Software

As we have noted throughout our guide thus far, robots are only as good as the underlying software. Do not forget, somebody has to manually design, build, and train the software to perform in the open marketplace.

As such, if the AI trading bot has not been designed effectively, it is likely that the software will lose you money.

⚡ Shady AI Trading Providers

If you Google the term ‘Best AI Trading Platform’s”, you will find thousands of providers that promise you guaranteed profits. In fact, these AI providers will make hyperbole claims that are beyond the realms of reality. As such, you need to tread extremely carefully before parting with your money.

Crucially, you need to ask yourself why the AI trading provider would share their ‘Secret Sauce’ to the general public if the underlying software was so profitable?

⚡ Markets can Change at any Given Time

If you are fortunate enough to purchase a successful AI trading bot that has been making you consistent profits for months on-end, there is no guarantee that this will always be the case. On the contrary, the make-up of the financial markets can change at any given time.

This is why you are required to adapt and amend your AI trading robot on a consistent basis to ensure its strategy is still effective. In this sense, AI trading is not 100% autonomous, as you still need to dedicate some time to ongoing maintenance.

How do I Choose an AI Trading Bot?

So now that you know the benefits and risks of using an AI trading bot. We are now going to explore how you can find a provider to meet your personal investment needs. Ultimately, no-two AI trading software programs are the same. So you need to spend some time thinking about what you are looking to achieve.

✔️ Required Input

First and foremost, you need to assess how much input you will be required to commit to getting your AI trading bot operational. On the one hand, some software algorithms are pre-packaged. It means that you simply need to activate the robot and it will begin to trade. Once again, you need to ask yourself whether or not the developer would release their successful strategies if they make consistent profits.

At the other end of the spectrum, you might be required to set up your own trading conditions for the AI robot to follow. Although this will require an element of know-how in the online trading space – such as understanding technical indicators and signals. You likely will not need any experience of coding. On the contrary, most AI trading providers offer a drag-and-drop design process.

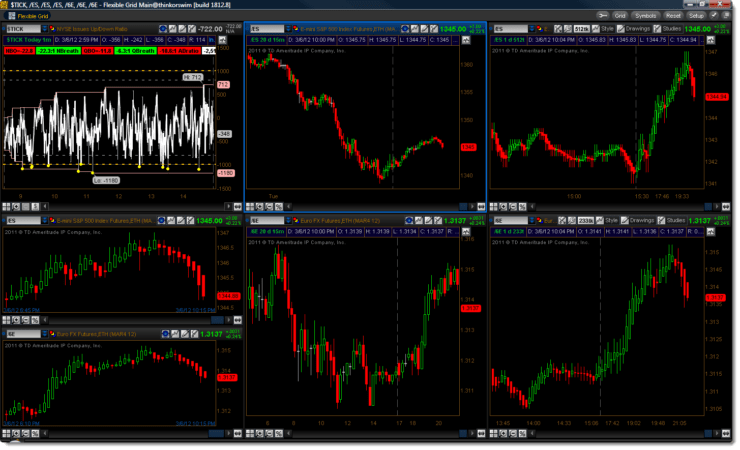

✔️ Where can Your AI Trading Software Operate?

You now need to consider where your AI trading robot can actually operate. Not least because you will still need a third-party broker to access the financial markets. In an ideal world, the AI trading robot will be compatible with both MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

This is because hundreds of established online brokers support these trading platforms. It means that your AI algorithm can have unfettered access to your preferred marketplace.

✔️ Supported Asset Classes

On top of finding an AI trading bot that is supported by well-known brokerage platforms, you should also consider the types of assets that you wish to trade. After all, while an AI robot might be able to analyze major forex pairs, it might not be compatible with traditional stocks and shares.

✔️ Pricing

If a developer really is ready to release their ‘Secret Sauce’ to the open marketplace, they are going to charge you for the privilege. In fact, you would expect the best AI trading providers to charge handsomely for their services if they can prove that the bot has been making profits consistently.

If they do, this typically comes as a monthly subscription. You will need to keep paying the subscription for as long as you wish to use the AI trading bot in the wild. We actually prefer providers that charge on a monthly basis. As opposed to a one-off flat fee, as it ensures that the developers perform ongoing maintenance to the underlying software.

✔️ Public Reviews and Historical Trading Results

So, you have found an AI trading bot that you like the look of. But how do you know whether or not it is actually going perform in the open marketplace? The reality is you do not know until the bot actually goes live. However, there is a couple of things that you can do to increase your chances of purchasing a legitimate bot.

Firstly, spend some time evaluating reviews available in the public domain. If you are going to use a rating platform like TrustPilot, just make sure that the ratings are based across thousands of verified users. Secondly, credible AI trading platforms will always publish historical results that can be verified. As such, ensure the bot has been performing well over a number of months at a minimum – but preferably, at least a year.

Conclusion

In summary, if you have read our guide on AI Trading all of the way through, you should know have a firm understanding of how the phenomenon works. In a nutshell, utilizing an AI-driven trading algorithm offers a number of benefits – such as the ability to trade on a 24/7 basis, access multiple markets, analyze huge data sets, and trade emotion-free. With that said, you still need to make some serious considerations regarding the risks.

Crucially, there is no guarantee that your chosen artificial intelligence trading provider is fit for purpose. On the contrary, the underlying algorithm is only as good as the person that designed it. As such, you need to ask yourself why a developer would release their secret trading strategies if it was making so much money. Ultimately, just make sure you perform enhanced due diligence on the AI trading provider prior to parting with your money.

Join Us and Start Getting Rich with Prime Advantage!

- Minimum deposit of $250

- Over 2,000 trading instruments

- Mobile app available