A combination of favorable conditions failed to help the commodity add to the gains recorded in previous trading sessions, instead, it was set into a range-bound mode on Tuesday. Increasing concerns about the ever-rising Coronavirus cases globally lent some support to the yellow metal in the early Asian session.

Investors remain worried that the second wave of Covid-19 infections could invoke renewed lockdown restrictions and that the recent economic recovery may be short-lived. These concerns triggered a slight pullback in the global equity markets and caused investors to seek refuge in traditional safe-haven assets.

Meanwhile, gold failed to muster any significant gain yesterday in light of the numerous supporting factors largely because the US dollar picked up demand as well, which tends to weaken the dollar-denominated commodity. The USD demand was ignited by a hawkish US ISM Non-Manufacturing PMI report, which showed that the economy has picked up in recovery.

Moving on, market participants will be looking to see if gold can attract dip-buyers from this level or if it will continue in its consolidative state. The gold market is expected to make a comeback today considering the absence of any major US economic release and the grim outlook of the Coronavirus pandemic.

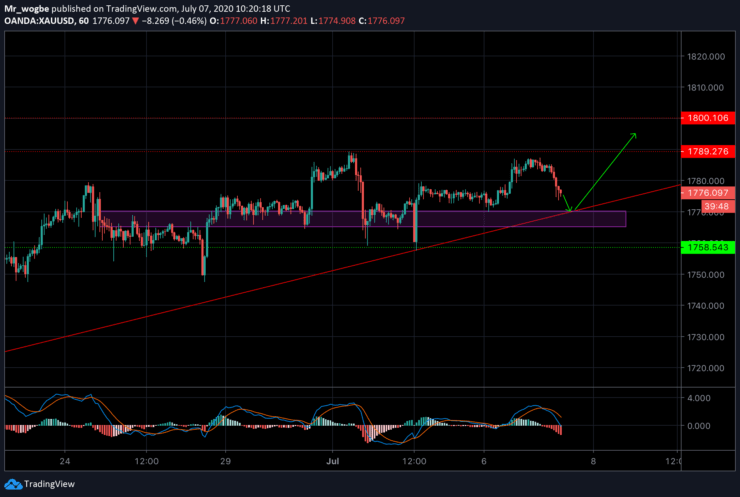

Gold (XAU) Value Forecast — July 7

XAU/USD Major Bias: Sideways

Supply Levels: $1,779, $1,790, and $1,800

Demand Levels: $1,765, $1,758, and $1,745

Gold was met with strong resistance at the $1,786 region as it attempted to capitalize on the $1,780 break yesterday. At press time, the yellow metal has reversed to the $1,775 region again as we wait for signs of the next possible surge. We could see a decline to the $1,770-65 region (the baseline of our ascending trendline) where it could likely pick up a strong bullish bounce to approach the $1,800 target again.

On the flip side, a sustained decline below the $1,745 could quickly switch the overall bias to bearish.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.