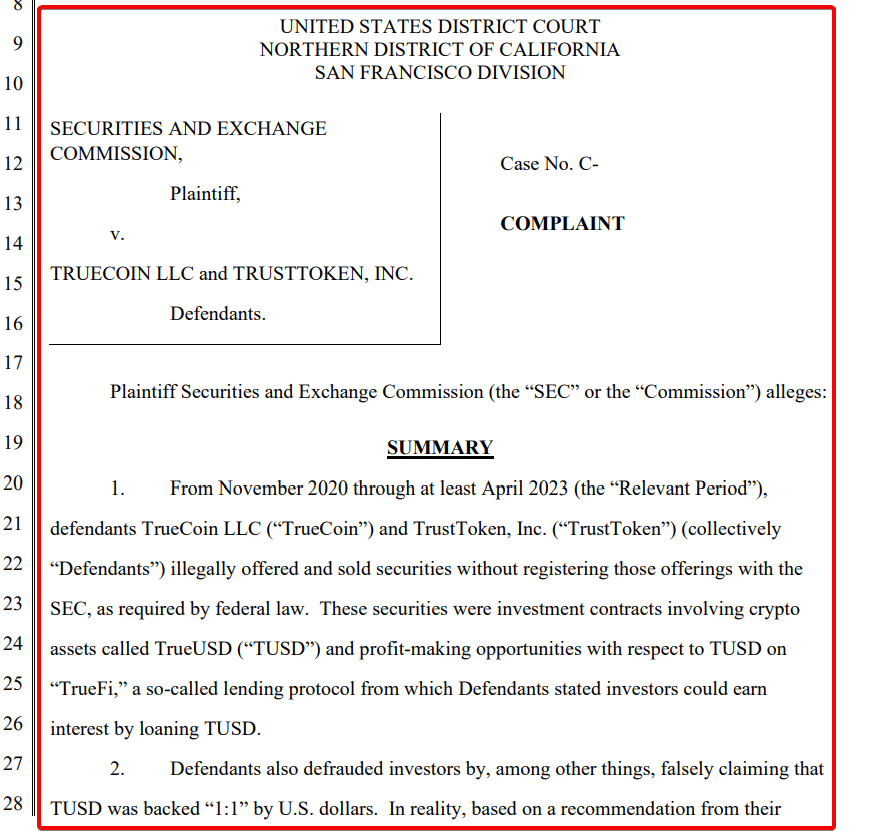

A major scandal has hit the cryptocurrency world as the Securities and Exchange Commission (SEC) reveals troubling allegations about TrueUSD (TUSD), a stablecoin with nearly $500 million in circulation.

The SEC’s findings suggest that almost none of this massive sum is properly backed by real assets, raising serious concerns about the safety of user funds.

The Controversy Around TrueUSD

What makes this case particularly worrying is how TrueUSD’s managers allegedly handled user deposits.

Starting in March 2020, instead of keeping user funds in safe, easily accessible accounts, they reportedly moved the money into risky investments. These included trade financing, export and import funding, and other complex financial deals that aren’t easily converted back to cash.

The situation got even more complicated when big names in crypto stepped in. In August 2021, well-known companies like a16z, BlockTower, and Alameda Research invested $12.5 million in TRU, the project’s governance token.

At this point, the SEC claims the misuse of customer funds had already been going on for 18 months.

The problems didn’t stop there. Binance, one of the world’s largest crypto exchanges, made TUSD its preferred stablecoin after dropping its own BUSD. They even offered free trading for TUSD pairs, which led to another $1.5 billion worth of TUSD being created.

As Paxos will no longer be minting new BUSD, #Binance has swapped the BUSD in the SAFU Fund for TUSD & USDT.

This change will have no impact on users, and the funds remain on publicly verifiable addresses.

Funds are SAFU.https://t.co/edLVgpdCUQ

— Binance (@binance) March 17, 2023

According to the SEC, none of these new tokens were fully backed by real money.

What This Means for Crypto Users

The most shocking part of this story is that by September 2024, approximately 99% of the assets meant to back TUSD were allegedly tied up in illiquid investments. This is completely different from how legitimate stablecoins work.

Companies like Tether, Circle, and Paxos typically invest their reserves in U.S. Treasury bills, which are both safe and easy to sell when needed.

This case shows that crypto investors need to be extra careful. Always check how stablecoins are backed and be wary when a token offers unusual benefits like zero trading fees. Rapid growth in token supply without clear backing should raise red flags, and investors shouldn’t assume that big-name investors mean a project is safe.

While other stablecoin companies make money by investing their reserves, they stick to safe, government-backed securities. TrueUSD’s managers allegedly took much bigger risks with user money, putting hundreds of millions of dollars in danger.

The SEC’s investigation revealed several concerning practices: making false statements about TUSD’s backing, maintaining unclear ownership structures, providing questionable proof of reserves, and issuing misleading attestation reports.

Looking Ahead: The Future of Stablecoins

This scandal comes at a crucial time for cryptocurrency markets. As more traditional investors enter the space through new bitcoin ETFs and other investment products, the need for reliable stablecoins has never been greater.

The TrueUSD case shows why transparency isn’t just a nice-to-have feature—it’s essential for the safety of the entire crypto ecosystem.

For the crypto industry to grow responsibly, stablecoin issuers must provide real-time proof of their reserves and use independent auditors. They need to keep most assets in easily sellable investments and be clear about who owns and controls the company.

The future of stablecoins will likely include stricter rules about what backing assets are allowed and how they must be proven. Projects that can’t or won’t meet these standards might not survive in an industry that’s growing more mature and regulated.

For now, crypto users should carefully research any stablecoin before using it. Pay attention to the company’s track record, how reserves are invested, the frequency and quality of audits, and the regulatory status in major markets.

The TrueUSD situation serves as a reminder that in cryptocurrency, as in traditional finance, if something seems too good to be true, it probably is. As the market continues to develop, transparency and proper asset management will become even more important for building trust and ensuring long-term success.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.