AUDUSD Price Analysis – June 25

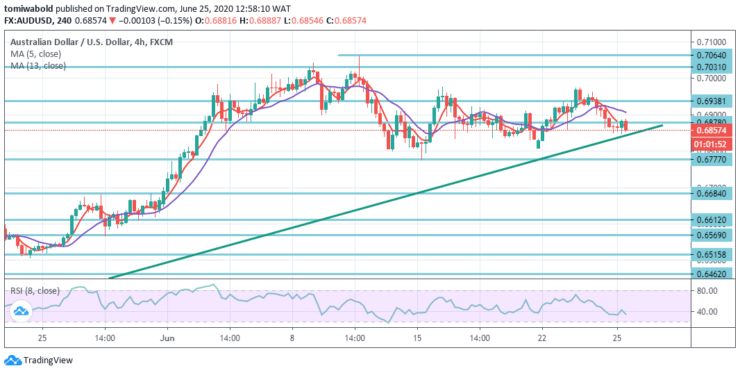

Once again, new buyers emerged just beyond 0.6850 level, allowing a cautious bounce in AUDUSD into mid-European trading, even though upside momentum seems to be capped amid risk aversion.

Key Levels

Resistance Levels: 0.7205, 0.7064, 0.6938

Support Levels: 0.6777, 0.6462, 0.5906

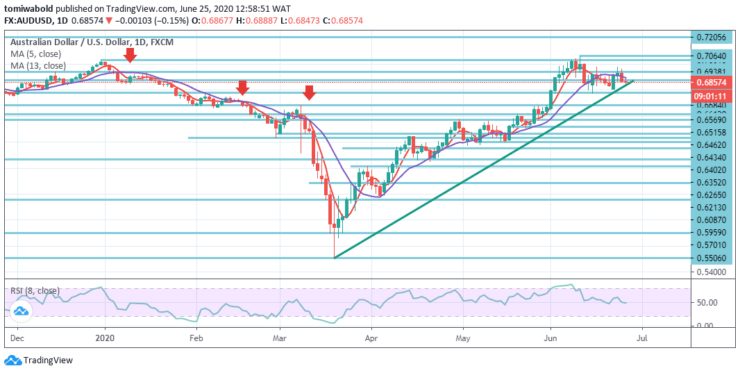

To the AUDUSD bulls, the level at 0.6900 is a hard problem to solve as it is the combination of the daily pivot point and round figure. Bulls may aim at a 0.6923 level high on a break beyond the latter on June 22.

On the contrary, the daily low of 0.6847 level may provide the initial support, upon which the low level of 0.6807 may be tested. However, price movements on the daily chart retained its bullish bias and signal of some dip-buying starting to emerge.

The AUDUSD intraday bias stays optimistic, and the trend stays unchanged. Before closure, a corrective trend from level 0.7064 is anticipated to have another sharp drop. On the contrary, the 0.6777 level breach may aim a retraction of 38.2 percent from 0.5506 to 0.7064 at 0.6462 levels.

Continuous breach of 0.7064 level, however, may also restore entire growth from 0.5506 level. A compelling turnaround for bearish traders might be seen as a new catalyst, which in effect may pave the way for a fall to daunting weekly lows around the vicinity of 0.6809 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.