The cryptocurrency market is experiencing a significant bearish trend, with digital asset investment products recording their fourth consecutive week of crypto outflows.

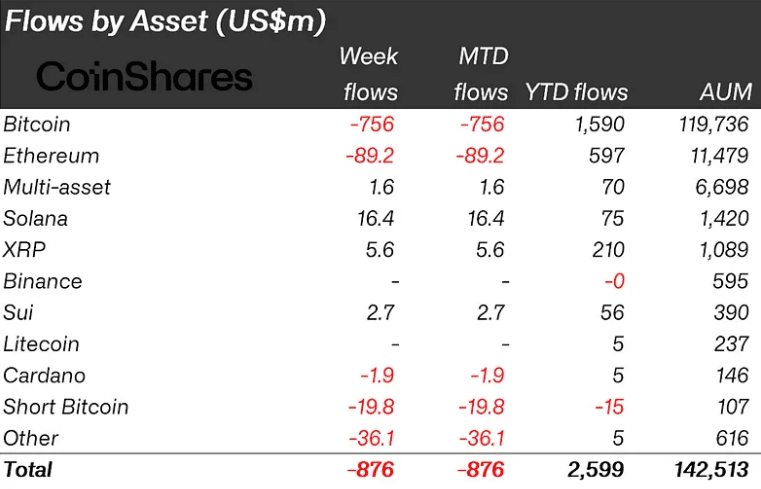

According to the latest CoinShares report, crypto outflows totaled $876 million last week, bringing the cumulative withdrawal over this negative period to a staggering $4.75 billion.

Understanding the Recent Crypto Outflows

Bitcoin has been the primary focus of this investor exodus, accounting for $756 million in outflows last week alone. Interestingly, short-Bitcoin investment products also saw outflows of $19.8 million, which suggests investors may be approaching capitulation—a sign that selling pressure could be nearing its peak.

The regional breakdown reveals that US investors have been the most bearish, pulling out $922 million. However, several other regions view the current market as a buying opportunity, with Switzerland, Canada, and Germany recording inflows of $23 million, $14.7 million, and $13.3 million, respectively.

Ethereum has also been hit hard during this period, seeing $89 million in outflows. Other altcoins experiencing significant withdrawals include Tron ($32 million) and Aave ($2.4 million).

Conversely, some cryptocurrencies continue to attract investment despite the overall negative trend, with Solana, XRP, and Sui seeing inflows of $16.4 million, $5.6 million, and $2.7 million, respectively.

This negative sentiment has significantly impacted the market’s assets under management (AuM), which have decreased by $39 billion from their peak to $142 billion. This marks the lowest point since mid-November 2024, driven by both declining prices and persistent outflows.

Broader Market Turbulence with Mass Liquidations

The outflows coincide with a chaotic period in the cryptocurrency market, where nearly $1 billion in liquidations occurred in just 24 hours. This dramatic sell-off has affected hundreds of thousands of traders, with long positions suffering the heaviest losses.

Several factors have contributed to this market downturn:

- Major asset movements by key players, including Mt. Gox transferring tens of thousands of Bitcoin and an Ethereum whale depositing a large amount of ETH into Kraken

- Political uncertainty following comments from President Donald Trump about potential economic disruption, which has rattled both traditional and cryptocurrency markets

- Overleveraged positions in highly volatile markets leading to cascading liquidations as prices fell

While some traders view these large corrections as potential buying opportunities, others remain cautious due to external factors such as regulatory developments and broader economic conditions that continue to influence market direction.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.