EURUSD Price Analysis – June 25

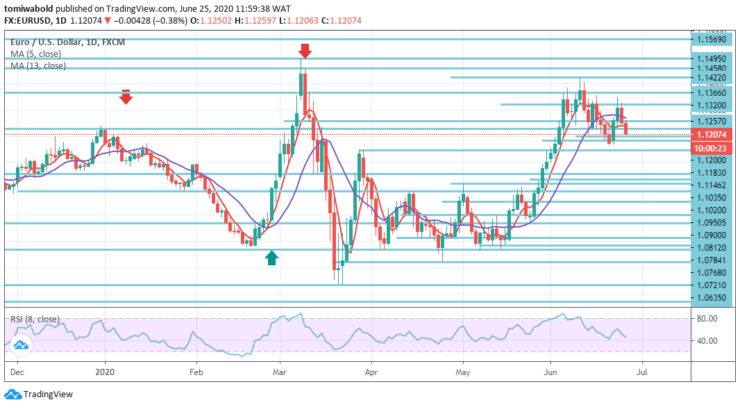

EURUSD contributes to the pullback of the prior day regarding the positive tone in the USD amid the risk aversion pick-up sentiment. EURUSD loses -0.38 percent to the level of 1.1210 as the pair remains vulnerable to more downside risks, with attention focused at 1.1200 level.

Key levels

Resistance Levels: 1.1495, 1.1422, 1.1366

Support Levels: 1.1183, 1.0950, 1.0635

The pair currently loses 0.38 percent at level 1.1210 and confronts the next support at level 1.1183 (low) seconded by level 1.1146 (low) and eventually level 1.1035. On the positive, a 1.1366 (high) level breach may reach 1.1422 (high) level en route to 1.1458 level.

In the wider sense, the whole downtrend from 1.255 (high) level may still be ongoing as long as 1.1495 resistance level stays. The upcoming goal is level 1.0339 (low). Nevertheless, a continuous breach of the 1.1495 level may suggest that such a downward trend is over.

The EURUSD pair drifted back across the downtrend support line – which had previously acted as a resistance. It has fallen beneath the 5 and 13 Moving Averages on the 4-hour chart on its way south. Although the traction appears upside down, EURUSD has struggled to rise beyond level 1.1366, forming a double-top.

Support lies at round level 1.12, which last week served as support. It is supported by a level of 1.1183, the low of the prior week. Even farther down, the next significant buffer is at just 1.1055, levels seen at the start of June. Resistance lies ahead at level 1.1257, last week’s minor top. It is accompanied by a level of 1.1320, another high swing, and then a strong level of 1.1366.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.