The Russian ruble experienced a sharp drop, hitting its lowest level against the dollar in over seven weeks, following Russian President Vladimir Putin’s recent accusations against the United States.

Putin, speaking from Sochi, accused the US of attempting to assert its waning global dominance, which further strained international relations.

On Thursday, the ruble initially showed some strength but ultimately surrendered its gains, sliding by more than 1.5% to 100.28 per dollar, marking its weakest point since August 14. It also lost 0.9% against the euro, trading at 105.39.

Ruble Weakened By Falling Oil Prices

Several factors contributed to the ruble’s decline. Reduced foreign currency supply from exporters early in the month played a significant role, as many had already converted their foreign exchange revenues to meet local tax obligations.

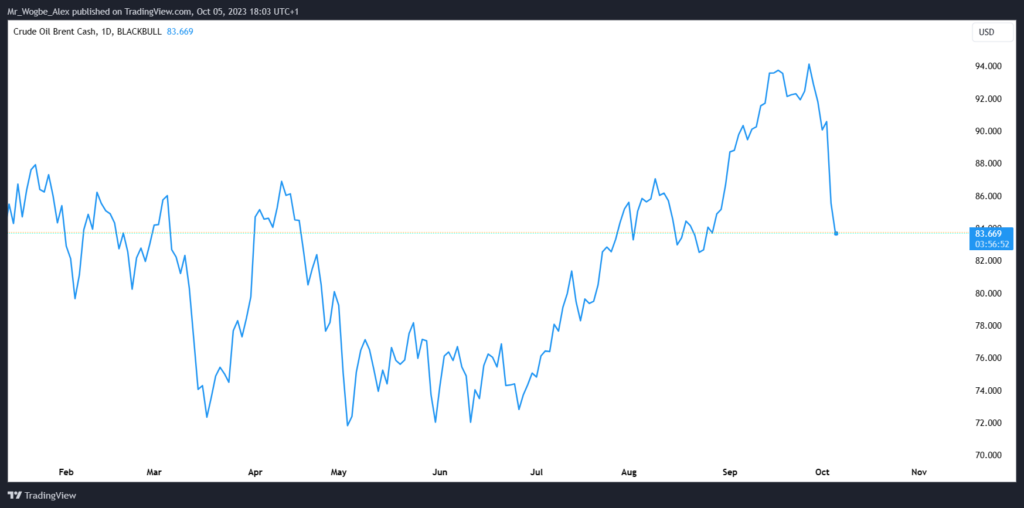

Additionally, lower oil prices, a crucial revenue source for Russia, added to the ruble’s woes. Brent crude oil, a global benchmark, fell 2.2% to $83.32 a barrel, reaching a more than five-week low and continuing its decline from the previous day.

However, there is optimism that the ruble could see a resurgence in October. Tax changes and robust commodity prices are expected to boost oil and gas revenues, potentially providing support for the currency. Russia’s energy revenues increased in September as Moscow sought new export markets following Western sanctions and a seaborne oil export embargo.

The country’s finance ministry anticipates higher tax collections from the oil industry in October, which could compel oil companies to increase the sale of their foreign currency earnings. This, in turn, may bolster the ruble, helping offset some of the negative impacts caused by geopolitical tensions and fluctuating oil prices.

As the ruble navigates these challenges, its performance remains closely tied to global events, particularly the evolving situation in Ukraine and international relations, which continue to influence currency markets.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.