Key Support Levels: $0.25, $0.20, $0.15

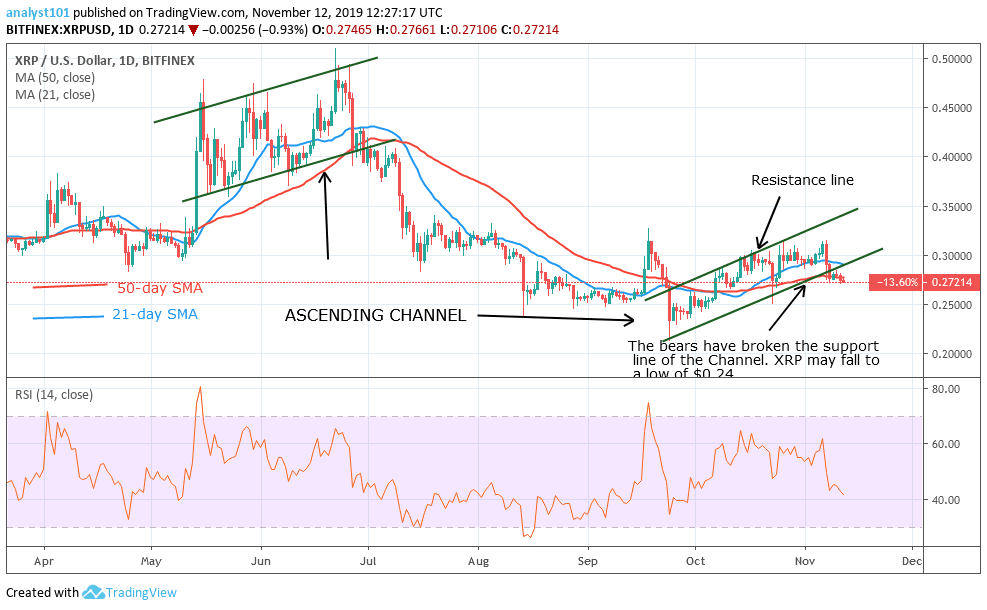

XRP/USD Long-term Trend: Bearish

On November 6, the bulls made a positive move but were resisted at the $0.31 price level. This singular resistance has thrown XRP into another downward move. In recent times, the coin has been making frantic effort to break into the previous highs but the $0.30 has been a strong resistance level. The bulls are faced with the challenge to penetrate the $0.30 and $0.31 price levels.

The price tested the resistance levels but lack of buyers at the upper price level, compels the coin to fall. XRP is trading at $0.27, and if the selling pressure continues, the market will reach a low of $0.24. However, if the coin has more buyers at the $0.25 price level, the price may find support at $0.25.

Daily Chart Indicators Reading:

The bears have broken the support line of the channel. This signifies that XRP may further depreciate. As the support line is broken, XRP may fall to a low of $0.24. The market has fallen to level 42 of the RSI, meaning that it is below the centerline 50. Also, the coin tends to fall.

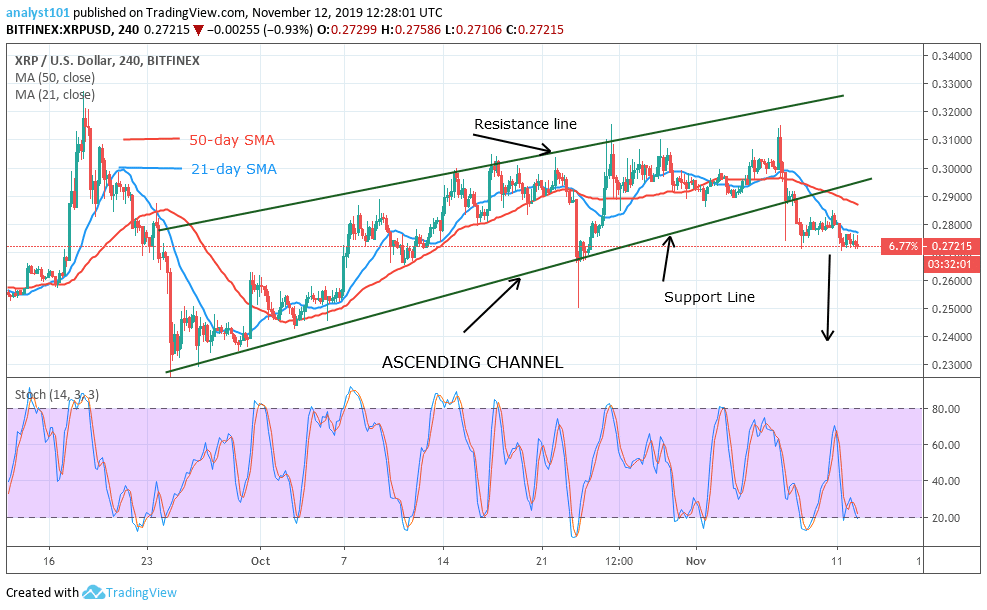

XRP/USD Medium-term Prediction: Bullish

On a 4-hour chart, XRP had its last bearish impulse on September 24 and the coin fell to a low at $0.23. It commenced a bullish move and reached a high of $0.30. XRP has been facing resistance at $0.30 in October. The bulls tested the resistance level several times before it was repelled. It appears the coin has resumed a downward move.

4-hour Chart Indicators Reading

In the same manner, the bears have broken the support line as the price fell to a low at $0.27. The price made retest at $0.28 and resumed the downward move. The 21-day and 50-day EMAs are sloping downward indicating that the market is falling.

General Outlook for Ripple (XRP)

All the indicators are showing that XRP is in a bearish momentum. There is likelihood that the coin will revisit the previous low of $0.24 if the downtrend continues. Nevertheless, as the market continues its fall, the price may find support at $0.24 or $0.25 price levels.

Ripple (XRP) Trade Signal

Instrument: XRPUSD

Order: Sell

Entry price: $0.27

Stop: $0.29

Target: $0.24

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.