S&P 500 Price Analysis – July 7

S&P 500 declined to 3149 levels, down 0.21% on a day, after markets reached two weeks high at 3194 level trading on Tuesday. The risk barometer surged to the highest since June 19 in the prior session while marking fresh gains on Wall Street.

Key Levels

Resistance Levels: 3300, 3250, 3216

Support levels: 3139, 3078, 3000

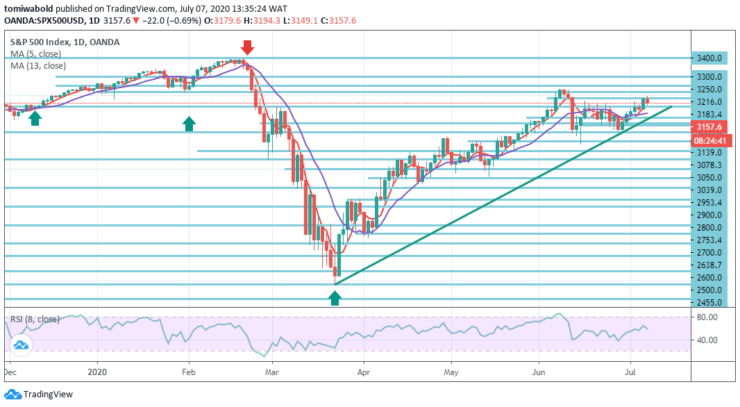

As seen technically on the daily, with the market above support from its rising 13-day moving average (currently at 3100 levels) not too far from its 5-day moving average (at 3139 levels) the immediate risk stays higher within the high-level consolidation range.

Its immediate support is seen at 3139 levels and we look for this to try and hold for a clear break above the highs of the past two weeks at 3159 levels for strength back to the top of the price gap from early June and potential downtrend from March at 3194 levels. Whilst we would expect sellers to show here, a direct break can expose the important 3233 June highs.

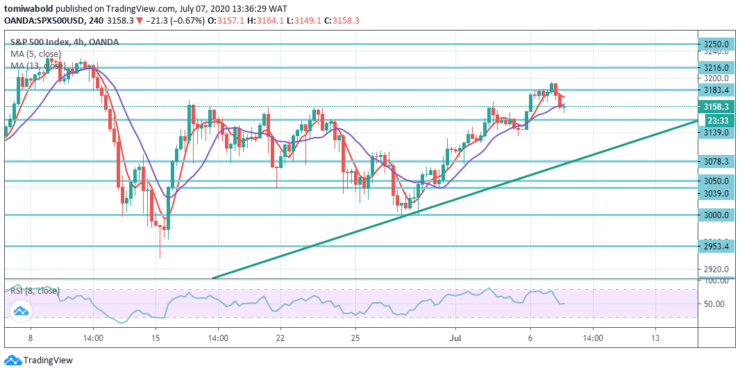

In the short term, while the 4-hour indicators appear tired and retracing downwards, that wouldn’t be a concern for the stock upswing to continue towards the 3233 near term high level. While the S&P 500 is trading comfortably above the support held at 3139 levels thus upswing continuation is more likely.

The price traditionally moves in waves and now it will be interesting to see if the 4-hour blue moving average 13 lines at 3160 level holds. Beyond that, if the support level does break the price could move back towards the trendline again for a retest or even back to fill the price gap at 3078 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.