The cryptocurrency industry, known for its volatility, is facing a tough challenge in the third quarter of 2023 as it grapples with a prolonged bear market.

According to a recent report by Messari, a respected blockchain intelligence firm, the fundraising landscape in the crypto world is experiencing its lowest ebb since the closing quarter of 2020.

The numbers are stark. In Q3 2023, crypto firms managed to raise a mere $2.1 billion across 297 deals. This figure represents a substantial 36% drop from the previous quarter and an astonishing 88% plummet from the remarkable peak seen in Q1 2022, when the industry attracted nearly $17.5 billion across over 900 deals.

Multiple factors are contributing to this somber environment for fundraising. Regulatory crackdowns on crypto exchanges have cast a shadow of uncertainty, making investors wary. The industry was also jolted by the shocking collapse of FTX, one of the largest crypto platforms, in November 2022. Furthermore, the broader market downturn has seen most cryptocurrencies lose more than half of their value from their all-time highs.

Messari: More Crypto Fundraising Going Towards Infrastructure Investments

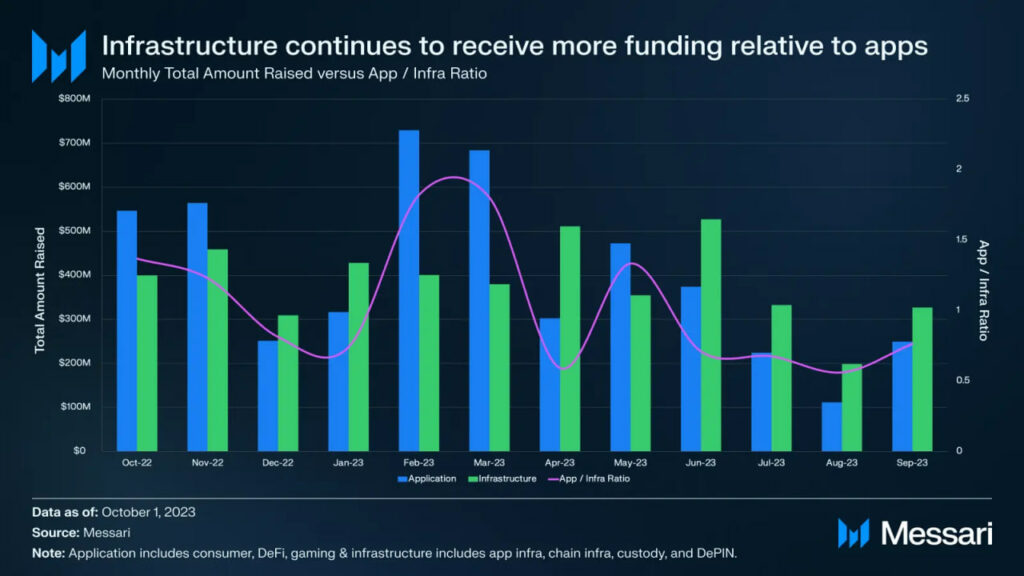

Despite these challenges, there are glimpses of resilience and innovation in the crypto sector. Investors are now turning their attention more towards early-stage projects and infrastructure investments rather than user-facing applications.

Meanwhile, segments such as decentralized finance (DeFi), non-fungible tokens (NFTs), and the gaming industry continue to flourish, attracting substantial funding.

While the fundraising figures for Q3 2023 may appear disappointing on the surface, they are not entirely surprising given the current market conditions. The industry remains cautiously optimistic, with hopes of a potential rebound in Q4 2023 or early 2024. This optimism is rooted in the ongoing growth of crypto adoption and continued innovation in the space.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.