The Bitcoin ETF market faces interesting developments as two contrasting trends emerge. While U.S. spot Bitcoin ETFs saw their third-largest daily outflow of $400.7 million on Thursday, investment giant Goldman Sachs revealed a significant increase in its ETF holdings, now worth $718 million.

Understanding Recent Market Movements

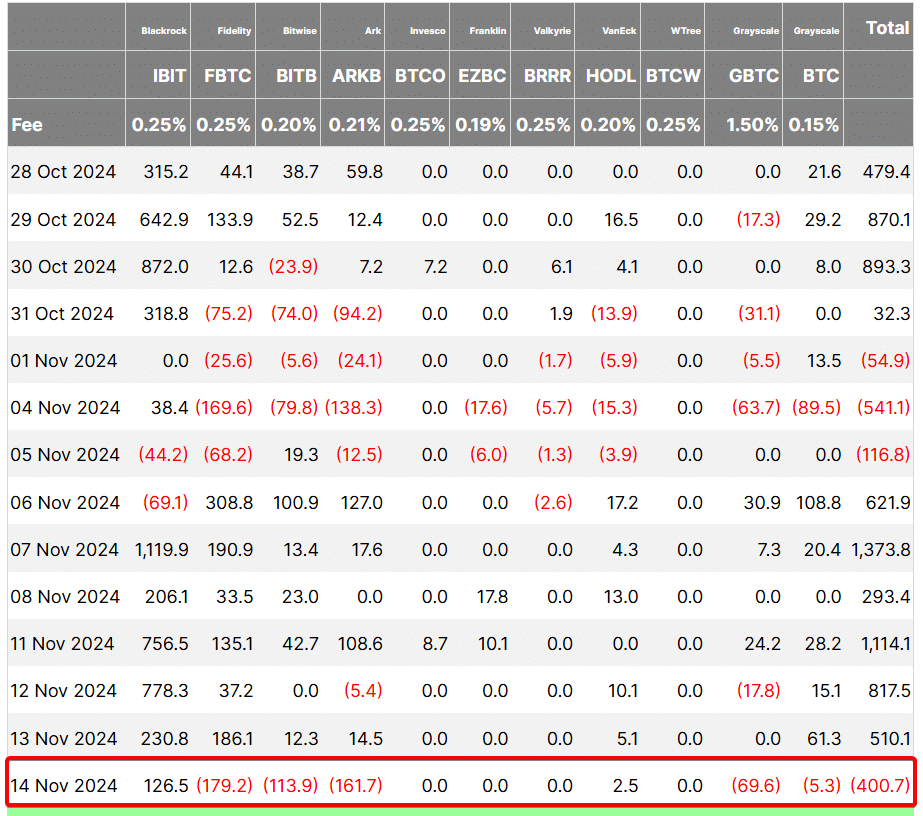

The substantial outflows on Thursday marked a significant change in investor behavior. Here’s what’s happening:

- Fidelity’s FBTC experienced the largest withdrawal at $179.2 million

- Ark’s ARKB saw outflows of $161.7 million

- Bitwise’s fund lost $113.9 million

- Only BlackRock’s IBIT bucked the trend with $126.5 million in new investments

This pattern of large outflows has historically signaled market bottoms. The two previous instances of outflows exceeding $400 million (on May 1 and November 4) were followed by price recoveries.

Bitcoin’s price has dropped about 6% since hitting its all-time high above $93,000 on November 13, now trading around $87,900.

The current market behavior suggests profit-taking by investors, with about $15 billion cashed out in the past three days. However, trading volumes remain strong at $4.8 billion, pointing to continued market interest despite the temporary pullback.

Goldman Sachs Bets on Bitcoin ETFs

In related news, Goldman Sachs has expanded its Bitcoin ETF portfolio by 71% since the second quarter. The bank’s SEC filing shows it now holds $461 million in BlackRock’s iShares Bitcoin Trust ETF (IBIT), making it their largest crypto investment.

The bank has spread its remaining holdings across several other funds, including $96 million in Fidelity’s Wise Origin Bitcoin Fund and $72 million in the Grayscale Bitcoin Trust ETF.

This situation creates an interesting contrast: while some investors are taking profits, major institutions like Goldman Sachs are increasing their exposure to Bitcoin through ETFs.

This shift is particularly noteworthy given Goldman’s previous stance that cryptocurrencies were “not an asset class” back in 2020.

The market’s response to these developments will be crucial in the coming weeks. Historical patterns suggest the current outflows might signal another potential buying opportunity, but investors should watch how institutional involvement, particularly from major banks like Goldman Sachs, affects the market’s direction.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.