Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

A new set of cryptos has emerged in the spotlight of this week’s list of trending coins. This has resulted in the displacement of regular coins such as PEPE and BTC. Without further ado, let’s examine each of these tokens one after the other.

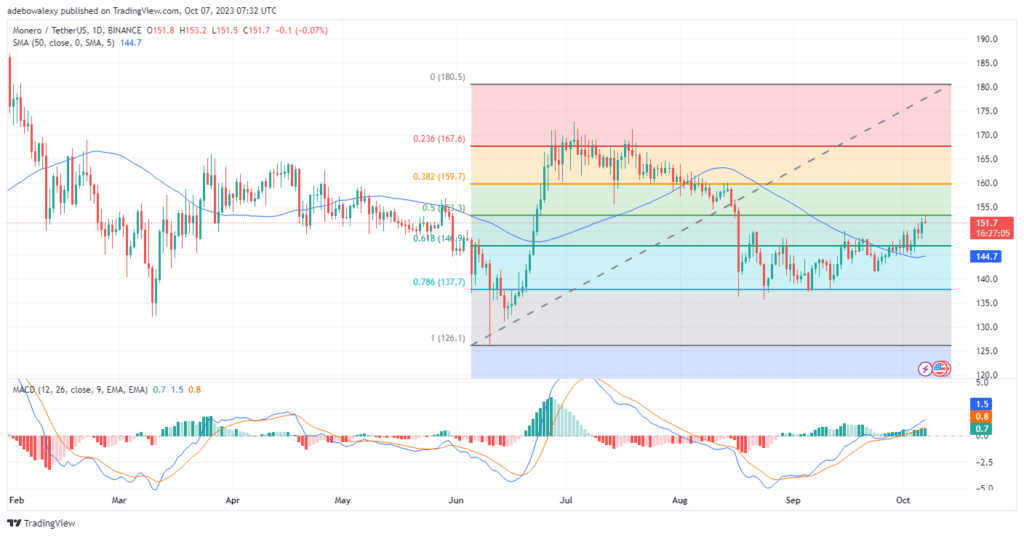

Monero – Guide, Tips & Insights | Learn 2 Trade (XMR)

Major Bias: Bullish

Monero – Guide, Tips & Insights | Learn 2 Trade stays largely bullish—not that it hasn’t seen some losses, but because of the fact that its price action stands a chance of gathering more profits. This token has recorded additional price increases of 1.73% and an overall price increase of 4.40% over the past week. Additionally, Monero – Guide, Tips & Insights | Learn 2 Trade has witnessed a market capitalization of over $2.78 billion and a trading volume of roughly $48 million. Meanwhile, on the daily chart, technical indicators are revealing that the price of this token may still approach higher price levels.

Although the ongoing session has produced minimal losses considering the size of the last price candle on this chart, it could be seen that trading activities remain above the 50-day Moving Average (MA) curve. Likewise, the Moving Average Convergence Divergence MACD indicator lines for this chart keep trending upward. Consequently, traders can project that this token price may approach the 155 price mark.

Current Price: $151.70

Market Capitalization: $2.78 billion

Trading Volume: $48 million

7-Day Gain/Loss: 1.73%

Lido DAO (LDO)

Major Bias: Bullish

The Lido DAO token has taken the second spot on this week’s list of trending coins. This token has a market capitalization of $1.40 billion and a daily trading volume of $24 million, posting daily gains of 1.25% and a 7-day loss of 6.08%. As of the time of writing, the token was worth $1.57. On the daily market, LDO’s price action has continued to trend slightly downward since July 1st. Most of the time, price action in this market has stayed below the 50-day MA line.

However, the ongoing session has placed the price of the token above the MA line drawn on this chart. Nevertheless, the MACD indicator isn’t showing much signs of life, as the lines of the indicator have started trending sideways just above the equilibrium level. Although the current price of the token lies above the 50-day MA, it stands to reason that not much may be expected from this token. Traders can only anticipate gains towards the $1.620 mark.

Current Price: $1.57

Market Capitalization: $1.40 billion

Trading Volume: $24 million

7-Day Gain/Loss: 6.08%

Internet Computer (ICP)

Major Bias: Bullish

The ICP token stands in the 3rd position, with a daily profit of 1.25%, while its weekly trading activities have incurred a loss of 0.91%. Furthermore, the token has a market capitalization of roughly $1.4 billion and a 24-hour daily trading volume of $13.71 million. On the daily chart, it could be seen that trading activities for the past two trading sessions have been occurring below the MA line.

This shows that bears are more dominant in this market. Also, the lines of the MACD indicator can be seen trending slightly sideways just below the equilibrium level, while the bars of this indicator appear pale above the equilibrium level. The majority of signs emanating from this market suggest that upside momentum is weak in this market, and the 50-day MA line at the price mark of $3.200 may be a strong resistance for this token.

Current price: $3.102

Market Capitalization: $1.40 billion

Trading Volume: $13.71 million

7-Day Gain/Loss: 0.91%

MultiversX (EGLD)

Major Bias: Bullish

Price action in the EGLD daily market has posted only very minimal profits in today’s session. With a market capitalization of $634.41 million and a 24-hour trading volume of $10.17 million. However, the token has recorded a 7-day loss of 4.37%. Meanwhile, the daily market shows that this token is on a downtrend despite the minimal profits recorded in today’s trading session.

The price action of this token keeps occurring below the MA line. Meanwhile, the MACD lines are trending sideways below the equilibrium level. In fact, with careful observation, one can see that red bars are already appearing below the equilibrium level as well. Therefore, this shows that the price of this coin may yet fall to lower support levels of $23.00 despite the printed profits, as the market lacks significant momentum.

Current price: $24.35

Market capitalization: $634.41 million

Trading volume: $10.17 million

7-Day Gain/Loss: 4.37%

Aptos (APT)

Major Bias: Bearish

Aptos, standing in the last position on this week’s list of trending coins, has printed just gains of 0.97% today, while it has seen losses of 1.71% over the week. It has also witnessed a market capitalization of $1.27 billion and a trading volume of $46.68 million. Although, on the daily chart, it could be seen that the ongoing session has brought some losses.

Meanwhile, studying the trading pattern of this token, it could be seen that it is trading in a falling wedge triangle pattern. Also, price action can be seen rising toward the ceiling of the falling wedge triangle. Nevertheless, the Relative Strength Index (RSI) can be seen trending downward towards the oversold region. Consequently, this holds the promise that price action may burst through the ceiling towards the $6.000 mark.

Current Price: $5.28

Market Capitalization: $1.27 billion

Trading Volume: $46.68 million

7-Day Gain/Loss: 1.71%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.