Gold suffered a slight intraday dip to the $1,753 support level before it attracted some dip-buying which has helped it erase all the previous day’s losses. The yellow metal suffered this drawdown as a result of a strong run-up in the US dollar yesterday.

However, the enduring bearish sentiment in the equity markets lent some support to the commodities safe-haven appeal. The bearish undertone in the market is largely due to worries over a surge in Coronavirus cases globally and weaning prospects for a sharp V-shaped global economic recovery.

The market worries were further stirred by a grim economic report from the International Monetary Fund (IMF) which forecasts a deeper recession in 2020 and expects the global output to contract by 4.9% in 2020.

Meanwhile, the US dollar index added to its overnight gains, which will likely be a major factor capping further gains by the dollar-denominated commodity. Regardless, the prevailing fundamental factors are still in full favor of a $1,800/oz gold price in the near-term.

Market participants will be looking at some major economic data coming from the US later today for clues. The US docket highlights the release of Initial Weekly Jobless Claims, Durable Goods Orders, and the final Q1 GDP.

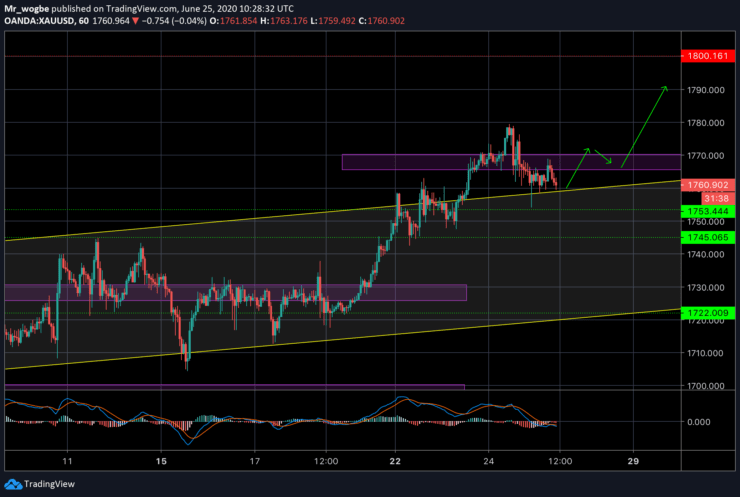

Gold (XAU) Value Forecast — June 25

XAU/USD Major Bias: Bullish

Supply Levels: $1,770, $1,790, and $1,800

Demand Levels: $1,753, $1,745, and $1,735

Gold appears to be going through a corrective phase and further corrections are a strong possibility at this point. However, the overall bias remains bullish. At the moment, we are stuck in a mild consolidation range between $1,770 and 1,760 and the upward scape is the “path of least resistance.”

Meanwhile, the bullish bias might come into contention if gold drops below the $1,735 pivot region.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.