Digital asset investment products are experiencing their worst crypto outflows on record, according to the latest CoinShares report. Meanwhile, US spot Bitcoin ETFs just posted their largest daily inflows in six weeks, suggesting the market might be stabilizing.

Crypto Outflows Reach Unprecedented Levels

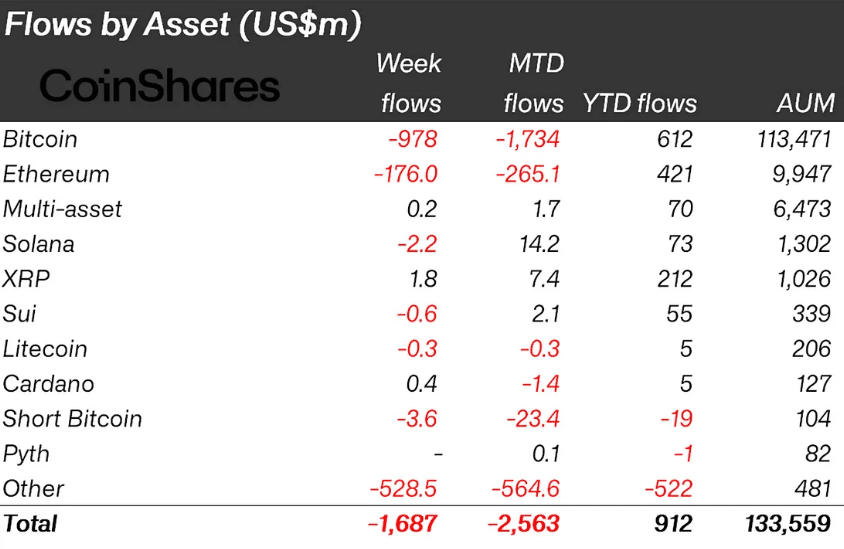

The crypto market has seen five consecutive weeks of outflows, with the latest week adding another $1.7 billion to the exodus. This brings the total outflows during this negative period to a staggering $6.4 billion, marking the longest negative streak since CoinShares began tracking data in 2015.

Bitcoin continues to bear the brunt of this selling pressure, with an additional $978 million flowing out last week. Over the past five weeks, Bitcoin alone has seen $5.4 billion in outflows.

These persistent withdrawals have caused a significant decline in assets under management (AuM), which has dropped by $48 billion following recent price corrections.

The US market accounts for the majority of the selling activity, representing 93% of all outflows during this negative streak, with $1.16 billion leaving US-based funds. Switzerland also saw substantial outflows of $528 million due to a seed investor exit, while Germany bucked the trend with minor inflows of $8 million.

Despite this ongoing negative sentiment, year-to-date inflows remain positive at $912 million, indicating that earlier strong performance is still offsetting recent losses.

Bitcoin ETFs Show First Signs of Recovery

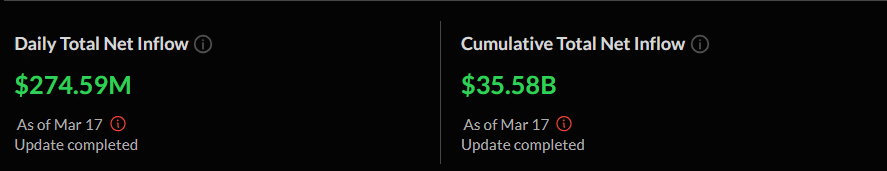

In a potentially positive development, US spot Bitcoin ETFs recorded $274.6 million in net inflows on Monday, March 17, their largest daily inflow since February 4. This comes after five straight weeks of significant outflows totaling over $5 billion.

Five Bitcoin ETFs reported net inflows on Monday, with no funds recording outflows. Fidelity’s FBTC led with $127.3 million in inflows, followed by Ark and 21Shares’ ARKB with $88.5 million. BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, added $42.3 million.

When speaking to The Block, Rachael Lucas, crypto analyst at BTC Markets, attributed this shift to “growing confidence, driven by bitcoin’s price stabilization and renewed institutional interest.”

She also noted that quarter-end institutional portfolio rebalancing and increased demand for lower-fee ETFs contributed to Monday’s positive flows.

While one day of positive inflows doesn’t necessarily signal a complete market reversal, it may indicate that investor sentiment is starting to improve after weeks of consistent selling. However, analysts caution that volatility is expected to continue, especially with quarter-end approaching.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.