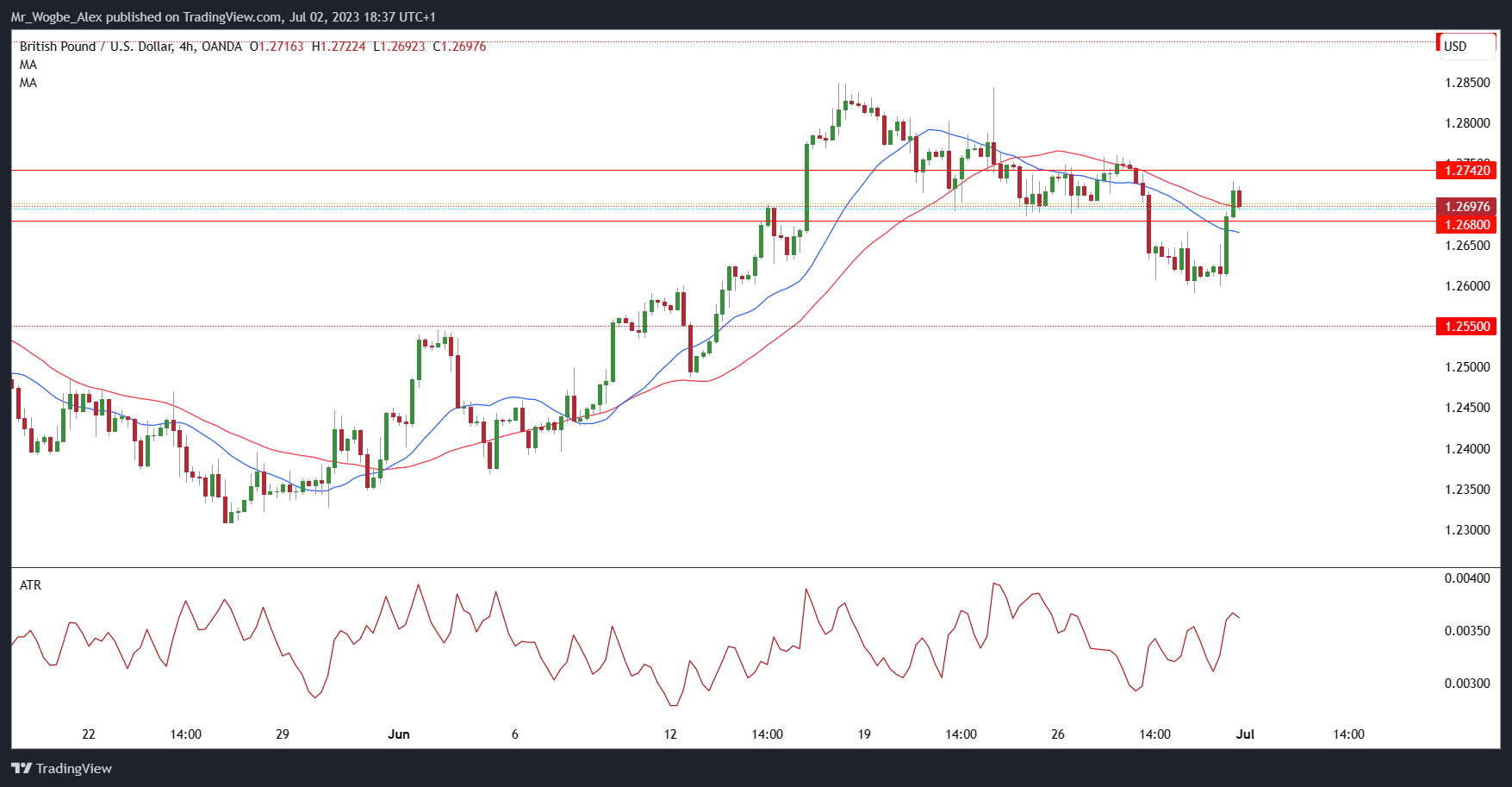

The British Pound fell for the second consecutive week against the US dollar as the greenback benefited from a hawkish Federal Reserve and upbeat US data. The GBP/USD pair traded below the 1.26 level for the first time since mid-June as investors priced in a sooner-than-expected rate hike by the Fed.

US Data and Fed Minutes in Focus for Cable Traders

The upcoming week will offer plenty of catalysts for the GBP/USD pair, with the US Nonfarm Payrolls (NFP) report being the main event. The NFP data, due on Friday, will provide clues on the strength of the US labor market and its implications for the Fed’s monetary policy.

The market consensus is for a solid increase of 200,000 jobs in June, following an impressive 339,000 gain in May. A higher-than-expected number could boost the US dollar further, while a lower-than-expected figure could trigger a corrective bounce in the pound.

source: tradingeconomics.com

Other key US data releases include the ISM Manufacturing and Services PMIs, the ADP Employment Change, and factory orders. These indicators will also reflect the state of the US economy and its recovery from the pandemic.

Additionally, the minutes of the Fed’s June meeting, scheduled for Wednesday, will be scrutinized for more details on the central bank’s hawkish shift. The Fed surprised markets last month by signaling two rate hikes by 2023 and opening discussions on tapering its bond-buying program.

UK Data Unlikely to Move the Needle for the Pound

On the other hand, the UK economic calendar will be relatively light, with only the final Services PMI for June on tap. The PMI is expected to confirm a robust expansion of the service sector, but it is unlikely to have a significant impact on the Pound.

The GBP/USD pair will also pay attention to any developments on the Brexit front as well as speeches from Bank of England (BoE) officials. Any hints of policy divergence between the BoE and the Fed could affect the exchange rate.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.