In 2023, the Mexican peso emerged as the top-performing currency in Latin America, surging 15% against the dollar, buoyed by the central bank’s robust interest rate of 11.25%. However, a recent Reuters survey of 25 currency strategists indicates potential headwinds for the peso in 2024.

The survey, conducted from January 2 to 4, suggests that the peso might encounter challenges, with projections indicating a 5.4% drop to 18 per dollar by the end of the year, compared to around 17 on Wednesday.

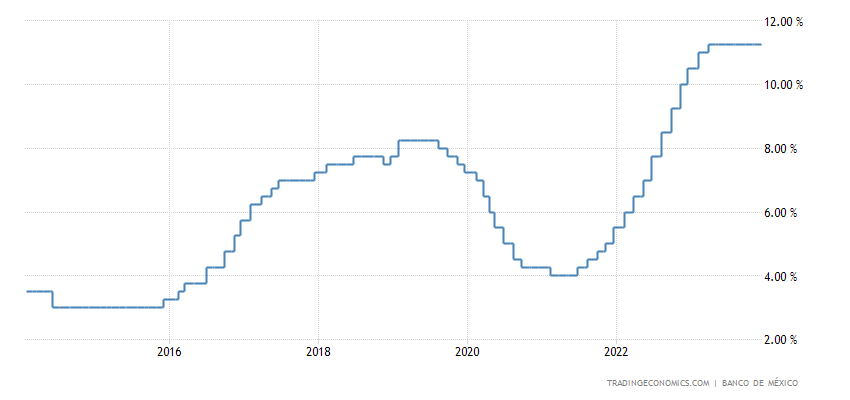

This anticipated weakening is attributed to Banxico’s expected easing of its monetary policy in 2024, diminishing the currency’s appeal for investors.

Montserrat Aldave, Principal Economist at Finamex, pointed out that central banks globally are likely to ease in 2024, leading to a predicted decrease of 100–150 basis points in rate spreads between Mexico and the United States.

While Banxico’s current rate still provides a significant premium over the U.S. Federal Reserve’s range of 5.25%–5.50%, the potential rate cut could alter the dynamics of the “carry trade” strategy.

Banxico’s governor hinted at the possibility of a rate cut in Q1 2024, citing a reduction in inflation to 4.32% in November from a peak of 8.70% in August 2022. This move, if materialized, could impact the peso’s real value and erode its interest rate advantage.

U.S. Monetary Policy and Mexico’s Elections Fueling Uncertainty of the Mexican Peso

The uncertainty surrounding U.S. monetary policy, coupled with Mexico’s upcoming presidential election on June 2, adds to the complexity of the peso’s outlook. Claudia Sheinbaum, the frontrunner from the ruling party, further introduces an element of unpredictability.

While the peso outperformed the Brazilian real in 2023, gaining 15% against the dollar compared to the real’s 9% increase, 2024 may present new challenges.

The Brazilian real is expected to end the year slightly weaker at 4.95 per dollar, maintaining its position around the 5.0 level for the third consecutive year.

As the year unfolds, investors and analysts will closely monitor Banxico’s policy decisions, the evolving U.S. monetary landscape, and the outcomes of the Mexican presidential election, all of which could significantly impact the trajectory of the Mexican peso in 2024.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.