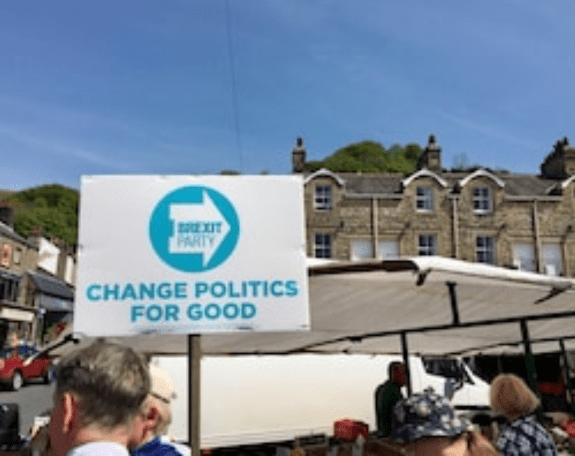

However events took a twist, as in a recent news release, Nigel Farage revealed his party will hands off every seat won by the conservative party in the last election and rather consolidate to win against the anti-Brexit stance.

Many see this as a prop up in support for Boris Johnson in the upcoming December 12 elections.

Effect on Major Currencies

The bulls had tested the market for sterling as it held steady having topped its May peak in its EURO pairing standing at 85.62 pence. At the time of the report, it traded at 85.79 pence. It rose significantly over a percent versus the USD within a 12-hour range after the news release. Before the news, Sterling traded above $1.28.

The Pound: the cable experienced a bounce as it traded at $1.2896 after the news release. Market analysts presume that Brexit may take a complicated twist as the chances of a hung parliament is lessened. A drop was later recorded as it traded at $1.2858 at the time of the report.

Other Currencies: the news had a muted impact on other currencies. For the Dollar, This may be because the U.S. market was not open fully in respect to Veterans Day. The euro/dollar pair last traded at $1.1033, holding steady, while the dollar edged higher at 109.15 yen.

Also impacting the USD is the recent uncertainty hovering around the trade talks between the U.S. and China. Investors are treading cautious grounds as they await the U.S. President’s speech to the Economic Club in NY. Hong Kong’s increased unrest is believed to have undermined the greenback.

The Chinese yuan held steady at 7.004 versus the dollar, as investors await new reports and market updates with Hong Kong politics in mind.

The New Zealand dollar fell as investors speculated an interest rate cut by the apex bank showing the recent inflation figures presented. It dropped by 0.6% to $0.6326 after the apex’s bank move. It last traded at $0.6333.the Aussie was also caught in the web as it slid to a low of $0.6832.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.