Trading is difficult at the best of times. The bulls and bears which dominate market movements are often difficult to predict. This invariably highlights the need for accurate forecasting and analysis vis-a-vis volatility, pricing, and demand. The world’s most actively traded market – currencies – eclipses stocks trading by a huge margin. Estimates suggest that the 2019 global forex market averaged a daily turnover of $5.1 trillion, while the US stock market averages several hundred million per day.

Down south, geopolitical events have hindered economic growth in South Africa in 2020 across all sectors, including retail, manufacturing, travel and tourism, and entertainment. Yet some industries have shown resilience. Consider that the most popular online slots in South Africa have retained their appeal. These include classic slots, video slots, and progressive jackpot slots. While overall participation in real money casino games has dipped [lockdowns], the same cannot be said of virtual entertainment.

Various interrelated and unrelated economic factors impact Forex trading on a day-to-day basis. Foremost among them is the capital markets. Such is the complexity of trading currency pairs, that a holistic perspective is required to make sense of the global market. Certain countries rely heavily on specific components of their economy for their economic stability. Canada, with its gold, oil, natural gas reserves is one such example. When the price of oil rises, the Canadian dollar (CAD) rallies, relative to other currencies. When the price of oil declines, the demand for CAD declines, all things being equal.

Much is true of the South African economy too, which is still largely driven by commodities like gold, coal, iron ore, manganese, nickel, palladium, et al. However, the instability of the South African rand (ZAR) is impacted by a variety of factors such as infrastructure weakness, lack of credibility, corruption, unions, the costs of extracting minerals from deep within the earth, and sluggish global demand. This all adds down pressure onto the ZAR, relative to other currencies. As such, we have seen an unprecedented decline in the value of the South African rand since 2015, when it averaged 12.7776 to the US dollar. Today, it is trading at 15.6075 to the USD, representing a 22.16% depreciation in 5 years.

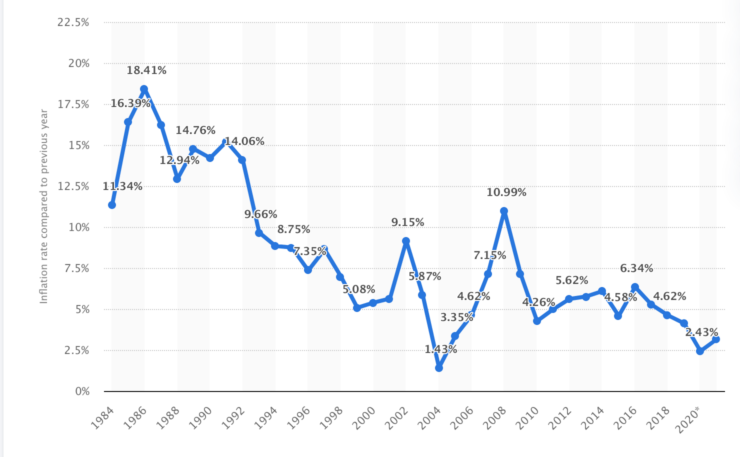

Coupled with a depreciating currency, the ZAR is also being impacted by inflation, to the tune of 4.58% in 2015, 6.34% in 2016, 5.27% in 2017, 4.62% in 2018, 4.13% in 2019, and 3.16% in 2020. While seemingly less important in recent years, a depreciating currency alongside growing inflation indicates one thing: the value of ZAR1.00 is worth significantly less today than it was five years ago.

According to Deloitte, the Rand’s depreciation is not necessarily a bad omen. The recent performance of the ZAR/USD currency pair is largely impacted by the forex practices of China. The Chinese currency, the CNY is routinely devalued, and since China is a big player in the SA economy, this impacts the South African Rand in a big way. Of prime importance is the lower global demand for commodities, brought about by rising costs of mining at depth, and increased labour demands, coupled with the massive and unprecedented economic downturn owing to recent events.

Of course, a weak Rand bodes well for export-driven markets, since South African goods and services will be cheaper relative to foreign goods and services. This also bodes well for the travel and tourism industry, on the proviso that inflation is held at a steady rate. The South African rand has experienced depreciation against major currencies in 2020, particularly from Q2 onwards.

Retail sales declined, and manufacturing output declined, largely in line with global expectations. The country has a public debt of 62.2% of GDP, and an annualized inflation of 4.0% heading into 2020. On a positive note, the PMI data from October 2020 turned bullish for the first time in 1.5 years, boding well for increased optimism for the ZAR. Overall, US election outcomes, NFP Data, and the Labor Market will impact the USD and the United States’ trading relations with other countries. The rand is likely to strengthen somewhat from a more liberal approach and inclusive approach to global investment, trade, and economics.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.