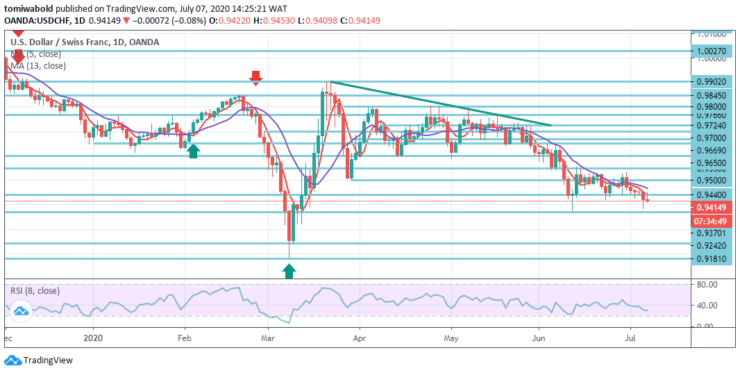

USDCHF Price Analysis – July 7

The US Dollar versus the Swiss Franc is currently trading in a descending channel pattern. The currency pair has declined by 1.45% since last week’s trading sessions. Sellers may aim at the 0.9300 level on negative bias within the following trading sessions.

Key levels

Resistance Levels: 1.0027, 0.9766, 0.9500

Support Levels: 0.9370, 0.9242, 0.9181

The USDCHF stays capped by the month’s resistance line at 0.9500 levels while a negative bias should persist, however, with downside target remaining at the 0.9370 level June 11 low which is the last defense for 0.9181 level the March low. Further resistance can be spotted at the 0.9550 level and late June highs.

Bearish traders could aim at the 0.9300 level and beyond within the following trading sessions. However, a support cluster formed by next horizontal support at 0.9242 level could provide support for the currency exchange rate within this week’s trading sessions.

At this point in time, the intraday bias in USDCHF stays slightly downside. The 0.9370 level break may restart the entire fall from 0.9902 to 0.9902 to 0.9500, from 0.9724 to 0.9242 levels.

On the positive side, a lower resistance level beyond 0.9440 may instead switch intraday bias back to the upside for resistance level at 0.9550. After all, trade within the short to medium range is probably to continue between 0.9181/1.0237 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.