The British Pound experienced a decline against the generally stronger United States Dollar on Friday as worrisome European economic data highlighted uncertainties in global growth and prompted cautious investors to flock towards the safe haven of the greenback.

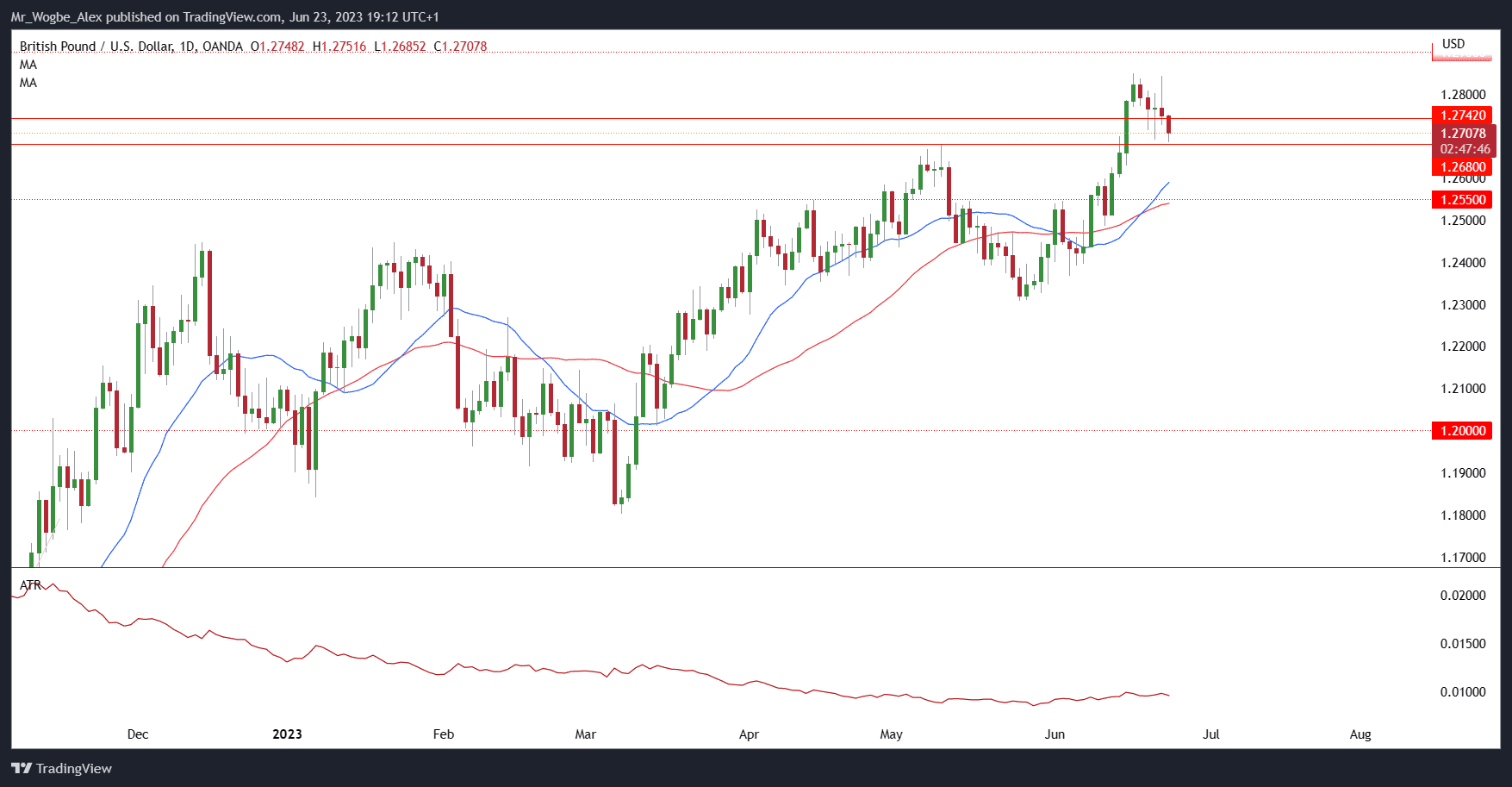

Despite the Bank of England’s unexpected half-percentage-point rate increase in the previous session, surpassing expectations, the British Pound failed to regain its strength above the 14-month high at 1.2848 seen on June 16.

Market concerns arise from the possibility of the Bank of England pushing the British economy into a recession to effectively combat domestic inflation, which remains persistently high among developed markets.

Resilient British Economy Fuels Inflation and Signals Potential for Further Rate Hikes

Contrary to initial forecasts at the beginning of the year, the British economy has displayed resilience, surpassing expectations. However, this strength has contributed to rising inflation, increasing the likelihood of further interest rate hikes.

Notably, retail sales unexpectedly rose due to favorable weather conditions and decreased fuel prices, as indicated by official data released on Friday.

Euro’s Weakness Weighs on Pound

While the Bank of England’s recent actions dominated the currency market’s attention, Friday witnessed a focus on the Euro.

Disappointing Purchasing Managers Index figures for Germany and the broader Eurozone exerted downward pressure on the single currency, consequently influencing the depreciation of the British Pound. The data revealed a contraction in manufacturing activity and sluggish growth in service sectors throughout June.

Given the limited availability of major UK economic data in the upcoming week, the British Pound’s trajectory is likely to be driven by the ebb and flow of US Dollar demand rather than its own intrinsic factors.

The sole significant release will be the final official snapshot of the first-quarter Gross Domestic Product, which is anticipated to show a downward revision, indicating modest annualized growth of 0.2% compared to the initial reading of 0.6%.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.